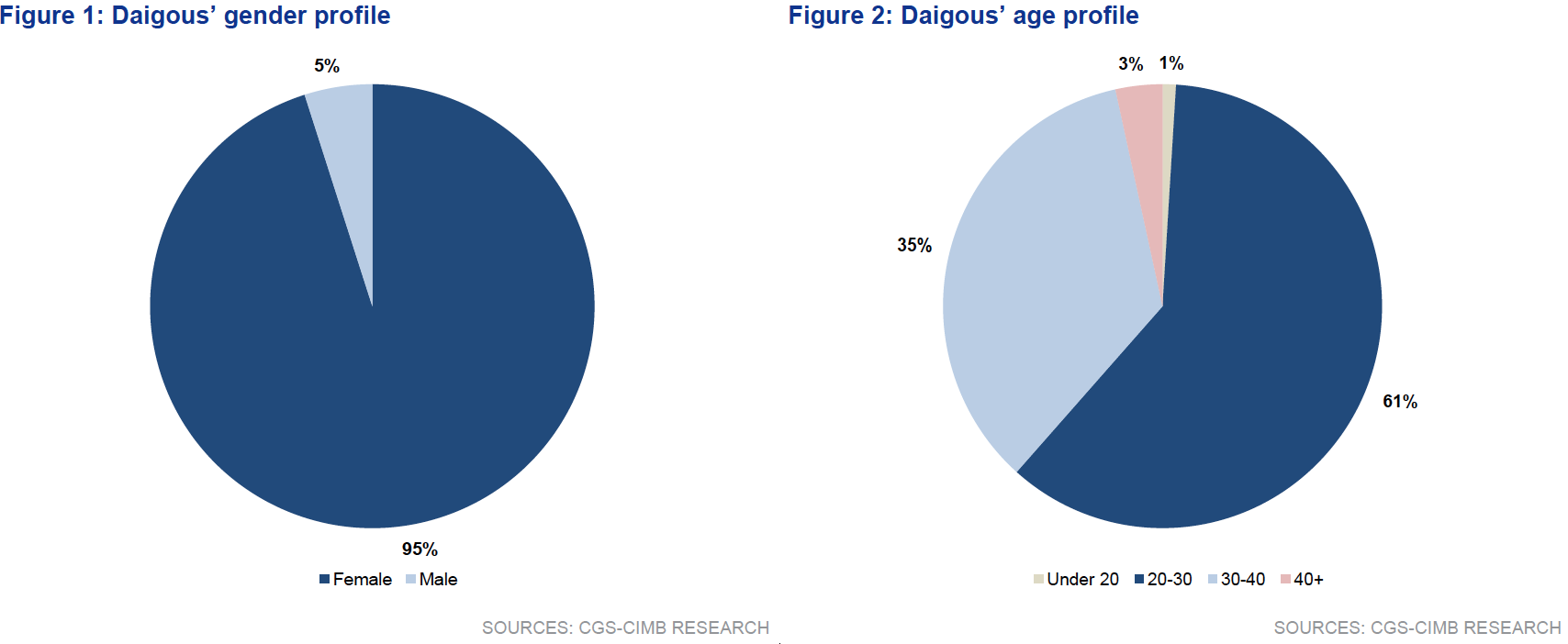

| Why does this survey matter? Daigous have always been considered the entities that are hidden behind the veil. The value chain of the daigou industry is known to be in the shadows, with some activities bordering on being or actually illegal. In this report, CGS-CIMB conveys a meaningful set of insights pertinent to the Korean duty free industry and its supply chain (including cosmetics), by collecting a set of thoughts from daigous, the core growth drivers of the industry, through an offline field survey. From this report, CGS-CIMB concludes that:

Source: CGS-CIMB |

SOUTH KOREA. Financial services provider CGS-CIMB Research Analyst Jun Lim has published the compelling results of a January survey of 557 daigou traders visiting Korea, with the key findings published here in exclusive association with The Moodie Davitt Report.

It offers some compelling insights into this all-important sector and the likelihood and nature of any bounce back post the COVID-19 crisis [which deepened in South Korea after the survey -Ed].

The survey assesses the likely winners and losers of any shift in demand following the severe market disruption caused by the outbreak. “Given our findings, we remain upbeat on the DFS [duty free shopping] sector, and pessimistic on [Korean] cosmetics brands,” Lim concludes. “We maintain Underweight on consumer discretionary.”

We will bring you further details in coming days and a full integrated report in the March edition of The Moodie Davitt Magazine (digital and print) but below are some key findings.

#1 – Basket size growth will underpin duty free industry growth. The survey results suggest a sustained hike in daigous’ basket size going forward, implying an upside risk to CGS-CIMB’s industry growth outlook, once inbound daigou traffic recovers from the COVID-19 impact.

Respondents were asked for their basket size outlook for 2020. Encouragingly, some 77% said they plan to spend more in 2020 vs. 2019. [Note: KRW1 million = US$811.8; KRW3 million = US$2,435)

- 33%/26%/15%/3% answered +0~+5%/+5-+10%/+10-+20%/20+%.

- Some 35% of respondents said their average basket size per visit would be KRWW1.0m-3.0m, followed by KRW3m+ (29%), KRW0.5m1.0m (29%), less than KRWW0.5m (7%).

- Compared to 2019’s blended basket size of KRW1.04m, upside in blended basket size seems obvious, upon higher daigou traffic, in our view.

#2 – K-beauty luxury brands will be less popular in 2020 vs. 2019. The findings indicate that the popularity of Korean cosmetics brands could decrease in 2020 vs. 2019. To the question ‘which countries’ cosmetics brands do you think will be more popular in 2020 vs. 2019?’ respondents chose Europe (55%), followed by Japan (34%), Korea (9%), and China (2%).

