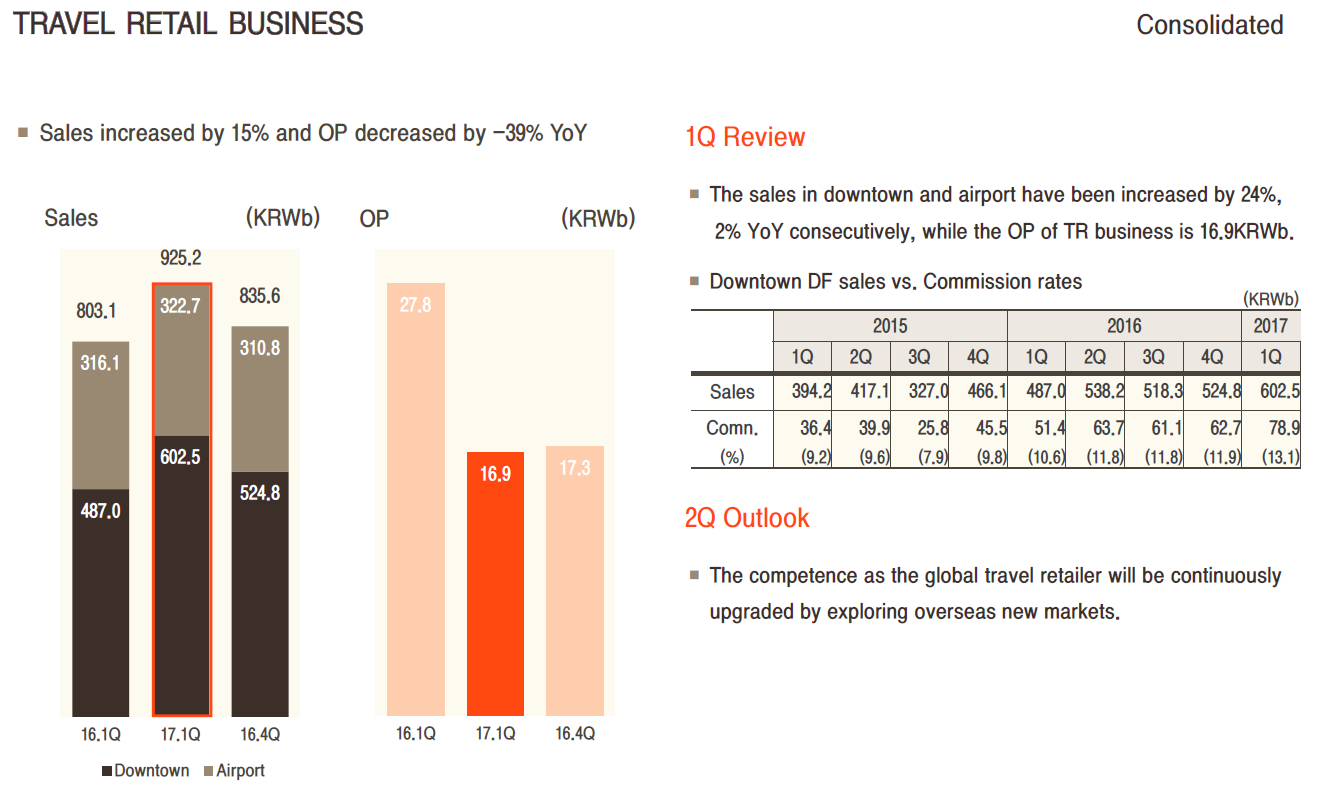

SOUTH KOREA. The Shilla Duty Free parent company Hotel Shilla reported a +14.9% rise in consolidated revenue to KW1.02 trillion (US$903.7 million) for the first quarter of 2017. However, group operating profit slumped by -48.2% to KW10 billion (US$8.86 million) on a whopping -39% slump in Korean duty free profits due to soaring tour group commission rates (brought on by the proliferation of duty free licences) and high promotional costs.

