INTERNATIONAL. Online is set to become the leading channel for luxury purchases by 2025, with tourism spend shifting to domestic markets – led by China – in the years ahead. That’s according to the 19th edition of the Bain & Company Luxury Study, released this week in collaboration with Fondazione Altagamma, the Italian luxury goods manufacturers’ industry foundation.

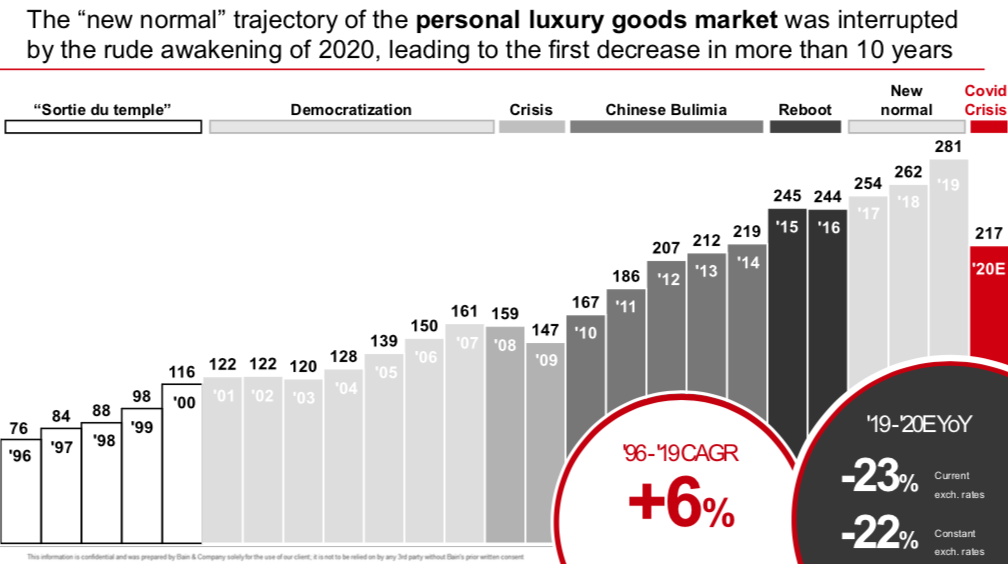

Assessing the market in 2020, the authors said that the core personal luxury goods market contracted for the first time since 2009, falling by -23% at current exchange rates to hit €217 billion due to the COVID-19 crisis.

The fall in luxury sales is the largest since Bain has been tracking the industry. The overall luxury market – encompassing both luxury goods and experiences – shrunk at a similar pace and now is estimated at approximately €1 trillion. Recovery will come by 2022-23, estimates Bain.

The report noted that the collapse in global tourism has changed “how, when and why” luxury is purchased. Online shopping for luxury goods has soared, doubling its share of the market to 23% in 2020 from 12% in 2019.

“We have all experienced a difficult year of rapid, unexpected changes and luxury has not emerged unscathed,” said Claudia D’Arpizio, a Bain & Company Partner and lead author of the study.

“While the industry has suffered from a pause in global travel and ongoing lockdowns, we believe it has the necessary resilience to manage through the crisis. We have faith in its ability to transform its operations and redefine its purpose to meet new customer demands and retain its relevance, especially for younger generations.”

A year of shock but recovery in sight

Following the second quarter, which was the worst the sector has ever experienced, there were signs of recovery in the third quarter, said the authors. The most likely outcome is a -10% year-on-year drop in the fourth quarter, which is heavily dependent on the future evolution of the pandemic and the additional restrictions that national governments could put in place.

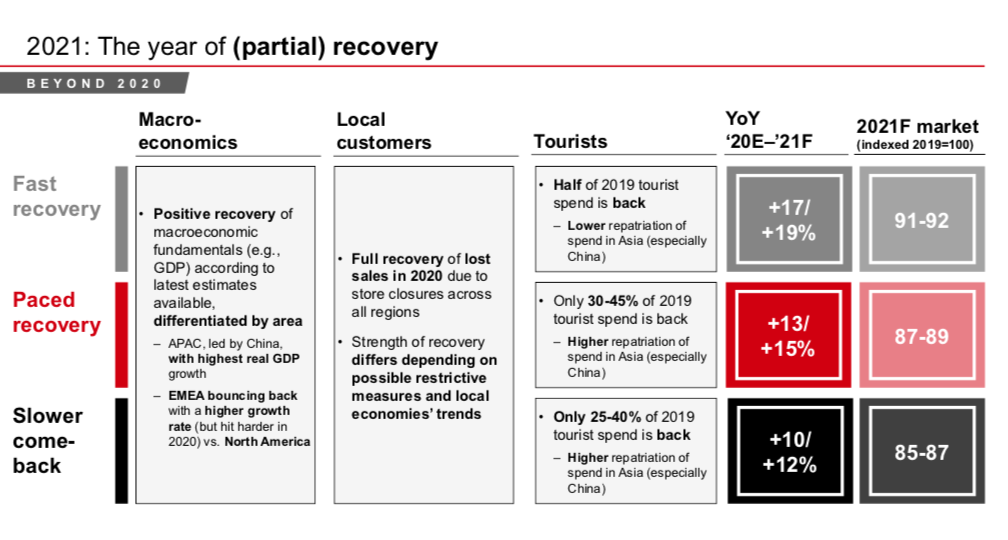

Bain forecasts growth that ranges from +10-12% to +17-19% depending on macroeconomic conditions, the evolution of COVID-19 and the speed of return to travel globally as well as the resilience and confidence of local customers.

