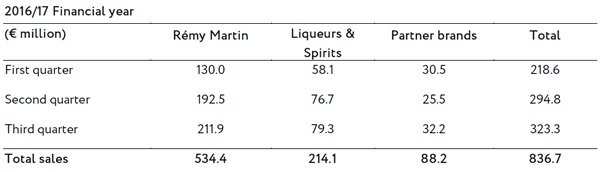

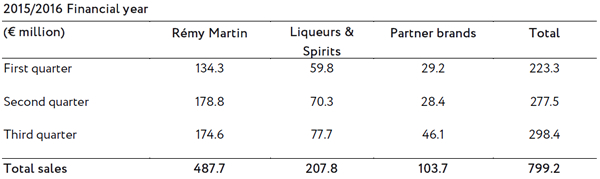

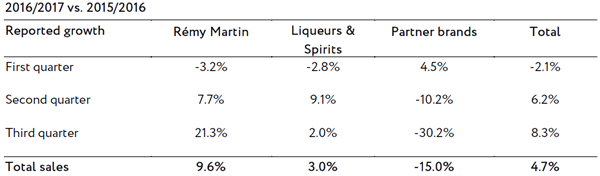

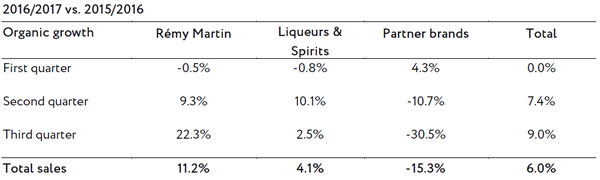

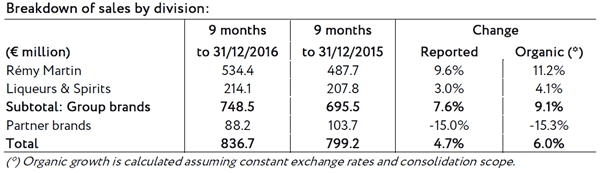

Rémy Cointreau posted what it described as an “excellent” third-quarter performance with sales rising by +9.0% year-on-year in organic terms*. For the first nine months, revenues increased +6.0% (+4.7% reported) to €836.7 million.

The company described the nine-month performance as fully in line with forecasts and confirmed its guidance of growth in current operating profit over the 2016/17 financial year, assuming constant exchange rates and consolidation scope.

Sales growth in the first nine months was driven primarily by the Group brands (+9.1% organic), while the dip in sales by Partner brands (-15.3% organic) was due to the end of the distribution contract for the Charles Heidsieck and Piper Heidsieck Champagne brands in France, Belgium and travel retail.

Geographically, the Group’s strong nine-month performance in the first nine months was bolstered by the Americas and the Asia Pacific regions. The latter was notable for a “solid recovery” in private consumption in Greater China — as well as “some improvement in travel retail trends”.

Performance was more contrasted in the Europe, Middle East and Africa with Russia, Central Europe, the UK and South Africa contributing to the Group’s strong momentum, the company said.

Rémy Martin resurgent in China and travel retail

The House of Rémy Martin posted an excellent performance over the nine-month period, the group noted, with organic growth of +11.2%. That performance was underpinned by strong momentum in the Americas, a step-up in private consumption growth in Greater China and travel retail, and anticipated shipments in the third quarter for the Chinese New Year celebrations. Sales have also returned to “robust “growth in Russia since the start of the financial year, the company commented.

The division also benefited from “remarkable mix effects” over the period, the result of investments in the highest-range categories in the Rémy Martin portfolio: notably the launch of Louis XIII Le Mathusalem, L’Odyssée d’un Roi project, the opening of a Louis XIII store in Beijing, and the launch of the new Rémy Martin XO.

The travel retail momentum looks set to continue with the group placing particular importance on the channel. As reported, The House of Rémy Martin this week unveiled its first ever pop-up store at Paris Charles De Gaulle Airport, in partnership with the Lagardère Travel Retail/AdP joint venture SDA..

[image_magnify src=”https://www.moodiedavittreport.com/wp-content/uploads/2017/01/Louis_XIII_Collection_Small.jpg” src_big=”https://www.moodiedavittreport.com/wp-content/uploads/2017/01/Louis_XIII_Collection_Large.jpg” alt=”” /]

[Lucky 13: Rémy Martin is putting an unprecedented focus on its ultra-premium Louis XIII Cognac, including this newly launched limited edition called The Origin – 1874, the first release in a new range dubbed The Time Collection. Hover over the bottle with The Moodie Davitt Magnifier to view the bottle in greater detail.]

Growth for the Liqueurs & Spirits division (+4.1%) was driven by a solid increase in main brands. Cointreau posted “satisfying growth” over the nine months, fuelled by the USA and France, as well as by new high-potential markets such as Greater China and Russia.

Metaxa put in a robust performance in the first nine months, Rémy Cointreau said, with the resumption of growth in Russia/CIS and Greece and continued strong momentum in Central Europe, notably thanks to the launch of the new ‘12 Stars’ bottle.

On the strength of a good third quarter in the USA, Barbados and the UK, Mount Gay recorded strong growth in the nine months, while the slight decrease for St-Rémy was attributed to a voluntary reduction in low-end volumes.

Islay Spirits (Bruichladdich/Port Charlotte/Octomore/The Botanist) continued to see double-digit growth in the first nine months, with particularly strong performances in its main markets (USA, Europe and travel retail).

*At constant exchange rates and scope of consolidation