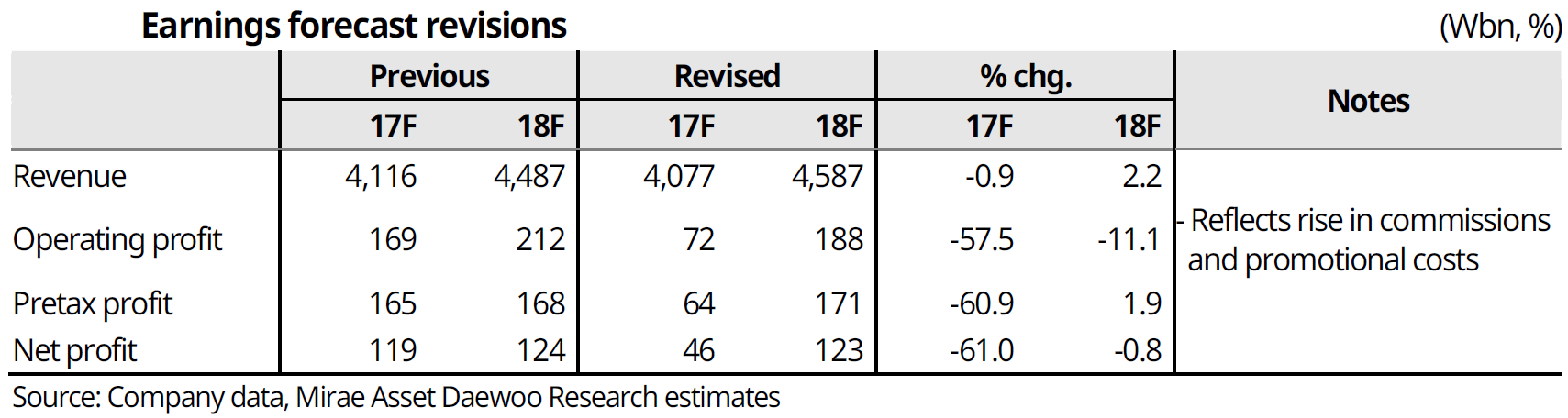

Revenue, which topped KW1 trillion for the first time, beat the market consensus estimate by +9.5%, according to leading analyst Mirae Asset Daewoo.

