NORTH AMERICA. The Airport Restaurant & Retail Association (ARRA) has issued its third ‘Facing Facts’ White Paper, which urges closer alignment of the economic interests of airports and their concession partners post-crisis. ARRA notes that, with recovery on the way, change is required to the prevailing business model – change that supports current “cost and operational realities” and ensures a sustainable recovery for businesses.

Two previous white papers from the association underlined the effects of the pandemic on airport concessionaires and proposed ideas that could help the sector survive and recover. The latest paper builds on these while acknowledging the continuing severe impact on the business.

Introducing the new paper, ARRA said: “Summer is starting strong and [traffic] appears to be robust. However, the longevity of this leisure passenger-driven recovery is unknown. Further, what will the recovery of business and international travel look like? This uncertainty means the concessions industry recovery is far from certain. Moreover, recovery—when it occurs—will not resolve systemic issues in the airport concessions business that were evolving before the pandemic.”

ARRA said that airport retail and restaurant operators lost over 90% of their business early last year—following a decade of “increasing headwinds” from escalating capital and labour costs, and revenue and margin challenges.

To survive, concessionaires large and small incurred vast debt and faced dramatically altered operating procedures, it noted. Now, even as US airport traffic reaches 70% of pre-pandemic levels, travel retailers and restaurateurs face “constantly changing flight schedules and capacity, slowly increasing, but uneven passenger levels, and a set of shifting airport dynamics that make planning and predicting operational needs nearly impossible—all the while challenged by a workforce reluctant to re-engage”.

ARRA added: “Our new debt reality must be acknowledged in order for the industry to move forward constructively. Moreover, the process of returning to positive cash flow is likely to be prolonged by several factors. Pre-pandemic debt remains outstanding; deferred rent remains outstanding; and new debt required to stay afloat during the pandemic has accumulated.

“All the while, airports are anxious to get their concessions programmes up and running amidst positive vaccination news and an uptick in traffic. Yet, concessionaires face new operational challenges as they work to reopen, ranging from extreme difficulty re-staffing restaurants and stores due to the overall national labour shortage, supply chain disruptions creating shortages and higher costs, and a changing mix of passengers with different spending patterns.”

It highlighted “fundamental flaws” in the business model, with the white paper examining four key areas in particular:

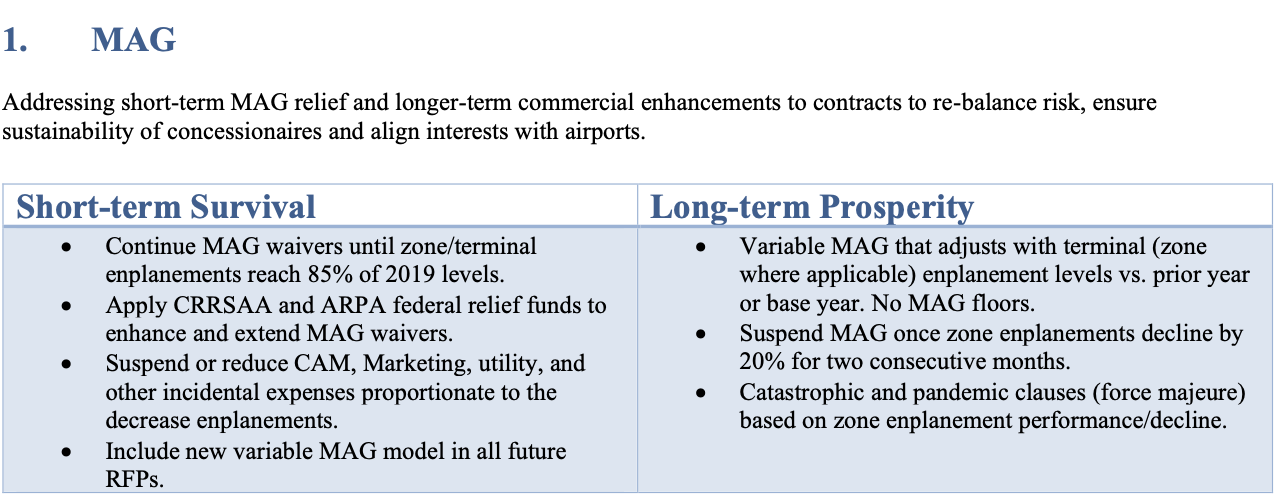

1) Minimum Annual Guarantees (MAG)

2) Capital Investment

3) Labour Access and Cost

4) Operational Flexibility

The latest ‘facts’ laid out by ARRA in its white paper are as follows:

#1: The current MAG model is unsustainable

ARRA said: “The model creates extraordinary, unnecessary risk for operators and does not achieve intended goals.”

The association noted that MAGs’ lack of flexibility subjects concession businesses to “extraordinary, disproportionate risk”, despite having no control over a key factor of their revenue stream—the number of potential customers. MAGs have historically contemplated only a small fluctuation in passenger volume over the course of a year but no plan exists traditionally for “dramatic, immediate, and/or prolonged loss of passengers”.

The white paper argues that the MAG model does not achieve its goals of maximising sales, offering a way to compare competitive [bid] proposals or supporting airport bond financing.

