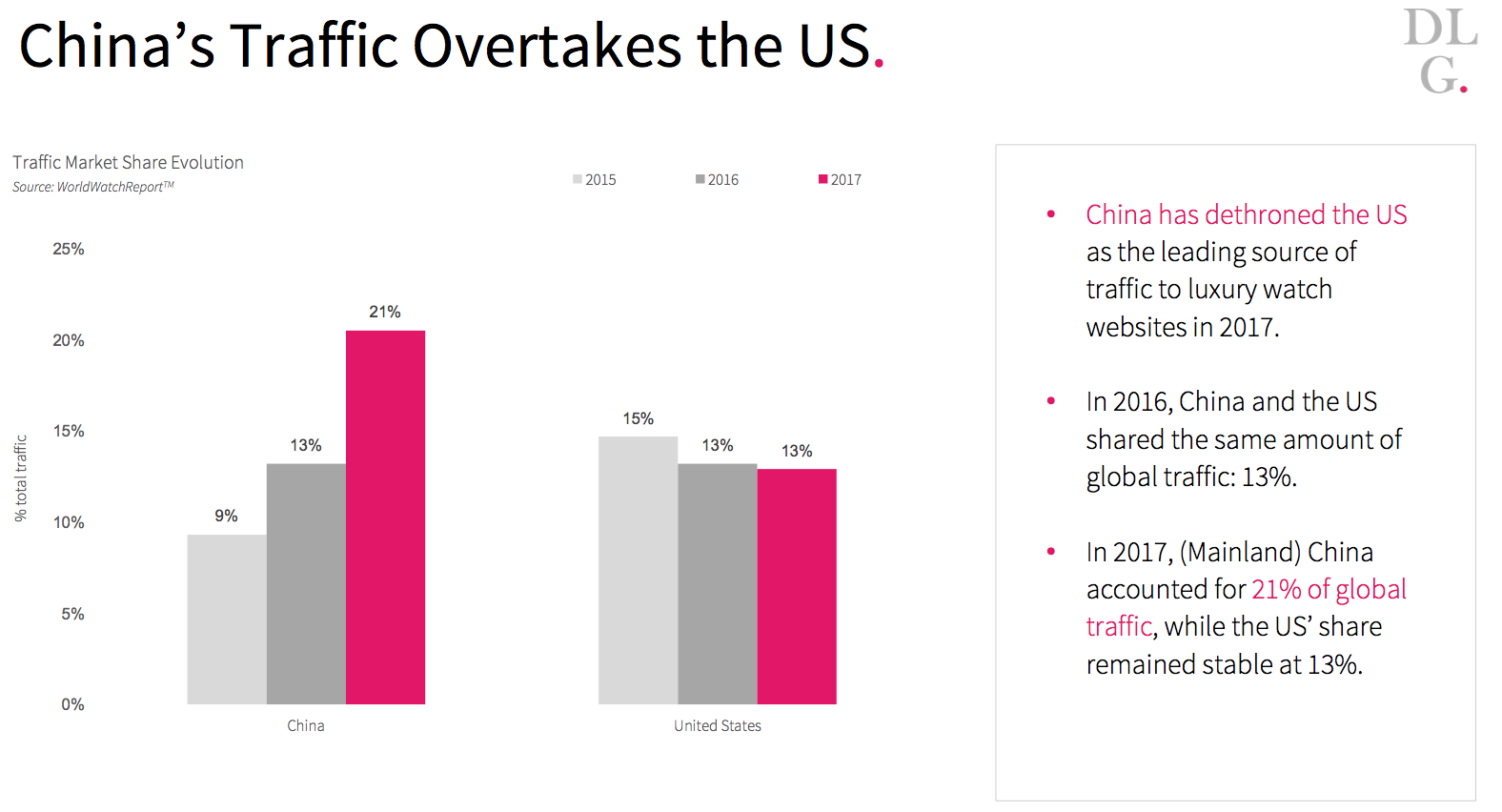

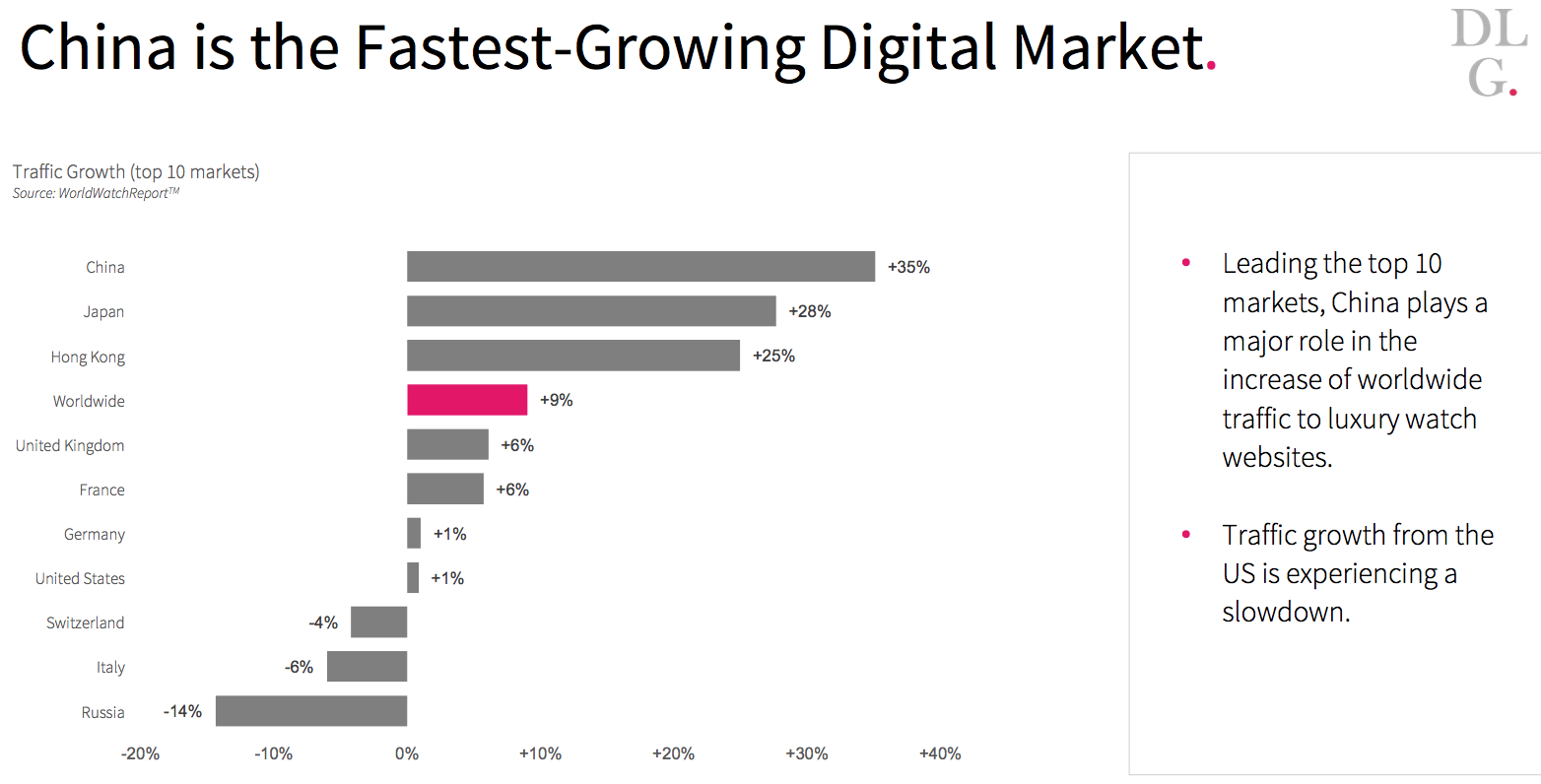

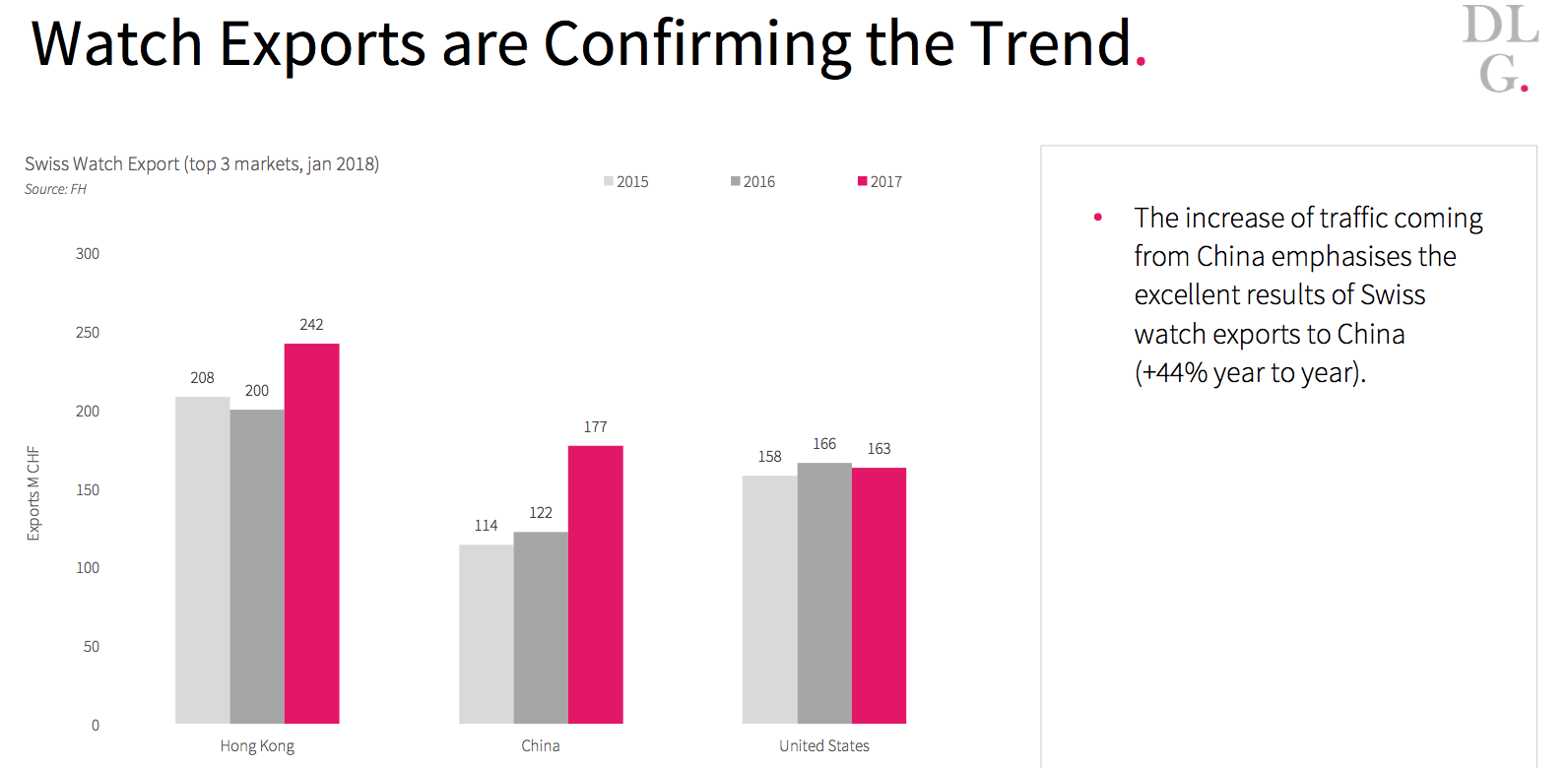

SWITZERLAND. Chinese consumers are now the leading visitors to luxury watch websites. That’s a key finding from Digital Luxury Group’s (DLG) WorldWatchReport Benchmark 2018, an annual study that tracks the global digital performance of luxury watch brands.

Revealing some preliminary insights from the study, DLG noted, “Chinese consumer interest in luxury watch and jewellery brands has been growing significantly over the years. Last year, however, marked the first time that China dethroned the US in terms of user visits to luxury watch websites.

“The destiny of the Swiss watch industry is now tied to Asia, and China specifically. Global watch brands that do not manage to generate desirability in China will find it hard to sustain their businesses in the long run.” – DLG CEO & Founder David Sadigh

According to research conducted for the WorldWatchReport Benchmark, the total number of visits from China accounted for about 21% of global traffic, while those from the US came in at around 13%.”

“The destiny of the Swiss watch industry is now tied to Asia, and China specifically. Global watch brands that do not manage to generate desirability in China will find it hard to sustain their businesses in the long run,” said DLG CEO & Founder David Sadigh.