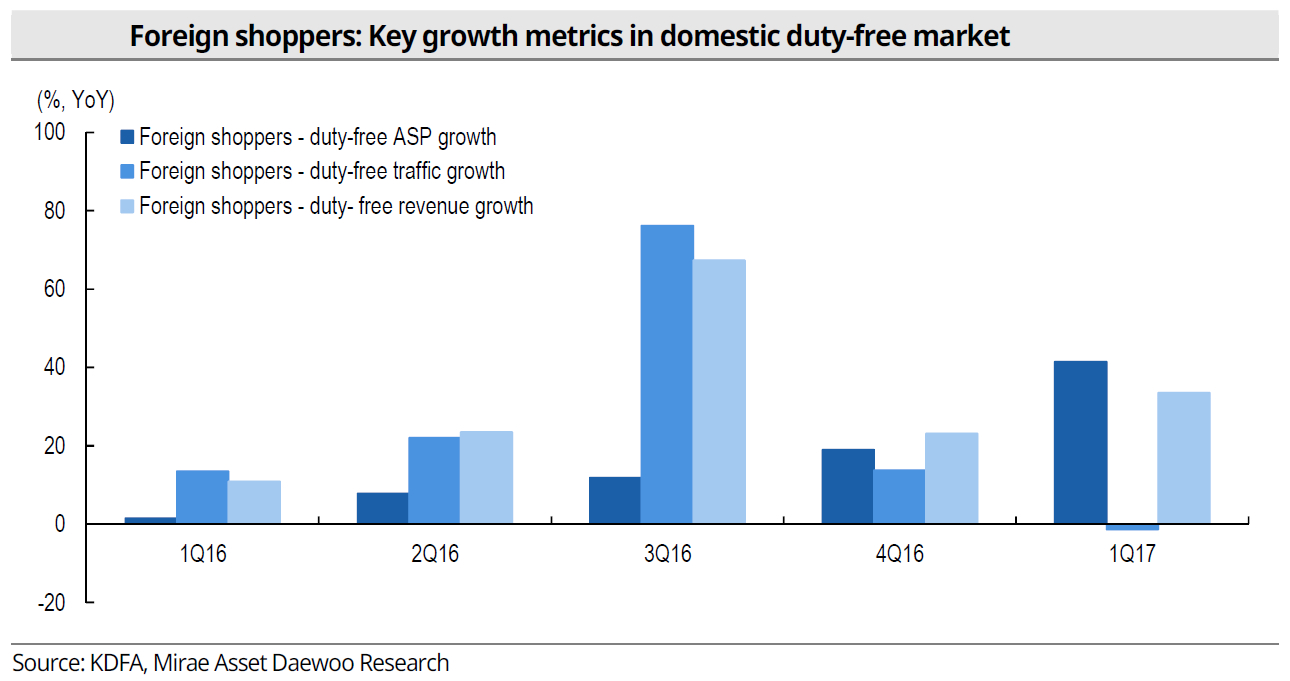

Despite stiffening competition and the collapse in Chinese tourism after mid-March due to the THAAD dispute with China, Shilla’s Korean downtown duty free revenue grew steeply (+23.7% year-on-year) to KW603 billion (US$534.3 million). However, Korean airport duty free sales fell by -1.6% year-on-year to KW185 billion (US$163.9 million). The company’s Korean market duty free sales overall rose by +17% to KW787.6 billion.

The next quarter, however, is certain to prove much more testing amid a drastic fall in Chinese visitors due to the THAAD controversy.

“Shilla is the first retailer to have simultaneously secured duty free perfumes & cosmetics concessions across Incheon International, Hong Kong International and Singapore Changi airports”

The rising commissions and promotional costs drove down The Shilla Duty Free’s operating margin from Korean duty free operations to 2.7% (vs. 5.2% in 1Q16).

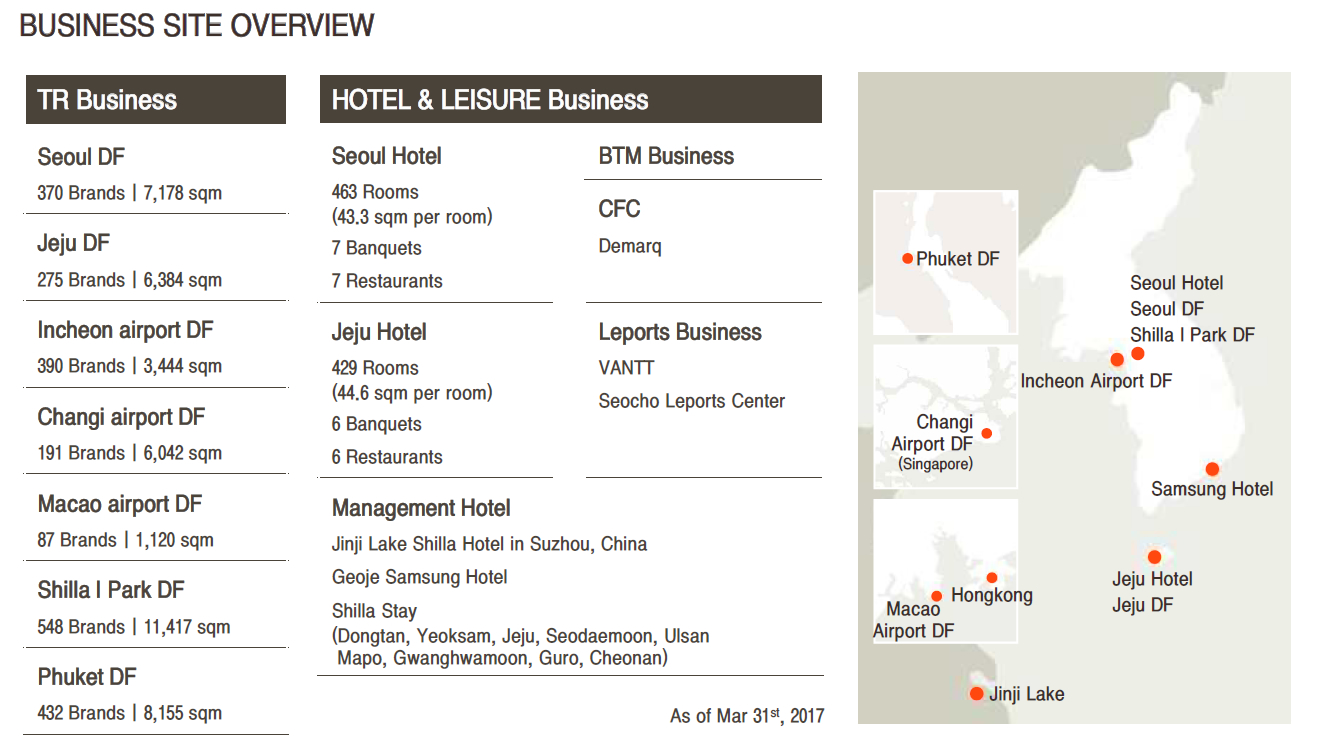

Shilla’s perfumes & cosmetics business at Singapore Changi Airport and interest in the much smaller duty free concession at Macau International Airport (a joint venture with Sky Connection) as well as its recently opened downtown store in Phuket, Thailand collectively posted record quarterly sales of KW137.6 billion (US$121.9 million).