The decline in revenue is taking a disproportionate toll on profitability – Bain expects operating profit to decline by -60% in 2020 versus 2019 levels (from an average of 21% margin to 12% margin) in the luxury goods sector. According to the study, in 2021 the market is expected to recover 50% of the profit loss of 2020 – still below 2019 levels. This is driven by requirement to continue spending, and sometimes even accelerate investment, on most cost items (marketing, online channels, store costs) despite the drop in sales.

Bain expects the recovery to gather pace over the next three years, with the market returning to 2019 levels by the end of 2022/early 2023, as noted above.

The China factor

Mainland China has been the only region globally to end the year on a positive note, growing by +45% at current exchange rates to reach €44 billion. Local consumption has roared ahead across all channels, categories, generations and price points, said the authors.

In Europe, while local consumption remains solid, regional consumption fell by -36% at current exchange rates to €57 billion.

The Americas experienced less impact and the market fell by -27% at current exchange rates to €62 billion. In the US, department stores face an uncertain future and the map of luxury consumption has been redrawn to move away from city centres.

Japan has seen a polarised performance among brands with higher resilience of those deemed timeless and seen as long-term investments. The region shrunk by -24%at current exchange rates to €18 billion in 2020.

The rest of Asia also struggled, with Hong Kong and Macau among the worst performers globally. The region contracted by -35% at current exchange rates to reach €27 billion.

The impact in the Middle East was mitigated by shorter lockdowns and repatriation of spending previously made abroad, though with different nuances among countries within the region. In Australia, a slowdown from the wildfires was amplified by the halt of tourism. Overall, the rest of the world contracted by -21% at current exchange rates to €9 billion.

Bain said: “The regional shifts mark an acceleration of a rebalancing of where luxury purchases are made as tourists shift to buy in their home markets. The share of purchases made locally reached 80-85% this year and going forward we expect it to represent between 65-70% as domestic purchases regain relevance especially in China and the broader Asian region.”

Online channel accelerates growth

In the luxury market, online sales made up €49 billion in 2020, up from €33 billion in 2019. The share of purchases made online nearly doubled from 12% in 2019 to 23% in 2020.

Online is set to become the leading channel for luxury purchases by 2025, fuelling the omnichannel transformation.

The report said: “This dramatic increase comes at the expense of bricks-and-mortar. Bain expects no growth in the number of stores operated directly by brands in 2020 and possible decline in store networks in 2021. Brands will need to adjust their footprints to the new map of luxury buying, evolve the store role and its ergonomics, and maximise the customer experience. The wave of transformation will not leave the wholesale distribution untouched: perimeter contraction, polarised performance and entry of new players will lead luxury brands to increase their control on the channel.”

Experience-based goods to lead recovery

All personal luxury goods categories have seen declines in 2020. Shoes were cushioned by demand in sneakers, falling by -12% to €19 billion while jewellery saw sustained demand in Asia and benefited from online sales. That category remains polarised with high jewellery and iconic entry priced items leading the recovery.

Watches and apparel both declined by -30%. For watches, COVID-19 amplified the already critical secular consumption pattern shifts from the category. Formal wear demand was in sharp decline and apparel players faced increasing competition from social media savvy, direct-to-consumer brands.

Across product categories, entry-price items increased their relevance, reaching more than 50% of volumes sold in 2020. Bain said: “In the quest for relevance with regards to pricing, the rules of the game and business models are rapidly changing accessible luxury as we knew them, increasing competition from new, insurgent brands with relevant purpose and business models for the customer of today.

“Looking at the wider luxury market, experience-based goods (which Bain defines as fine art, luxury cars, private jets and yachts, fine wines & spirits and gourmet food) are expected to recover at a faster pace than personal goods, while experiences will lag in the recovery given strong reliance on tourism.”

A growing social agenda for consumers

In addition to sustainability and environmental issues, diversity and inclusion have come to the fore in 2020. Younger generations – who are set to drive growth in the market from 2019 to 2025 – place an unprecedented emphasis on tackling social and racial injustice, noted the study.

“Luxury brands have faced a year of tremendous shifts but we believe that the industry will come out of the crisis with more purpose and more dynamism than ever before,” said Federica Levato, a Bain & Company Partner and co-author of the study.

“By 2030, this industry will be drastically transformed. We will not talk about luxury industry anymore, but of the market for insurgent cultural and creative excellence. In this new enlarged space, the winning brands will be those that build on their existing excellence while reimagining the future with an insurgent mindset. Luxury players will need to think boldly to rewrite the rules of the game.”