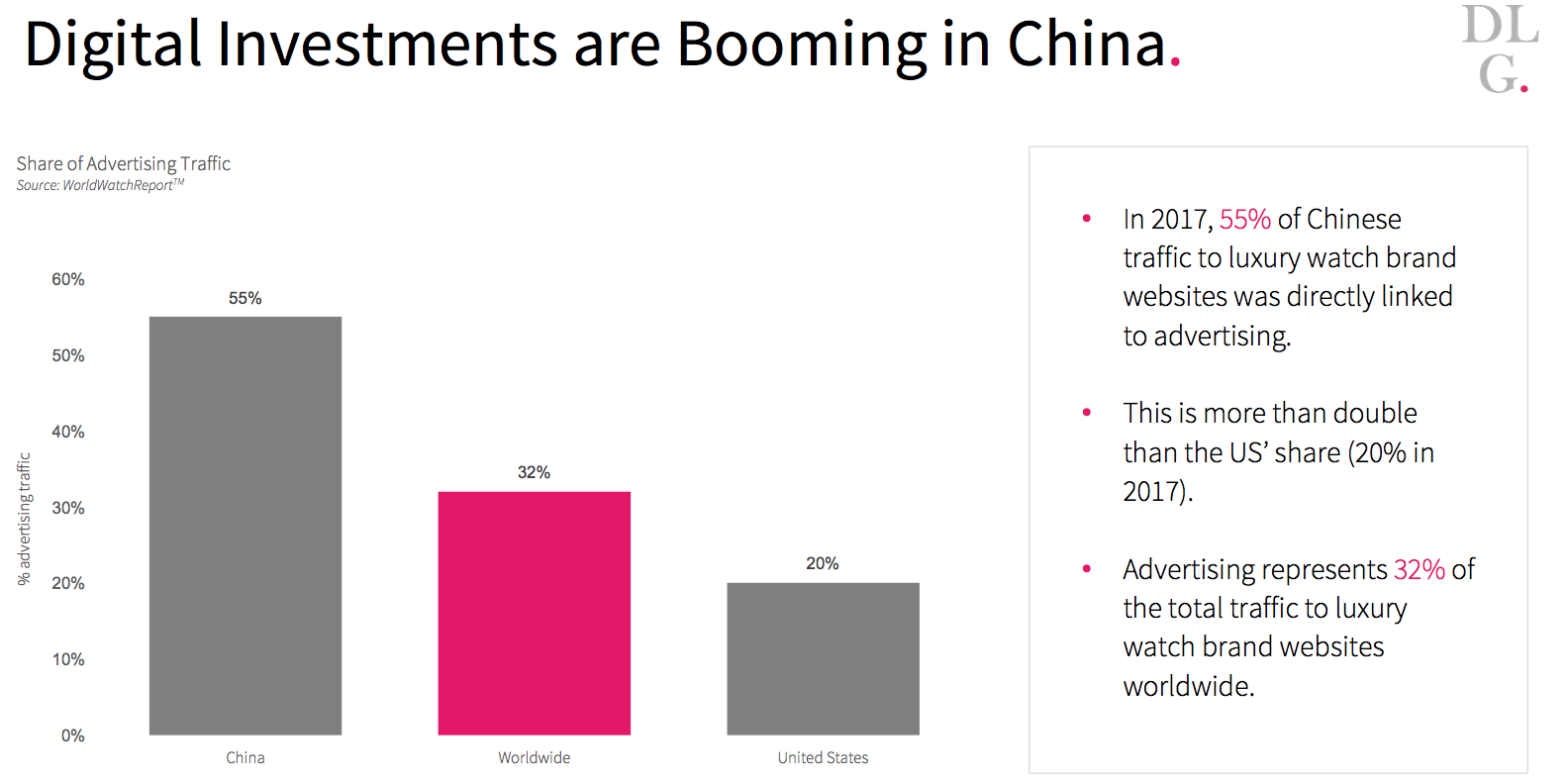

“The WorldWatchReport Benchmark confirms China has become the number one battleground with its ever-growing digital investments,” added DLG Head of Client Services Yoann Chapel. “However, beyond impressions and clicks, ability to drive user engagement will be key to become the leading brand locally.”

DLG has been publishing the WorldWatchReport, the leading market intelligence study in the luxury watch industry, for ten years. The WorldWatchReport Digital Analytics, launched in 2017, analyses the performance of luxury watch brand websites. It explores topics ranging from the role of a brand website and the impact of social media on drive-to-store, to the importance of balancing owned and earned media.

The study is designed to help brands to better leverage digital platforms and create a seamless customer journey that will result in measurable business results.

Key findings from the study include:

- Consumer behaviour has changed.

- Digital & Social have become key in the watch purchasing process.

- Watch brands usually spend between 30% to 50% of their total marketing budgets on digital channels.

- Measuring search intention is not enough.

- For the first time, China has dethroned the US as the leading source of traffic to luxury watch brand websites.

- 55% of Chinese traffic to luxury watch brand websites is directly linked to advertising.

- Most brands have yet to develop a fully satisfactory experience on their platforms.

- A user in China has to wait three times as long as a user in America for a page to load.

- Brands should not think of WeChat merely as a social media platform, as it is a full eco-system.

China WOM Index revealed: Tracking the global digital performance of luxury watch brands

DLG has also introduced the China WOM Index, a mobile tool that measures the word-of-mouth performance of luxury watch brands in China.

The index was launched to coincide with the world’s premier watches show, Baselworld (22-27 March). Powered by big data technology firm simplyBrand, the online solution streamlines the monitoring and analysis process for brands and offers a quick overview of day-to-day performance on WeChat, Weibo and Baidu. The current version is only available on mobile and allows for the tracking of 23 different luxury watch brands that are present at Baselworld.