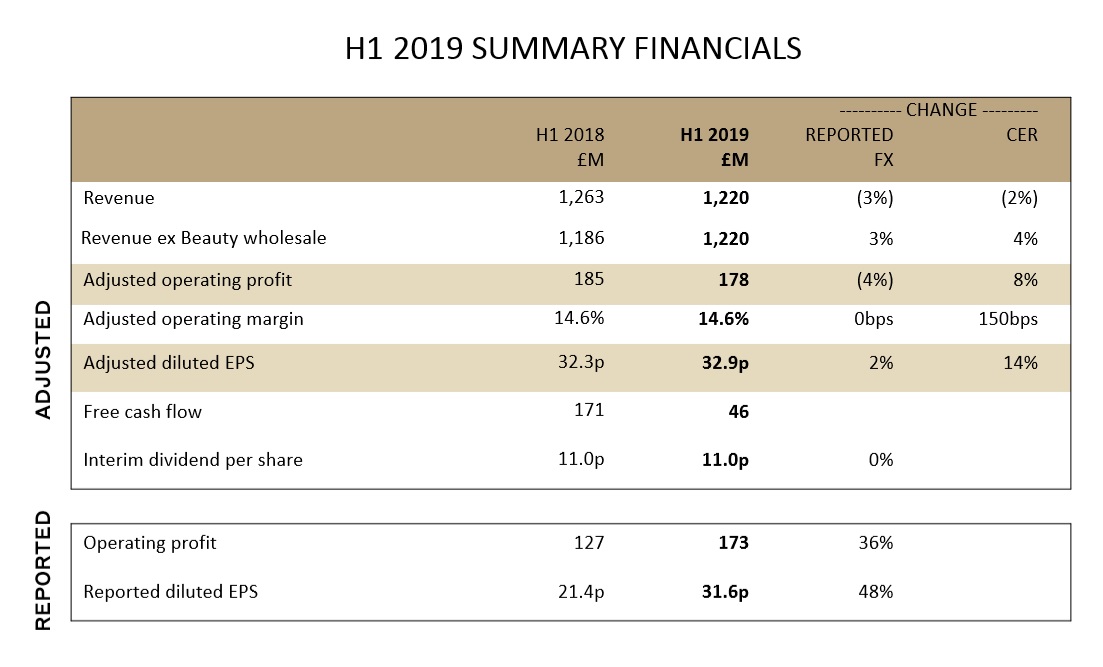

The wholesale division of UK luxury brand Burberry – led by Asian travel retail growth – kept the company on track in the half year ended 29 September 2018 (H1 2019). This was at a time when retail sales were flat and the company has been repositioning the brand.

Burberry said: “Excluding beauty, wholesale revenue grew +10% at constant exchange rates (+9% reported), ahead of expectations, due to strength from Asia travel retail accounts given regional travel patterns.”

The boost from travel retail led to wholesale reaching £254 million (US$325 million) in sales whereas the biggest division – retail – was flat at £944 million (US$1,208 million). In the period, wholesale accounted for 20.8% of sales, and retail for 77.4%. The two divisions combined contributed 96.5% of Burberry’s turnover.

Total revenue slipped by -2% at at constant exchange rates (-3% reported) to £1,220 million (US$1,561 million).

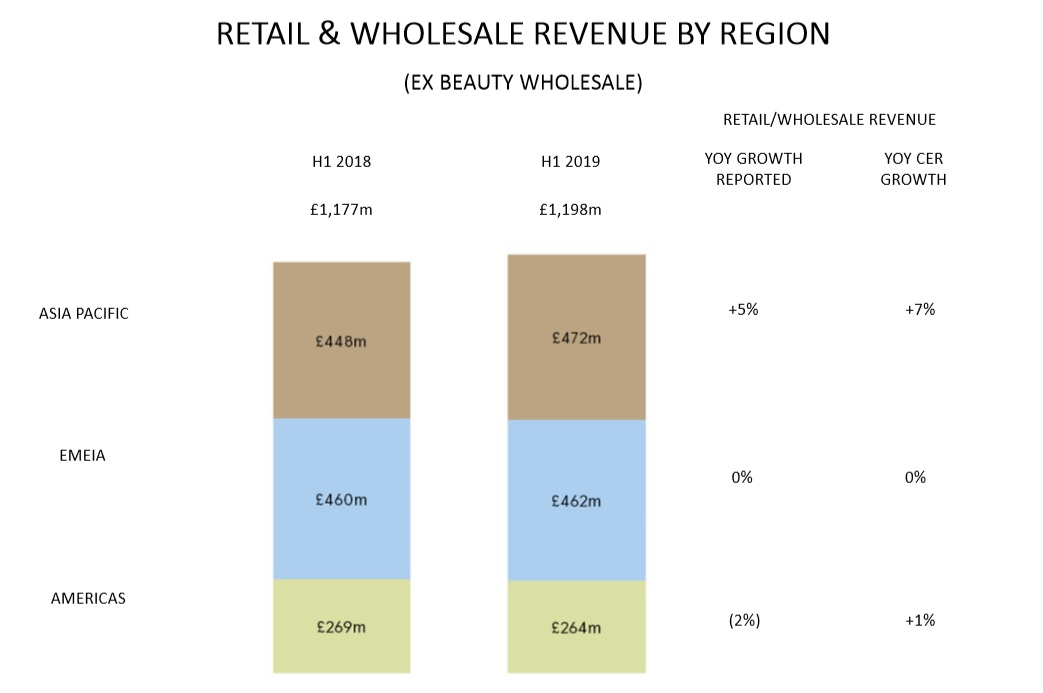

Asia Pacific overtakes EMEIA

Across retail and wholesale combined, +7% growth in Asia Pacific (constant exchange rates) means that the region is now generating slightly more revenue than EMEIA where growth was flat. In the period, sales were £472 million and £462 million respectively.