While the heavy Changi losses shrunk by -43% quarter-on-quarter, according to Mirae Asset Daewoo, the offshore duty free business still lost KW4.5 billion (just under US$4 million) in the three-month period (significantly better than the KW7.2 billion/nearly US$6.4 million loss in Q1 2016).

“An entirely new chapter”

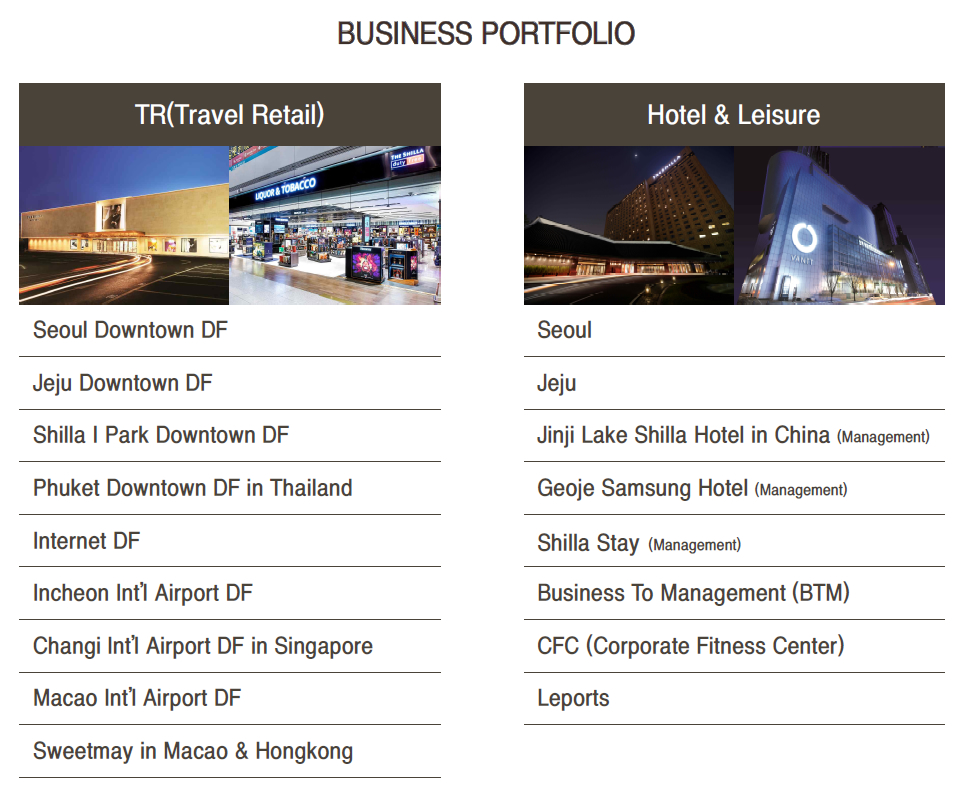

Assessing the results, Mirae Asset Daewoo Research Center Equity Analyst (Cosmetics, Hotel & Leisure, Fashion) Regina Hahm noted Shilla’s recent double success in winning the perfumes & cosmetics concessions at Incheon International Airport Terminal 2 and Hong Kong International Airport.

“Now having secured airport duty free concessions for cosmetics/perfume in Singapore, Incheon, and Hong Kong, Hotel Shilla will likely benefit from medium/long-term improvement in negotiating power and cost efficiency” – Mirae Asset Daewoo Research Center Equity Analyst (Cosmetics, Hotel & Leisure, Fashion) Regina Hahm

She noted: “Of the country’s two major airlines, the top carrier [Korean Air] is highly likely to operate out of T2. From 2018, Hotel Shilla will control 70.8% (in terms of total area) of all cosmetics/perfume duty free shops operated by general enterprises in Incheon International Airport. And given T2’s advantageous location, the company’s market share in terms of revenue should exceed its share in terms of total area.”

