SME retailers out in forceStrong interest is being shown in the Incheon International Airport concessions set aside for small and medium enterprises (SMEs). The pre-bid meeting attracted representatives from Thomas Julie; KAL CND Service (KAL’s inflight sales & catering outsource company); Cityplus Duty Free (an incumbent at T2); Grand Duty Free (T1 incumbent T1); Kyung Bok Kung Duty Free (T1 arrivals and departures incumbent) and newcomer Daon. They were joined by Busan Duty Free (Busan port), and Dongwha DF(one of Seoul’s oldest downtown duty free retailers. |

SOUTH KOREA. Leading Korean duty free retailers are wary of facing a blockbuster bid from China Duty Free Group – the world’s number one travel retailer by sales* – according to a report in the powerful right-wing Chosun Biz business title.

The report was sparked by China Duty Free Group (CDFG) attendance at the pre-bid meeting and airport tour hosted by Incheon International Airport Corporation on 12 January. CDFG was the only non-Korean company present though Thomas Julie, Dufry’s partner in its Busan joint venture, attended. South Korea’s ‘big three’ – Lotte Duty Free, The Shilla Duty Free and Shinsegae Duty Free – and Hyundai Duty Free were all present (see panel for details on the SME concessions).

“As China Duty Free Group (CDFG), the world’s No. 1 duty free shop operator, is interested in bidding… concerns are growing among the ‘big 3’ duty free retailers in Korea. This is due to concerns that CDFG, the biggest player in the global duty free industry, will offer high bids based on its financial power,”

Noting that this is the first time CDFG has expressed interest in a Korean duty free tender, Chosun Biz reporter Kim Eun-young wrote: “The reason CDFG showed interest in this bidding is because Chinese account for a large portion of Incheon International Airport duty free shop sales. It can be interpreted that they are considering setting up duty free shops at Korean airports in order to redirect the consumption of Chinese tourists who are outflowing abroad to their home country.”

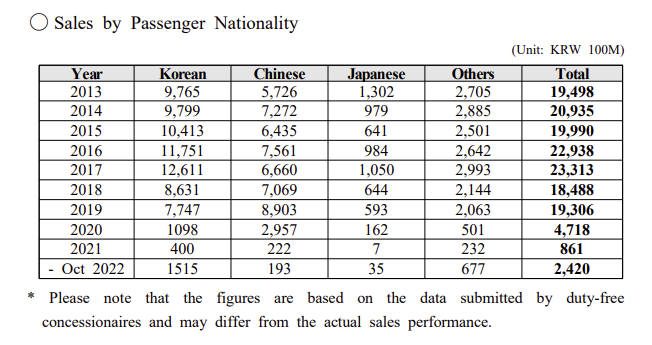

As reported (see below), Chinese shoppers overtook Koreans as Incheon International Airport T1’s leading spenders by total sales in pre-pandemic 2019, representing more than 46% of revenues; At T2, home to Korean Air, 31.7% of sales were to Chinese with Koreans the leading contributors.

The report suggested Incheon International Airport Corporation’s revised tender model (click here for full analysis) had helped spark CDFG interest. A ten-year term and a change to a monthly rental formula adjustable according to passenger numbers were particularly significant, Chosun Biz said.

Incheon International Airport had shown an average annual growth rate of +6% since its opening in 2001 culminating in record KRW 2.8 trillion (US$2.43 billion) sales in 2019. However, sales plummeted by -95% in 2020 due to the pandemic and have only recently begun to recover.

Whatever Korean retailers say about China Duty Free Group’s presence at the bid meeting, Incheon International Airport Corporation (IIAC) will not be too concerned, writes Martin Moodie.

Whatever Korean retailers say about China Duty Free Group’s presence at the bid meeting, Incheon International Airport Corporation (IIAC) will not be too concerned, writes Martin Moodie.

As I noted in my most recent analysis of this always fascinating tender, the pandemic has made the ‘sell’ of the airport retail opportunity – historically one of the world’s most sought-after – much more difficult for IIAC, as evidenced by the multiple failure to attract bidders for the T1 tender (now combined with T2) through the pandemic-ravaged 2021. China Duty Free Group’s potential arrival on the scene may make that sell a whole lot easier.

To its great credit, the IIAC has attempted to address Korean retailers’ concerns in the way it has structured the tender, both in tenure and rental terms. Nonetheless, after the commercial trauma they faced through 2020-2022, those retailers face an unusually complex evaluation in deciding how much to offer for any of the ten-year contracts.

As I pointed out last time, the perennial weighing of opportunity and risk is affected by prevailing uncertainty regarding the lingering pandemic; the timing and speed of the return of Chinese travellers; and concerns over the Korean and global economic climate. Throw in China’s recent tit for tat response to the Republic’s alleged ‘discriminatory’ treatment of Chinese visitors and there are plenty of reasons to be cautious.

However, China Duty Free Group’s apparent strong interest in the Incheon contracts has, to coin a western phrase, thrown a very large cat among the pigeons. Korean duty free retailers know full well (and fear) the heavyweight competition, investment capability, and deep knowledge of Chinese consumers that CDFG would bring to what has historically been the world’s biggest duty free market.

How to keep their foreign rival out without overcommitting themselves? The tender decisions involve Korea Customs Service as well as the IIAC and the history of the duty free industry is laced with examples of politics and nationalist sentiment overcoming financials. Expect, as in this case with the notoriously business-friendly Chosun Biz, to hear some subtle (and occasionally unsubtle) positioning from unnamed Korean duty free sources.

Note the mixed messages in the following comments from Chosun Biz.

- An official from an unnamed large duty free retailer: “Incheon International Airport is not economically viable due to high rent, but it is symbolic of being a gateway to Korea, so there are many places to consider entering.”

- Another duty free retailer, “China’s government is stepping up to grow the duty free business globally, but in Korea the market itself has frozen, with the extension of rent reduction for airport duty free shops not being resolved. It is not an environment to compete in.”

The Chosun Biz rightly noted that the IIAC had ended sales-linked rents from the end of last year, reverting to a fixed rent formula. “As a result, Shinsegae Duty Free Shop will have to pay an additional KRW18 billion (US$14 million) in monthly rent from January this year,” it noted.

The report quoted The Moodie Davitt Report, saying that an unnamed industry insider had told the title, “Incheon’s position as a global hub airport has deteriorated due to the development of its competitors.” The source claimed that Korean duty free retailers had damaged the sector by selling excessive amounts at low prices to big Daigou traders during the crisis and that Chinese buyers no longer need to buy duty free goods offline in Korea.

While there is some merit in that view, it is an overstatement. Once the current Korean-China furore is over, the Chinese will return to the Republic in great numbers. And China Duty Free Group will be very confident of its capability to sell to them. A fascinating drama is set to be played out.✈

Note: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport or other travel-related infrastructure revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

The Moodie Davitt Report is the only international business media to cover all airport or other travel-related consumer services, revenue-generating and otherwise. Our reporting includes duty free and other retail, food & beverage, property, passenger lounges, art and culture, hotels, car parking, medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.