Regionally, Burberry noted that Asia Pacific’s significant growth, and stability in EMEIA (Europe, Middle East, India and Africa), “was offset by a decline in the US, as we take action to improve customer perception in the market”.

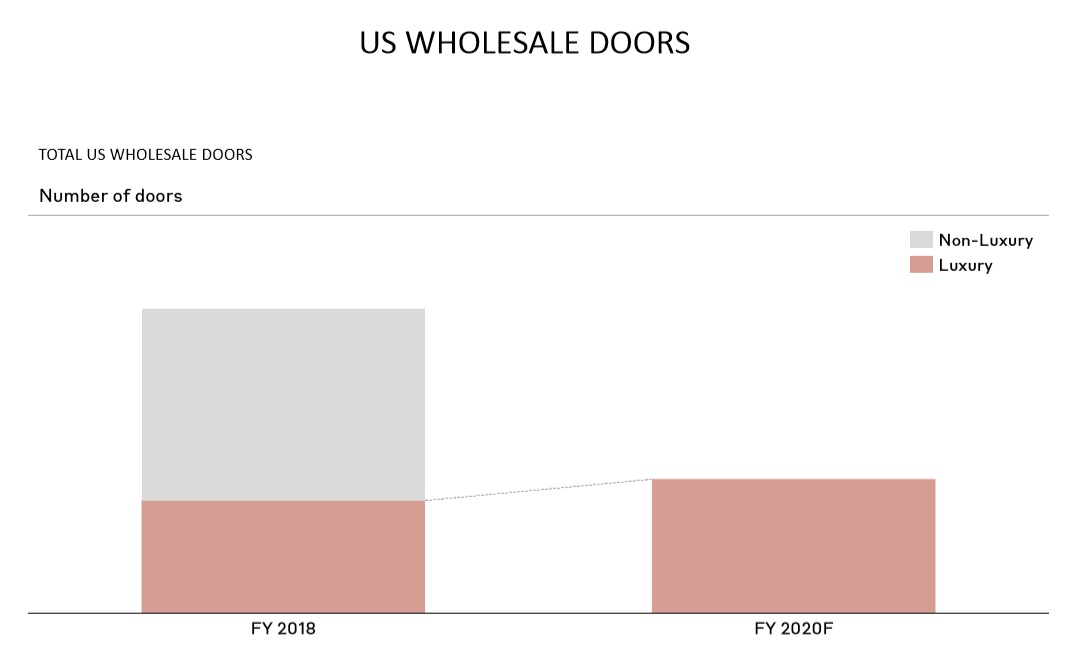

That comment refers to Burberry’s decision to rationalise its doors in the US by more than half by 2020. It will do this by cutting all non-luxury locations and increasing those it considers luxury.

As part of a general wholesale transformation the brand says that “negotiations for all non‐luxury closures are complete and that the company has “established relationships with new, brand‐driving partners”.

Social media momentum

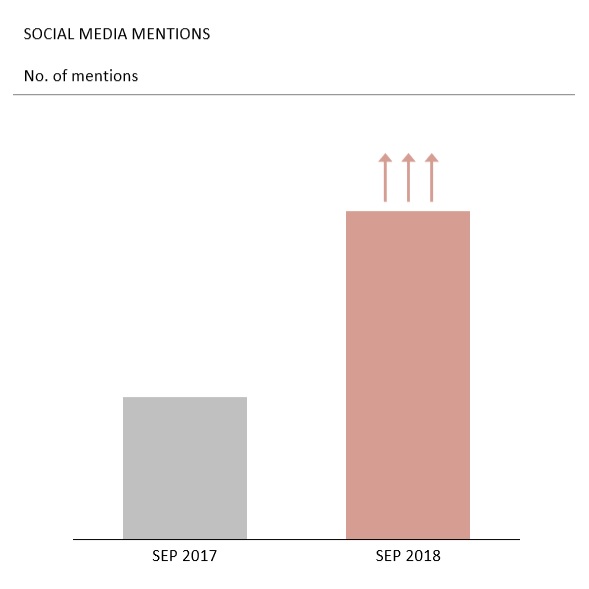

Burberry is also engaged in a strong social media strategy including Instagram and WeChat as it builds endorsements through influencer relationships. The brand has seen its mentions on key social sites more than double in September 2018 versus September 2017 (source: Linkfluence; Instagram Analytics, WeChat; Twitter Analytics).

Burberry Chief Executive Officer Marco Gobbetti commented: “We are energised by the early results as we begin to transform and reposition Burberry. The initial response from influencers, press, buyers and customers to our new creative vision and Riccardo’s debut collection, Kingdom, has been exceptional [Riccardo Tisci is the Chief Creative Officer of Burberry Group-Ed]. “Mindful that we are only in the first phase of our multi-year plan, we continue to manage dynamically through the transition. We confirm our outlook for the full year.”

Burberry Chief Executive Officer Marco Gobbetti commented: “We are energised by the early results as we begin to transform and reposition Burberry. The initial response from influencers, press, buyers and customers to our new creative vision and Riccardo’s debut collection, Kingdom, has been exceptional [Riccardo Tisci is the Chief Creative Officer of Burberry Group-Ed]. “Mindful that we are only in the first phase of our multi-year plan, we continue to manage dynamically through the transition. We confirm our outlook for the full year.”

In FY 2019 Burberry expects net space reduction to impact retail revenue by -1%, as the programme of store rationalisation and relocation continues but wholesale revenue (excluding beauty) is now expected to be up by a mid-single digit percentage due to anticipated growth from luxury accounts more than offsetting rationalisation activities.

Full H1 2019 top-line results below.