By brands, 1) Hera, 2) O Hui, 3) Sum 37, 4) Laneige, and 5) Sulwhasoo ranked the lowest on ‘net increase in popularity in 2020 vs. 2019’.

The History of Whoo also ranked among the lower half. Estée Lauder, SK-II, YSL, Chanel, Shiseido, and Dior ranked the highest on the same list. For the respondents, quality (53% of respondents) was the most important factor in choosing one brand over another, followed by brand prestige (34%), and value for money (12%).

#3 – China’s duty free industry is still only a distant threat to Korean duty free. Despite rising concerns in the Republic over the potential threat of China’s duty free industry to Korea’s, the survey suggests otherwise. 97% of the respondents answered ‘no’ when asked whether they intend to visit Chinese duty free for business activity instead of Korean shops in the next two years, largely due to price (31% of respondents), merchandising (29%), and reputation (15%). These differences will not easily narrow in the short term the survey finds.

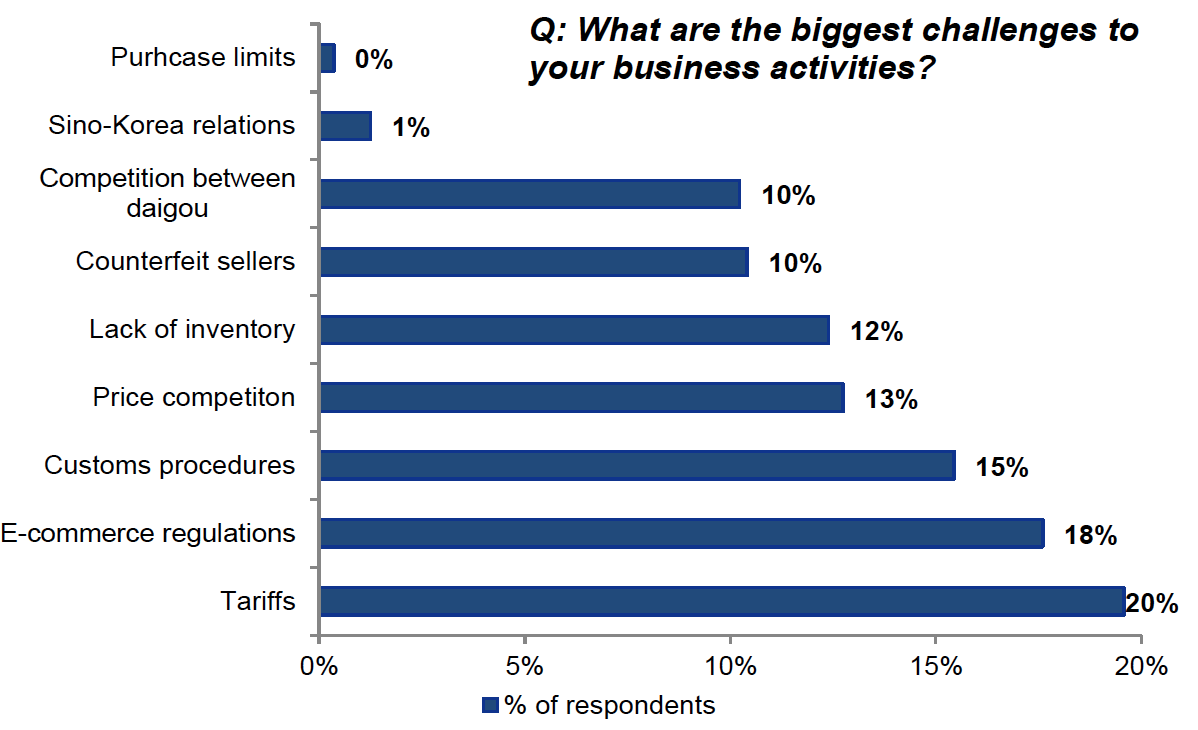

#4 – Regulation remains the biggest risk and challenge The biggest challenges to the daigous’ business activities are regulatory – tariffs (20% of respondents), ecommerce regulations (18%), and customs procedures (15%). This is obvious as complying with 1) required tariffs, 2) stipulations under ecommerce laws, and 3) customs declarations directly squeezes a daigou’s margins, and may jeopardise the survival of their business, unless still supported by the appropriate guanxi – the invisible hand of influence

CGS-CIMB’s recommendations

Long duty free shopping, short cosmetics; maintain sector UW.

CGS-CIMB remains upbeat on the long-term growth of Korea’s duty free industry but questions the sustainability of growth in sales of Korean cosmetics overall growth given their waning popularity in duty free – “the cash cow”.

“Sector valuations have declined due to COVID-19, but duty free shopping industry fundamentals are intact,” Lim concludes. “Our top buy is Shinsegae. Our top short is Amorepacific. Maintain sector underweight.”

| Coming soon The Moodie Davitt Report is soon launching a series of unique proprietary reports in association with Billion Connect, the China-based world’s largest mobile operator for the outbound traveller, driven by the exponential growth of its SIM card business. The first report (click here for details) is complimentary (by request) to The Moodie Davitt Report readers. Please email The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung, head of Moodie Davitt Business Intelligence Unit at minyong@moodiedavittreport.com for details. The Moodie Davitt Report is partnering with Billion Connect and will soon launch a series of subscriber-only monthly reports to provide actionable insights on the Chinese outbound shopper market as it bounces back from the depths of the COVID-19 crisis. |