CHINA. China Duty Free Group (CDFG) President Charles Chen has underlined the vast potential of the Hainan Island travel retail market, and said he welcomes the addition of new players who will help to “grow the size of the cake” in the offshore duty free business. Chen was speaking as today’s TFWA China Reborn virtual event on the Chinese market got off to a strong start.

Chen highlighted the resurgence of the CDFG business since February, led by the offshore duty free channel, with sales accelerating since new, expanded allowances were introduced on 1 July. He said the policy and allowances had released “new demand among Chinese shoppers for duty free consumption”.

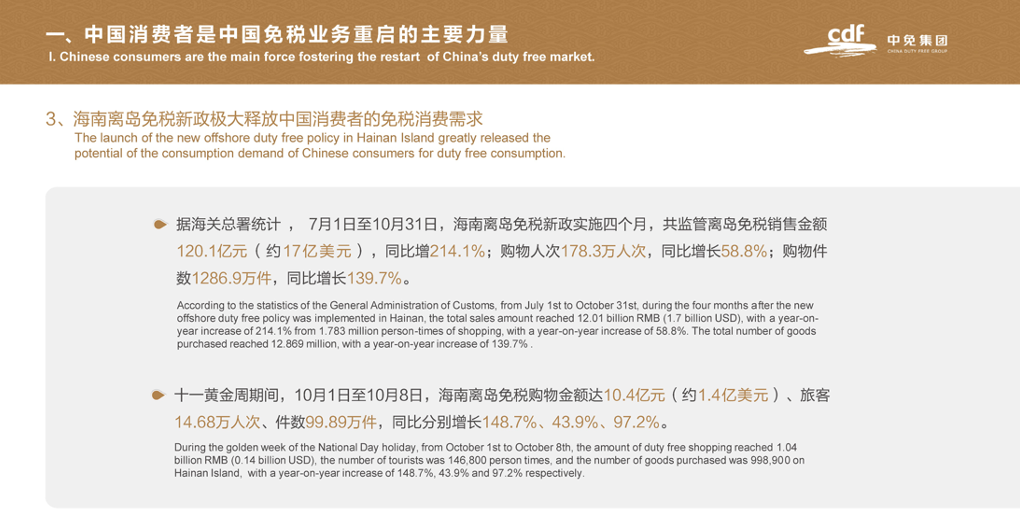

Citing Haikou Customs figures, Chen said that Hainan duty free sales from 1 July to 31 October had reached US$1.7 billion, +214% higher than the figure from the same period in 2019. The number of goods sold was 12.869 million, up by +139% year-on-year.

CDFG, said Chen, has “seized the opportunity” of the expanded duty free policy in Hainan to introduce new categories and brands. Liquor and electronics stores have been added to the mix at the Sanya International Duty Free Shopping Complex, Haikou Downtown Duty Free Shop and Haikou Meilan Airport Duty Free Shop.

Growing demand for high-end luxury has also seen CDFG partner with leading houses such as Cartier, Bvlgari, Tiffany, Prada and Canada Goose to open new branded boutiques recently. “Since [the business restarted in] February we have had much cooperation with vendors and we thank them for their support,” said Chen.

Growing demand for high-end luxury has also seen CDFG partner with leading houses such as Cartier, Bvlgari, Tiffany, Prada and Canada Goose to open new branded boutiques recently. “Since [the business restarted in] February we have had much cooperation with vendors and we thank them for their support,” said Chen.

Speaking about the addition of new licences in Hainan – three more stores will open there shortly – Chen said: “We welcome all the competition in the Hainan Island market. New players will bring new models and methods of managing duty free stores.

“We have competition in Hainan but in fact the cake is big enough for everyone to do business there. We are open to all of the new licence operators and we have good relations with the other duty free operators. What is important is not the competition but how to better serve the customers.”

He added: “Hainan Island has a very great future. The government is developing a Free Trade Port which will be a great step. There are challenges travelling elsewhere so in coming months Hainan Island will be a place for Chinese people to spend their holidays when they cannot travel overseas. So the strategy given by our government is important and we will invest a lot in our existing and new stores.