ARRA’s recommendations for the short-term include:

- Continue MAG waivers until zone/terminal enplanements reach at least 85% of 2019 levels.

- Apply federal relief funds to enhance and extend MAG waivers.

- Suspend or reduce Common Area Maintenance (CAM), marketing, utility, and other incidental expenses proportionate to the decrease enplanements.

- Include new variable MAG model in all future RFPs.

Longer term ARRA proposed:

- Variable MAG that adjusts with terminal (zone where applicable) enplanement levels vs. prior year or base year. No MAG floors.

- Suspend MAG once zone enplanements decline by 20% for two consecutive months.

- Include new variable MAG model in all future RFPs.

#2: Capital investment model needs to be restructured

ARRA said: “A fair return on investment (ROI) is unachievable given escalating construction costs which have severely impacted prime and ACDBE operators.”

While street-side restaurant and store construction costs vary regionally and range between US$100 to US$400 per square foot, ARRA said, based upon the project scope, an overall average for airport restaurants ranges between US$1,000 and US$1,400 per square foot and for retail stores between US$400 and US$800 per square foot.

These costs continue to rise sharply, with retailers further hit by changes in project scope and the fact that term lengths have not extended in line with rising capex needs. Cash flow is a particular issue for smaller, minority-owned businesses seeking to enter or remain in the airport system.

ARRA’s recommendations for the short-term include:

- Grant contract term extensions as a means of providing a longer runway to earn sufficient operating cash flow to recover initial capital investment.

- Defer and reduce or eliminate mid-term capital obligations.

- Review current expansion and reopening plans to ensure optimal programme size for business potential.

- Implement airport-sponsored funding assistance programmes, such as low- or no-interest loans, for ACDBEs.

Longer term ARRA proposed:

- Extend contract term for new RFPs to 10-15 years.

- Provide a tenant improvement allowance to offset capital requirements.

- Redefine base building obligations and commitments from the airport.

- Reconsider expected levels of finishes in stores and restaurants.

- Ensure optimal programme size focusing on industry benchmarks.

- Implement airport-sponsored funding assistance programmes, such as low-or no-interest loans, for ACDBEs.

#3: Labour costs are unsustainable, and employee hiring challenges are real

ARRA said: “Collaboration on employment related decisions is key to attracting a talent pool. A concessions surcharge will help defray rising employee costs.”

While all businesses face the challenge of hiring staff post-pandemic, the issue is especially acute at airports, noted ARRA, with premiums required to offset less attractive work conditions, concessionaires often face higher labour costs due to unionised labour or airport-mandated above-market minimum wages and/or benefits.

“Today on average, due to suppressed sales and minimum staffing requirements to maintain levels of service (or brand standards), US$0.35 to US$0.45 of every dollar an airport restaurant or retail store earns goes to labour. This is well over normal proportions pre-COVID. This proportion also exceeds street-side comparable businesses where labour accounts for only 25% to 30% in food service and 15% in retail. When these costs are combined with higher on-airport construction costs, security, and other airport-specific costs, concessionaires face razor-thin margins, making it difficult to operate profitably.”

ARRA’s recommendations for the short-term include:

- Implement a 3-5% surcharge on all retail and restaurant checks (non-rentable) to offset higher wage and benefit costs.

- Support the marketing and attraction of employee recruiting efforts through measures such as expedited badging, parking, transportation, and job fairs.

Longer term it proposed:

Assist all vendors at making the ‘Airport’ an Employer of Choice, relying on: Day care facilities for all employees; education benefits; fringe benefits similar to those provided by a municipality; ensure quality and time efficient public transportation to service early and late hour employee commuting. Plus, ARRA suggested, support implementation of new technology initiatives which offset labour needs.

#4: Operating flexibility for concessionaires is critical to addressing the current pandemic and ongoing survival

ARRA said: “Reopening strategy must be tied to exposed enplanement growth, and greater latitude on critical business decisions is needed for operators.” The association said that a measured approach was needed to reopening shops and restaurants, but said that their ability to react to market circumstances was often hindered by airport decisions made “in the name of sustainability, sponsorships, and pricing policies”.

ARRA’s recommendations for the short-term include:

- Agreed to benchmarks by zone for reopening triggers and hours of operation.

- Staffing and menu changes at the discretion of the concessionaires working in partnership with airports.

Longer term ARRA proposed:

- Avoid in-terminal airport exclusive vendor arrangements.

- Explore efficient Central Receiving and Distribution Center (CRDC) models and Transportation Security Administration (TSA) screening integration.

- Augment market basket pricing approach to allow for more flexibility and higher spreads.

Background

Facing Facts III: Survival, Revival and Braving the Future is presented as a continuation of ARRA’s series of white papers discussing the COVID-19 pandemic and its impact on the airport restaurant and retail industry. This instalment is informed by contributions from ARRA’s weekly COVID-19: Survival and Revival industry calls, discussions with airport leaders and industry experts, and close collaboration among ARRA’s Board of Directors and members—large and small, primes and Airport Concession Disadvantaged Business Enterprises (ACDBEs).