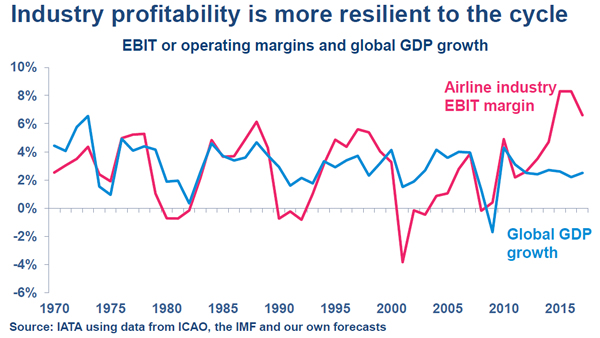

INTERNATIONAL. The airline industry will make net profits of US$35.6 billion in 2016, a new record according to the International Air Transport Association (IATA). This is a downward revision from June owing to slower global GDP growth and rising costs. But it is slightly ahead of the US$35.3 billion recorded in 2015 and will be the highest absolute profit generated by the airline industry and the highest net profit margin (5.1%).

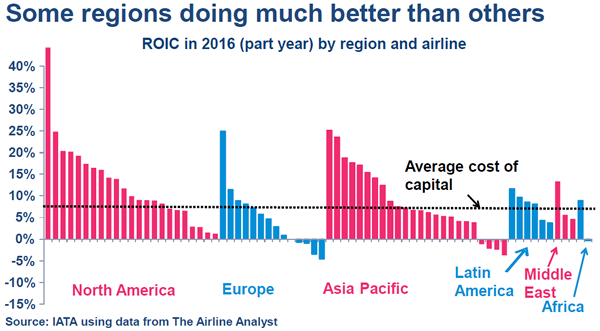

Profits for 2017 should hit US$29.8 billion with a net margin of 4.1%. 2017 would be the third consecutive year (and the third year in the industry’s history) in which airlines make a return on invested capital (7.9%) which is above the weighted average cost of capital (6.9%).

IATA Director General and CEO Alexandre de Juniac said: “Airlines continue to deliver strong results. This year we expect a record net profit and even though conditions in 2017 will be more difficult with rising oil prices, we see the industry earning US$29.8 billion. That’s a very soft landing and safely in profitable territory.

“These three years are the best performance in the industry’s history—irrespective of the many uncertainties we face. Indeed, risks are abundant— political, economic and security among them. And controlling costs is still a constant battle in our hyper-competitive industry.”

Outlook for 2017

2017 is expected to be the eighth year in a row of aggregate airline profitability. On average, airlines will retain US$7.54 for every passenger carried.

Expected higher oil prices will have the biggest impact on the outlook for 2017. In 2016 oil prices averaged US$44.6/barrel (Brent) and this is forecast to increase to US$55.0 in 2017. This will push jet fuel prices from US$52.1/barrel (2016) to US$64.9/barrel (2017). Fuel is expected to account for 18.7% of the industry’s cost structure in 2017, which is significantly below the recent peak of 33.2% in 2012-2013.

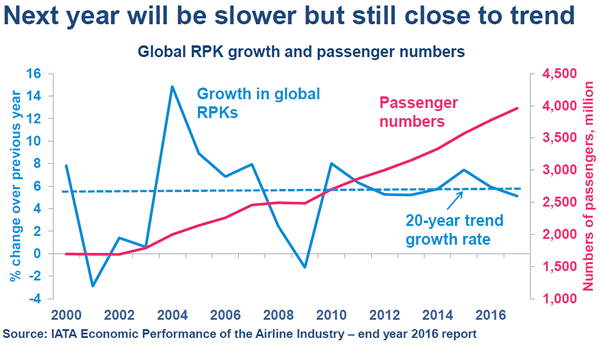

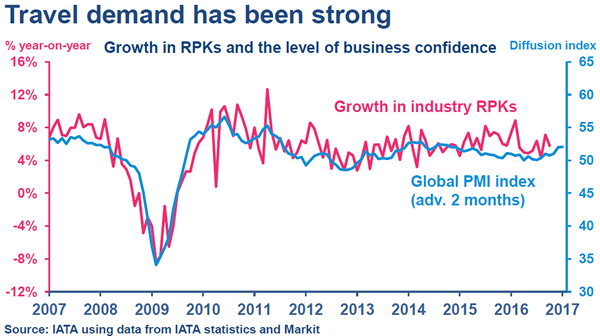

The demand stimulus from lower oil prices will taper off in 2017, said IATA, slowing traffic growth to +5.1% (from +5.9% in 2016). Industry capacity expansion is also expected to slow to +5.6% (down from +6.2% in 2016). Capacity growth will still outstrip the increase in demand, thus lowering the global passenger load factor to 79.8% (from 80.2% in 2016).