Hahm also highlighted what she described as “an entirely new chapter in the history of local retailers”, with Shilla being the first retailer to have simultaneously secured duty free perfumes & cosmetics concessions across Incheon International, Hong Kong International and Singapore Changi airports.

Short-term results less relevant amid sharply improving fundamentals

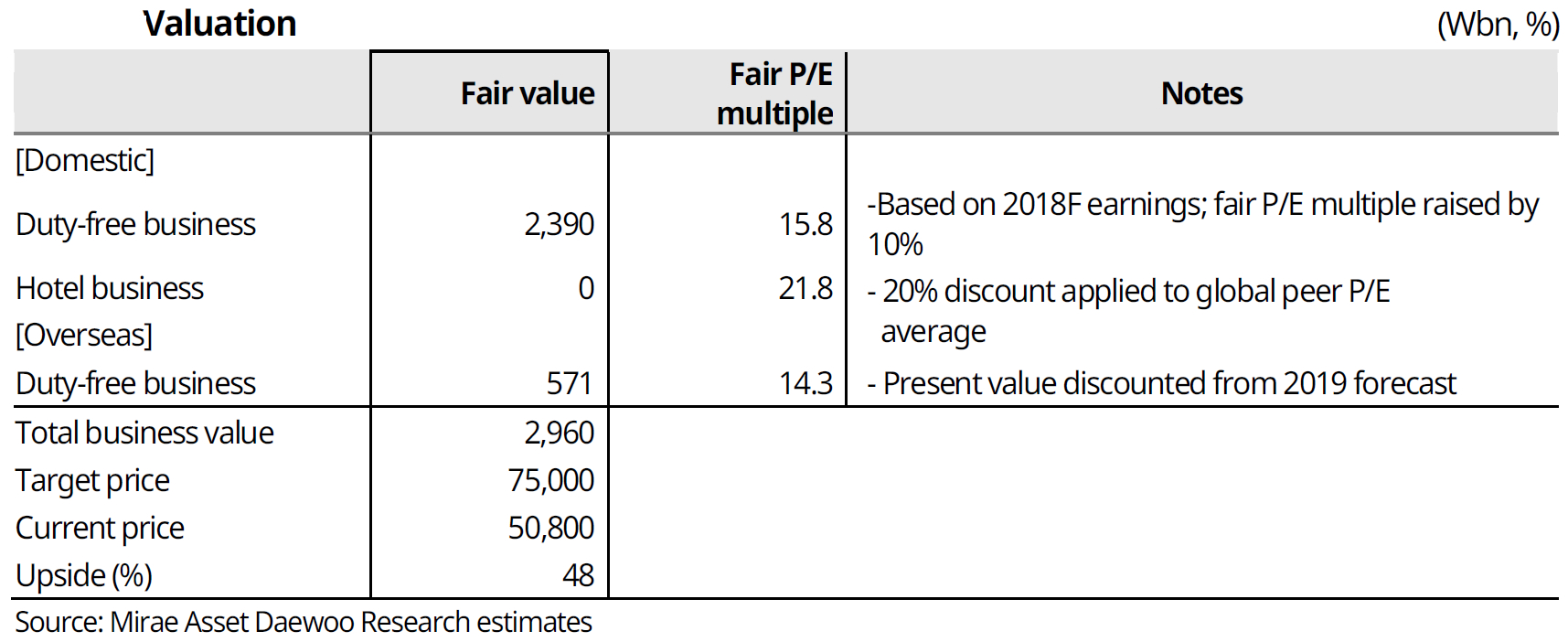

Mirae Asset Daewoo maintained its ‘Buy’ rating on Hotel Shilla and raised its target price by +21% to KW75,000.

Ms Hahm concluded: “Given the sharp improvement in the company’s fundamentals and competitiveness, short-term earnings results are now of less importance for investors. We thus change our valuation period to 2018F to better reflect forecasts for earnings stabilisation and the growing value of duty free operations with expansions to Incheon T2 and Hong Kong International Airport.

“Now having secured airport duty free concessions for cosmetics/perfume in Singapore, Incheon, and Hong Kong, Hotel Shilla will likely benefit from medium/long-term improvement in negotiating power and cost efficiency.”