CHINA. It’s a warm late October evening in Shanghai as I enter the CNSC downtown duty free store in Shanghai’s bustling Jing’an District, writes Martin Moodie. I’ve heard many positive things about this store since its opening to much fanfare two years ago on 8 August and I’m intrigued to find out whether it lives up to expectations.

The choice of inauguration day was not random – the 8th day of the 8th month is an auspicious date in the Chinese calendar (the Beijing Olympics began on 08/08/2008) – and if those pre-opening signs augured well, then the operational reality has certainly delivered.

The two-level, post-arrivals store for Chinese consumers, housed in the popular Yueda 889 Square shopping mall, is spacious, elegant and well-merchandised. That’s not surprising perhaps, given that the opening of this new CNSC (full name, China National Service Corporation for Chinese Personnel Working Abroad) flagship marked a vivid statement of intent for an organisation that ranks as the pioneer of duty free retailing in China.

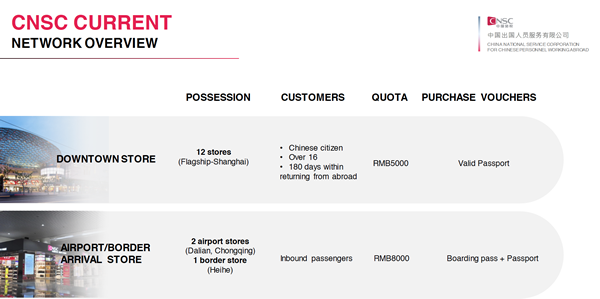

Founded in 1983, the state-controlled organisation was the first to be granted a duty free licence in the country and today remains China’s leading downtown travel retailer as well as running shops in the airport and land border channels.

“CNSC will strive to be among the top ten retailers in the international duty free industry.”

Today, CNSC, like the Chinese travel retail market in general, is undergoing profound change. The company, which for years focused mainly on white goods provided for returning Chinese overseas workers, is morphing into a modern, forward-thinking travel retailer. It is expanding at tremendous pace and investing heavily in existing and new stores, of which the Shanghai shop is the most ambitious play to date.

In the downtown sector (where it operates 12 stores), CNSC is upgrading 11 shops over the next two years with firm plans to open more stores in the coming five years. In the airport and land border sphere it will participate in open bids to build its presence. CNSC also harbours ambitions to explore the opportunity of opening an offshore duty free business on Hainan Island. And it would like to expand abroad by opening stores along the route of China’s hugely ambitious ‘Belt and Road Initiative’.

These are serious aspirations held by a serious player. CNSC is a subsidiary of Sinopharm (China Pharmaceutical Group Co), China’s biggest pharmaceutical health group, which boasts the country’s largest drugstore chain with some 4,412 stores across 60 large and medium-sized cities. Sinopharm was ranked number 194 in the Fortune Global 500 rankings for 2018.

In line with the Chinese government’s oft-stated desire to maximise domestic consumption, Sinopharm attaches great strategic importance to the duty free business and has prioritised the sector as a key component of its commercial development. Sinopharm and its subsidiaries have signed 110 strategic cooperation framework agreements with all major provinces and cities in China and the duty free business forms an integral element of many deals.

In line with the Chinese government’s oft-stated desire to maximise domestic consumption, Sinopharm attaches great strategic importance to the duty free business and has prioritised the sector as a key component of its commercial development. Sinopharm and its subsidiaries have signed 110 strategic cooperation framework agreements with all major provinces and cities in China and the duty free business forms an integral element of many deals.

The opportunity is huge, say Chang Zhen, Executive Deputy General Manager, and Evita Qu, Deputy General Manager, talking to The Moodie Davitt Report during a tour of the flagship store just before the recent Trinity Forum in Shanghai.

“China’s economy has entered a stage of high-quality development,” says Chang.“The Chinese middle and high income group is continuing to grow at +13% per annum and will occupy 42% of the population by 2021, which indicates a huge potential for the high-end consumption market.

Additionally, says Qu, the government is encouraging “orderly competition” in the Chinese duty free industry. In a critical policy address on 13 June this year, Premier Li Keqiang emphasised the need to redress the balance of overseas consumption by Chinese travellers and underlined the government’s desire to expand the country’s own duty free industry.