The negative impact of a lower load factor is expected to be offset somewhat by a strengthening of global economic growth. World GDP is projected to expand by +2.5% in 2017 (up from +2.2% in 2016). Along with structural changes in the industry, this is expected to help stabilise yields for the business.

Regional analysis

North America: The strongest financial performance is being delivered by airlines in North America. Net post-tax profits will be the highest at US$18.1 billion next year, although down slightly from the US$20.3 billion expected in 2016. The net margin for the region’s carriers is also expected to be the strongest at 8.5% with an average profit of US$19.58/passenger. In 2017 capacity offered by the region’s carriers is expected to grow by +2.6%, slightly outpacing expected demand growth of +2.5%. Recent consolidation continues to underpin the region’s strong profitability, even as the region faces upwards cost pressures which include the price of fuel, noted IATA.

Europe: Airlines based in Europe are expected to post an aggregate net profit of US$5.6 billion in 2017 which is below the US$7.5 billion for 2016. Nonetheless, carriers there are forecast to generate a 2.9% net profit margin and a per passenger profit of US$5.65.

Capacity in 2017 is expected to grow by +4.3%, ahead of demand growth which is forecast at +4.0%. The region is subject to intense competition and hampered by high costs, onerous regulation and high taxes, claimed IATA.

Asia Pacific: Airlines in the Asia Pacific region are expected to generate a net profit of US$6.3 billion in 2017 (down from US$7.3 billion in 2016) for a net margin of 2.9%. On a per passenger basis average profits are anticipated to be US$4.44. Capacity offered by the region’s carriers is forecast to grow by +7.6%, ahead of a forecast growth in demand of +7.0%.

Middle East: Middle Eastern airlines are forecast to generate a net profit of US$0.3 billion for a net margin of 0.5% and an average profit per passenger of US$1.56. This is below the US$900 million profit expected in 2016. Average yields for the region’s carriers are low but unit costs are even lower, partly driven by the strong capacity expansion, forecast at +10.1% this year, ahead of expected demand growth of +9.0%.

IATA noted: “Threats are emerging to the success story of the Gulf carriers, including increases in airport charges across the Gulf States and growing air traffic management delays.”

Latin America: Latin American airlines are expected to post a net profit of US$200 million, which is slightly lower than the US$300 million forecast for 2016. Profit per passenger is expected to be US$0.76 with a net profit margin of 0.7%. Capacity offered by the region’s carriers is forecast to grow by +4.8% which is ahead of expected demand growth of +4.0%.

Africa: Carriers in Africa are expected to deliver the weakest financial performance with a net loss of US$800 million (broadly unchanged from 2016). For each passenger flown this amounts to an average loss of US$9.97. Capacity in 2017 is expected to grow by +4.7%, ahead of +4.5% demand growth. The region’s weak performance is being driven by regional conflict and the impact of low commodity prices.

IATA also noted some key indicators of the strength of global connectivity. These include:

*The average return airfare in 2017 is expected to be US$351, which is -63% below 1995 levels.

*The number of unique city pairs served by aviation grew to 18,429 in 2016, a +92% increase on 1995.

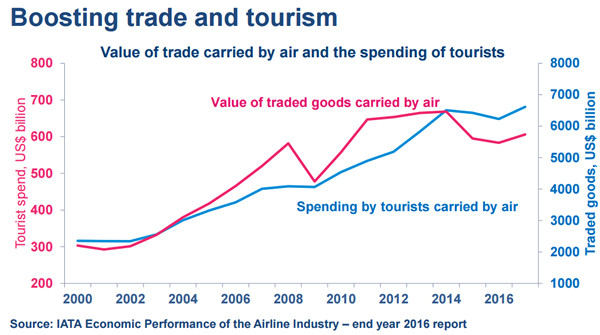

*The global spend on tourism enabled by air transport is expected to grow by +5.1% in 2017 to US$681 billion.

*Airlines are expected to take delivery of some 1,700 new aircraft in 2017, around half of which will replace older and less fuel-efficient aircraft. This will expand the global commercial fleet by +3.6% to 28,700.

*Airlines are expected to operate 38.4 million flights in 2017, up by +4.9%.