CHINA. Luxury spending in China is on the rise but many European brands aren’t effectively engaging with consumers digitally, according to a new report.

Research from Exane BNP Paribas and customer engagement specialists Contactlab shows that Chinese shoppers, who account for 30% of the total global spend on luxury goods, are beginning to buy more goods in China itself rather than from overseas.

European brands such as Burberry and LVMH saw significant growth in revenue in Mainland China in the second half of 2016. But some European luxury brands are struggling to adapt their digital marketing and customer engagement to the market, according to the report, which is titled ‘The Online Purchase Experience in China: Local Champions Dominate’.

The report notes that digital development is happening at “lightning speed” in China, causing the demise of physical retail formats like hypermarkets.

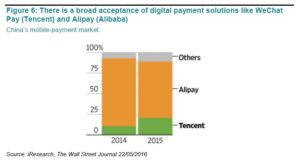

“The Chinese are not only the most important nationality for luxury goods but also the most digitally advanced consumer population,” said Contactlab Senior Advisor Marco Pozzi. “Whilst luxury brands around the world are dramatically improving their digital marketing and e-commerce customer experience, digital in China is different. This is a market where mobile is key, delivery in 1-2 days is expected as a standard, and the social media landscape is extremely idiosyncratic.”

The reports suggests that some European brands are too reliant on email for communication, but noted that Chanel was a good example of a brand embracing channels such as WeChat.

“The expectations of Chinese consumers include online chat assistance and social elements such as brand and product reviews, as well as the option to pay via WeChat. These elements are supported by most Chinese e-commerce operators, but European brands are not supporting these features yet,” said Pozzi.

Pozzi also noted the impact of daigous – the millions of Chinese people overseas purchasing goods (ranging from household items to luxury goods) for customers in Mainland China at way below the prevailing Chinese domestic price.

“So far the practice of local daigous mixing foreign-sourced authentic products and fakes has prevented digital luxury from taking off in earnest. Issues remain, but a more convincing transition to authenticity by local champions would confront luxury brands with tough choices, making digital essential and unavoidable.

“While this seems far away today, things in China change quickly, and European brands must be ready to connect with the Chinese consumer digitally.”

Contactlab and Exane BNP Paribas’ research tested 65 parameters, both online and in-store, covering three global luxury brands, four e-retailers and one department store. The metrics focused on communication in regards to ordering, purchasing, packaging, return procedure, and return communication.

The full report can be downloaded here.