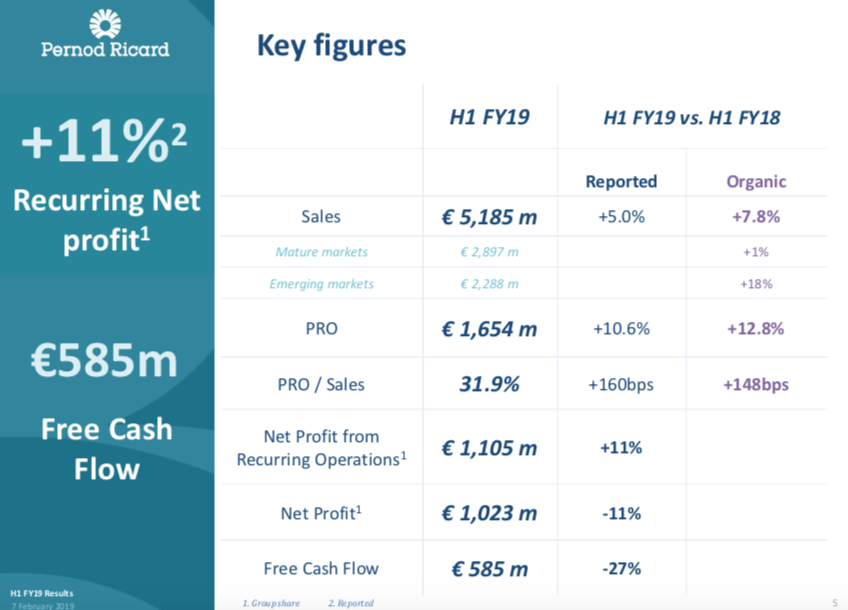

Pernod Ricard today reported first-half sales of €5,185 million, with organic growth at 7.8% and reported growth lower at 5% due to a negative foreign exchange impact. Travel retail played a solid role across the key regions, led by the Scotch business and strong growth at Martell Cognac.

The company said that overall growth was well diversified, with a strong price/mix notably on its Strategic International Brands, the positive impact of an earlier Chinese New Year and progress on its Operational Excellence roadmap. The latter is expected to create savings of €200 million by the end of June, a year ahead of plan.

The Americas business showed “robust growth” of 4%, with the USA growing broadly in line with the market. The company singled out the performances of Jameson, Malibu, The Glenlivet and Martell, but Absolut remains in decline. Travel retail in the Americas grew by 6% in sales, driven by Scotch and a positive price and mix, notably on Martell and Chivas.

Asia-Rest of World delivered “strong acceleration” of 16%, thanks to China and India and Africa Middle-East. Travel retail posted a 6% sales rise, aided by the growth of Martell (up 12% in this channel) and Chivas, the latter buoyed by the launch of Chivas XV.

Europe was stable, with momentum in Eastern Europe but a contrasting performance in Western Europe. Travel retail turned in a “weaker performance”, said the group, “driven by a negative environment in Russia and reduced promotional activity on Martell”.

The Strategic International Brands business overall posted sales growth of 10%, driven by Martell (up 23%, aided by performance in China, USA and travel retail) and Jameson (up 8%), with good performances in Scotch (up 9%), gin and Champagne.

Strategic Local Brands posted a rise of 11%, thanks to Seagram’s Indian whiskies (including positive pricing) while Specialty Brands also grew by 11% aided by Lillet, Monkey 47 and Altos. Sales in Strategic Wines arm fell by 8%, due to the implementation of a value strategy and a high basis for comparison on Campo Viejo (up 23% in H1 FY18).

First-half profit from recurring operations (PRO) was €1,654 million, with organic growth of 12.8% and 10.6% reported. For full-year 2019, the FX impact on recurring profits is estimated at €30 million.

Group share of net profit was €1,023 million, down by 11% on a reported basis against H1 2018. This was due to positive non-recurring items in the previous year.

Chairman and Chief Executive Officer Alexandre Ricard said: “H1 FY19, the first semester of our new Transform & Accelerate three-year plan, was very strong. While enhanced by phasing, it confirms the acceleration of our growth, resulting from our long-term investment strategy.

“For full year FY19, in an environment that remains uncertain, we aim to continue dynamic and diversified growth across our regions and brands. By the end of June 2019, we will have completed our operational excellence plan announced in 2016, delivering €200 million of P&L savings one year ahead of plan.

“We are increasing our guidance for FY19 organic growth in Profit from Recurring Operations to between 6% and 8% while improving operating leverage by c. 50bps. We will continue to roll out our strategic plan, focused on investing for sustainable and profitable long-term growth.”

Looking ahead, Pernod Ricard said it aimed to capture new consumer trends by focusing on innovation, portfolio management (divesting non-core brands and acquiring others in growth sectors), focusing on luxury and prestige and developing a speciality brands range.

It also singled out travel retail as one of its “must win” markets for the future, alongside China, India and the USA.