The performance of the Hainan market has helped CDFG rebuild 2020 sales to close to 2019 levels, showing ”strong momentum against the trend”. He said that the market’s strength was promising enough to mean that CDFG will lead the rankings of the world’s top travel retailers for the year.

This is also being aided by strong Chinese domestic tourism figures. During the National Day and Mid-Autumn holidays, China reported 637 million domestic tourists, recovering to 79% of 2019 levels for these events. Domestic tourism revenue reached almost 70% of prior year levels and airline passenger recovery in Q3 reached 98% of 2019 numbers.

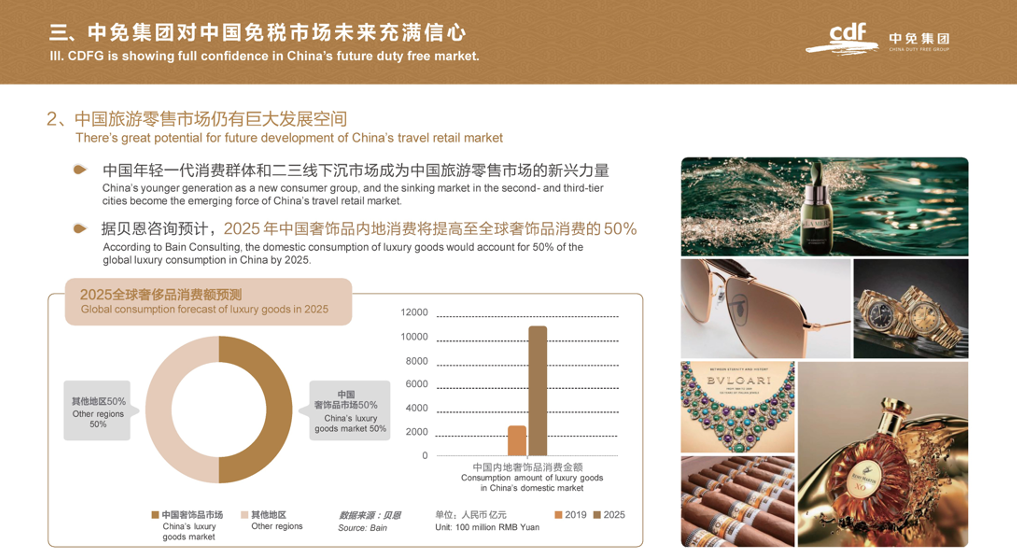

Chen said that China’s potential as a duty free market remained relatively untapped. “In 2019 China’s consumers purchased about 40% of the duty free products in the world. However China only accounts for about 8% of the global duty free market.” Chinese consumers also account for around one-third of luxury goods sales, a figure expected to hit 50% by 2025 according to Bain & Company, as reported.

In addition, younger consumers and those from second and third tier cities represent vast opportunity and an “emerging force for the Chinese duty free market”, said Chen.

CDFG has been transforming its own approach and operations to match new demand, said Chen. This means increased investment in Hainan, where the Haikou International Duty Free Mall will become the largest duty free store in the world when it opens in 2022, plus a new operation at Sanya Phoenix Airport, alongside its four existing operations. A strong focus on online sales across its business – with enhanced digitalisation and targeted marketing to its 10 million high-end members – complement that expansion of physical stores.

Chen noted: “The pandemic means that business will not return to what it was before. We are introducing contactless services, more online and even after the pandemic we’ll see new models such as pre-order, home delivery and other non-contact models. We are increasing our logistics and distribution [capabilities] and developing new business formats meet the needs of customers.”

Chen noted: “The pandemic means that business will not return to what it was before. We are introducing contactless services, more online and even after the pandemic we’ll see new models such as pre-order, home delivery and other non-contact models. We are increasing our logistics and distribution [capabilities] and developing new business formats meet the needs of customers.”

Chen concluded: “The Chinese duty free market will continue to grow vigorously. We have strong faith and confidence in this. CDFG looks forward to enhancing the exchanges and communications with partners in this industry. We continue to introduce more brands and limited collections to the Chinese market with favourable prices to better cater to the needs of Chinese consumers.