CNSC is ideally positioned to benefit from that directive, says Chang. To facilitate those aims, the corporation is seeking “win-win” partnerships with various Chinese cities. Chang points out that the opening of duty free stores symbolises commercial prosperity and that the fusion of “tourism + retail” drives tourism to cities and their surrounding regions – in turn spurring GDP and employment at a local level. “Many cities have expressed their willingness to open downtown duty free stores and welcome us,” he says.

With the green light from the government, CNSC has embarked on a sustained investment programme. During the balance of 2018 and through 2019, the corporation plans ambitious, government-backed refurbishments of its downtown stores in Dalian, Chonqing, Nanjing, Zhengzhou, Hangzhou and Harbin.

In 2020, similar improvements will transform the stores in Beijing, Qingdao, Kunming, Hefei and Nanchang.“So, the full scope of CNSC’s duty free network is beginning to take shape,” comments Qu.

By choosing high-traffic “new” retail locations, CNSC benefits from existing footfall as well as bringing customers to the areas. And, critically, that helps mitigate any potential conflict with local market retail.

SHANGHAI STORE GROWS FAST

It is the Shanghai business that has CNSC – and the duty free industry at large – most excited. Since the 3,300sq m store opened amid great expectations, sales have been growing at around +20% year-on-year. It houses some 220 brands, across four key categories – beauty, fashion, watches & jewellery, and confectionery. The beautifully merchandised cosmetics and perfumes department is the commercial linchpin, representing around 65% of total sales. As consumer awareness of the store grows, CNSC projects that sales will climb much higher.

The store is defined by its high-class beauty offer, anchored by a broad and refined presence from The Estée Lauder Companies. “After two years of operation, our Shanghai store has received excellent recognition from many brands,” says Chang. “We work hard to maintain their image. All the brands are nicely displayed, and we have also used various social media platforms to enhance the brands and our offer.”

Chang says that consumer reaction has been overwhelmingly positive to the post-arrivals duty free shopping concept, not just in urban Shanghai but also the surrounding provinces, which he says account for around 25% of the customer base.

CNSC chooses its downtown locations carefully. Firstly, they need to be in a “landmark” shopping mall but secondly – and critically – the company selects fast-developing new areas within its chosen cities, rather than long-established, often overdeveloped downtown retail centres. By choosing high-traffic “new” retail locations, CNSC benefits from existing footfall as well as bringing customers to the areas, Qu points out. And, critically, that helps mitigate any potential conflict with local market retail, she says.

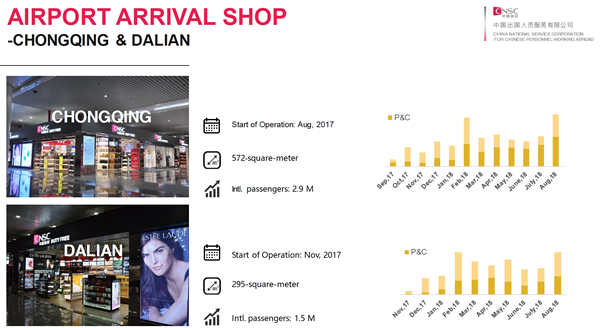

AIRPORT ARRIVAL SHOPS BREAKTHROUGH

If 2016 was a landmark year for CNSC due to the Shanghai store opening, then 2017 maintained the momentum. Last year, CNSC opened its first-ever airport retail stores – 572sq m and 295sq m arrivals duty free shops at Chonqqing (August) and Dalian (November) airports. It also inaugurated a land border shop at Heihe, a prefectural-level city on the crossing to Russia.

CNSC is confident of securing further arrivals stores contracts through open bidding in line with the government’s determination to make shopping at home easier and more desirable for Chinese travellers.

As Chinese consumer awareness of airport arrivals shopping grows, says Qu, sales will soar – and may even outstrip the departures business in certain locations. Sales are growing fast (see table), particularly for perfumes & cosmetics which again account for the lion’s share of sales.

