INTERNATIONAL. Aside from the phenomenal growth in online distribution, airports were the next best performing channel for luxury sales in 2017, according to estimates by management consulting firm Bain & Company.

The 16th Bain Luxury Study, commissioned by the trade association of Italian luxury goods manufacturers Fondazione Altagamma, found that online sales grew by a huge +24% while airports had a solid year with +12% growth. The off-price store segment also posted good growth at +8%.

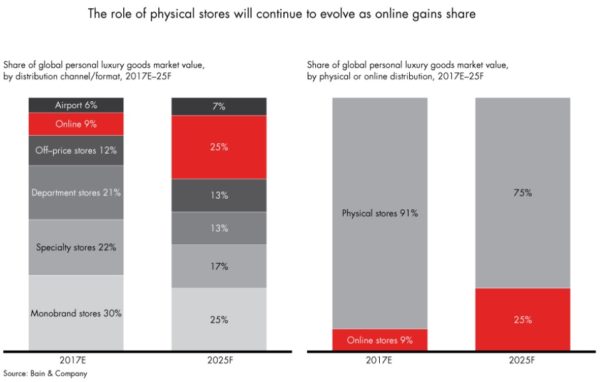

Together, the three channels hold a 27% share of the €262 billion (US$315 billion) global personal luxury goods market, with respective slices of 9%, 6% and 12%.

“The market for personal luxury goods reached a record high (last year) boosted by a revival of purchasing by Chinese customers both at home and abroad, as well as strong trends within other customer groups and in other regions,” stated Bain.

Personal luxury is one of nine segments tracked by the consultancy. Others include cars, experiences, hospitality, and cruises. According to Bain, the sector experienced growth across all regions worldwide, driven by more robust local consumption (+4%) and by strong tourist purchases (+6%).

This was exemplified by big long-haul spending gains in Europe, particularly in the UK (+22%) and Spain (+19%) based on the annual growth of tax-free transactions in 2017. Among the top five European markets for luxury spending only Germany was down (-3%).

Future shift to 2025

Bain expects growth in personal luxury goods sales to continue at an estimated +4% to +5% compound annual rate (CAGR) over the next three years (at constant exchange rates), with the market reaching €295–€305 billion (US$362-US$374 billion) by 2020.

By 2025, the firm believes that the three fastest-growing segments of 2017 mentioned above will shift from a 27% share of the market to 45% as follows: airports (7%), off-price stores (13%), and online (25%).

This will be to the detriment of traditional physical stores whose share is expected to fall from 91% last year to 75% in 2025.

While that is still the vast bulk of the market, Bain foresees the mix of store formats to move away from mono-brand shops, department stores and speciality retail, and towards off-price stores, airport stores and online.