“Let’s join hands to create a better Chinese duty free market with openness, communication, cooperation and innovation. Let’s share the prosperity of the Chinese duty free market.”

Other speakers on day one of TFWA China Reborn included Lagardère Travel Retail CEO North Asia Eudes Fabre (click here for his comments), Ant Group President of International Business Group Angel Zhao and TFWA President Alain Maingreaud, with the sessions chaired by TFWA Managing Director John Rimmer.

Opening the event, Maingreaud said that despite the “considerable commercial and human pain caused by COVID-19”, new possibilities are emerging in the duty free and travel retail sector. He highlighted developments in China, which has seen the fastest economic recovery of all regions since the start of the pandemic.

“China’s duty free and travel retail market is prime example of what can be achieved when stakeholders proactively embrace change in a supportive, regulatory environment. The Chinese government’s success in bringing the pandemic under control and the strength of the subsequent economic recovery has helped fuel the substantial rise of sales to Chinese travellers in off-shore and downtown duty free stores.

“The surge in domestic tourism has increased footfall at these outlets. But it is the government’s new duty free policy for Hainan island, added to the development of new free trade ports, that is playing a decisive role.”

Maingreaud highlighted the success of China Duty Free Group as evidence of China’s economic resurgence, with CDFG becoming the world’s largest travel retailer by revenue for the first six months of 2020. He added that the group’s CDF Mall in Sanya had benefited from several high-profile summer activations by prominent luxury and duty brands, including Ray-Ban and Shiseido, which had used strong digital elements to amplify their effect.

Maingreaud said: “Interactivity, virtual reality and live-streaming, have all served to boost shopper engagement on the ground and, just as importantly, extend the reach to wider audiences of potential travellers online. While not new to travel retail, these digital tools have become essential at a time when our global industry urgently needs to attract and inspire shoppers. Brands and retailers operating outside China will be keen to learn from this experience.”

Maingreaud echoed the CDFG view that China will be at the centre of the next stage of development within duty free and travel retail. While online and digital will be “crucial” to the industry’s short- and long-term development, Maingreaud said that bricks-and-mortar will continue to play a vital role. Over recent weeks, a number of leading brands have chosen to open new boutiques in Sanya, clearly seeing the benefit of a physical retail presence at high traffic destinations like the CDF Mall.

Maingreaud said a blend of physical and digital elements will likely be the formula for future TFWA events, including the TFWA Asia Pacific Exhibition & Conference in Hainan next May.

“Given the present uncertainty affecting international travel, we are keeping an open mind about the format of this event. We will take into account the wishes of our own members and the wider industry, as well as local conditions throughout the region as we make our plans. Yet Asia Pacific’s importance to duty free and travel retail makes a regionally focused event essential, whatever shape it takes.”

We’ll bring you further highlights from the event soon.

Hainan Island: Travel retail’s global hotspot

The Moodie Davitt Report will publish a Hainan Island Special Report with the China edition of The Magazine in February 2021. Written by Martin Moodie and Dermot Davitt, it will explore how the offshore duty free business in China has become critical to the world’s leading brands across many categories.

The report will feature:

- Comment & analysis on the seismic impact of the new offshore duty free policy in Hainan since 1 July

- The potential of new offshore duty free allowances across categories from beauty to fashion and watches and from wines & spirits to consumer electronics

- Major interviews with and profiles of China Duty Free Group, CNSC, Hailvtou Sanya Downtown, Hainan Provincial Bureau of International Economic Development and others, with a special focus on the ambitious Hainan Free Trade Port project

- Beyond Hainan, we examine the rebound in the China domestic market, assess prospects for Chinese airports and hopes for an eventual return to international travel. With input from leading travel retailers in the Mainland, Macau and Hong Kong markets

- The ecommerce drive: Assessing the potential of the partnership between travel retail’s long-time market leader Dufry and the digital powerhouse Alibaba; plus digital strategies at CDFG and other major players

- With contributions from our content partner Globuy, iClick, Jessica’s Secret and DutyFree Expert on trends among Chinese consumers and the duty free market

Contact Irene@MoodieDavittReport.com to partner with The Moodie Davitt Report for this special edition.