“The business is starting to rise,” adds Qu. “At first people were a little cautious, thinking ‘There is a store in departures, why should I have another one here?’ But now they see the real potential and it’s so convenient for them to buy and the customer service is so good.”

NO CONFLICT WITH THE CHINESE DOMESTIC MARKET Downtown expansion on the Chinese mainland will be integral to delivering such goals, says Chang. And he is adamant that international brands should embrace the opportunity rather than fear any conflict with their domestic market business in China. The downtown duty free market is a purely incremental business, he argues, a channel specifically established to drive post-arrivals sales to returning Chinese and to maximise domestic consumption. Under the Chinese model, travelling nationals returning to China are eligible for a one-off, post-arrivals purchase of duty free goods up to a limit of RMB5,000 (US$2160). They can shop for up to 180 days after returning from abroad, provided they show their passport and proof of arrival date. That allowance is on top of their original RMB8,000 (US$1,150), which they can spend abroad (RMB5,000/US$719) and in Chinese airport arrivals shops. Further reassurance for international brands is provided by the fact that post-arrivals shopping is so strictly monitored, Chang notes. “Everything is fully regulated by Customs and carefully controlled,” he says. Shoppers must show their passports and their travel records, while allowances and categories (no liquor or tobacco) are set by law. Additionally, CNSC insists that it works very closely with brands to protect and nurture their brand image. “After two years of operating the Shanghai store, we have extensive data and analysis and we think that our downtown stores present no contradiction with the local market,” Qu says. “Both the airport arrivals stores and the downtown shops share the same group of target customers. The downtown business model is simply an extension of the airport arrivals store. “Additionally, we have strict control policies, as mentioned. We must double-check the stamp on your passport to know that you are buying within the six-month period since you returned. The quota is strictly controlled and fully regulated by Customs as well as conforming to the brands’ requirements.” |

Emboldened by its arrivals shop successes, CNSC also participated in the recent tender for the blockbuster seven-year duty free contract at Shanghai Pudong and Hongqiao International Airports. Though ultimately unsuccessful (the contract was retained by China Duty Free Group-controlled Sunrise Duty Free), the bid underlined the seriousness of CNSC’s intentions, notes Chang.

Disappointed by the result but determined to bounce back, CNSC is now preparing to bid on another big opportunity, the duty free contract at Beijing Daxing International Airport, the capital’s second international airport which is currently under construction and due to open next September. The spectacular facility will be the world’s largest airport, featuring four runways – eventually six – and handling a projected 72 million passengers a year by 2025 (with capacity, incredibly, for 100 million).

It’s that kind of drive and ambition that underpins CNSC’s plans to open 40 new stores over the next five years and reach over CNY10 billion (US$1.4 billion) in turnover over the next five years. A serious ambition? Do not doubt it. “CNSC will strive to be among the top ten retailers in the international duty free industry,” says Chang. The message is clear. CNSC is determined to plant a prominent Chinese flag in the global travel retail landscape. It has the funding and vision in place and considerable momentum from its recent Chinese successes.

TARGET DAIGOU

One of the abiding themes of the Asian travel retail scene over the past two years has been the phenomenal growth of the daigou or shuttle trader business, particularly between South Korea and China, and Japan and China.

That unregulated business spurred huge turnover (though not profitability) gains in Korea last year, acting as an unofficial distribution channel for beauty (predominantly) and other brands throughout China.

Neither fact pleased the Chinese authorities, who showed their displeasure during the recent Golden Week holiday through a major crackdown by Customs officials on travellers exceeding their allowances. Well-publicised photographs of daigou traders having their holdalls and suitcases searched at Customs helped spread the message that this is a business that the Chinese authorities will not tolerate much longer.

In one prominent case, over 100 passengers from a single flight were stopped and fined. According to a recent report in Jing Daily, a Chinese daigou who had operated a store on Alibaba’s Taobao marketplace since 2013, was sentenced to ten years in jail for tax evasion and smuggling. The daigou was found to have evaded over RMB3 million (US$430,000) in taxes on imported apparel worth over RMB10 million (US$1.4 million).

“Daigou disrupts China’s market order,” says Chang. “The business also often features fake goods, which damage brand image.” Underlining its concerns, the PRC government will introduce a sweeping new e-commerce law on 1 January 2019 that will force e-commerce practitioners, including daigou traders, to pay taxes on all imported goods. “That will dramatically restrain the traditional daigou business,” says Chang.

The e-commerce law will force individual traders who are importing goods to China to register as a company – not just in China but also in the country from where they are importing the goods. “With the crackdown on the daigou business, who will satisfy the huge and increasing demand from Chinese citizens?” Chang asks. CNSC believes it can supply a big part of that answer, while simultaneously addressing the state policy to repatriate overseas consumption.

“Chinese consumers will still seek the top-quality brands. We think that downtown duty free stores are one of the solutions to satisfy their needs. Because we are also a state-owned company, we have the obligation to respond to the government’s policy requirement and we can act as one of the major channels to attract overseas consumption back.

“But we will also protect the brands’ image by respecting their requirements in pricing, positioning and marketing strategy, while providing a high-quality, experiential service in the stores,” Chang says. “This will simultaneously increase brand sales in an incremental channel, curb the daigou business and satisfy consumer demand.”

Chang insists repeatedly that brands should not fear any conflict between post-arrivals downtown duty free business and the domestic market. “Our target customer is different from the local market,” he says, breaking down the CNSC consumer into three key groups.

• Young mature women – fashion and trend conscious, price-sensitive, resourceful in terms of the channels they use for purchasing (for example airport arrivals and departures stores). More than 80% of CNSC’s downtown customers are women.

• Business people – they travel frequently and have knowledge of and access to alternative sales channels rather than the local market. “These clients come here, especially at the weekend, with their families. Instead of buying abroad they realised that they can now shop here,” says Chang.

• Loyal CNSC members – for whom post-arrivals shopping is a supplementary purchase opportunity that offers a leisurely shopping experience. “This group generally don’t want to shop when they are abroad,” says Chang. “They just want to enjoy the sights and scenery and would like to buy when they return home.”

“CNSC strives to cultivate such customers, who tend not to use local market boutiques,” Qu comments. “We aim to build their brand loyalty by providing an excellent purchasing channel and an extraordinary shopping experience.”

BEAUTY PRODUCTS BOOM

The formula appears to be paying off richly, particularly in beauty. According to Shanghai Municipal Commission of Commerce, P&C sales at CNSC’s downtown store in Shanghai soared +27% year-on-year in 2017. Notably though, the same category also experienced a +20% growth rate in the Jing’an local market. “This strongly indicates that the operation of a downtown duty free store promotes the development of the local market by attracting an increased people flow to the area,” Chang claims.

“We seek a win-win strategy with business partners,” he says, looking to the future.“Most of the major brands which work with CNSC achieve more favourable sales result through cooperating with us. The downtown duty free business develops harmoniously with the local market.

“And by building this kind of brand loyalty through our customer base, we can help the brands to broaden their customer base and their sales performance in China.”

CNSC says that the combination of airport arrivals stores, post-arrivals downtown shops and the company’s online offer presents an ideal “three-in-one” combination for Chinese travellers – and for brands.

The airport, says Chang, offers an optimum opportunity for promotions and a “quick-decision shopping experience”. The downtown store complements that by allowing more comprehensive marketing and communications opportunities in a comfortable and experiential shopping environment, bolstered by VIP service. And the online platform bolsters the other channels with an orderly integration of the product offer.

“The development pace of China’s duty free market has far exceeded the imagination of everyone,” says Chang. He cites initial brand skepticism about CDFG’s offshore duty free complex in Haitang Bay, Hainan before it opened. That enterprise is now a runaway success and the doubters have long since disappeared.

“Today, CNSC downtown duty free shops are in a similar situation as back at that time, it is a great opportunity now,” he insists. “I am very confident that CNSC will achieve rapid development and growth in the future.”

Given the Chinese government’s determination to maximise domestic consumption (a view emphasised repeatedly during a recent visit to The Moodie Davitt Report’s headquarters in London by China’s State-owned Assets Supervision and Administration Commission of the State Council, and the power of CNSC’s Sinopharm backing, that confidence appears well-placed.

SHANGHAI DOWNTOWN STORE PICTURE GALLERY