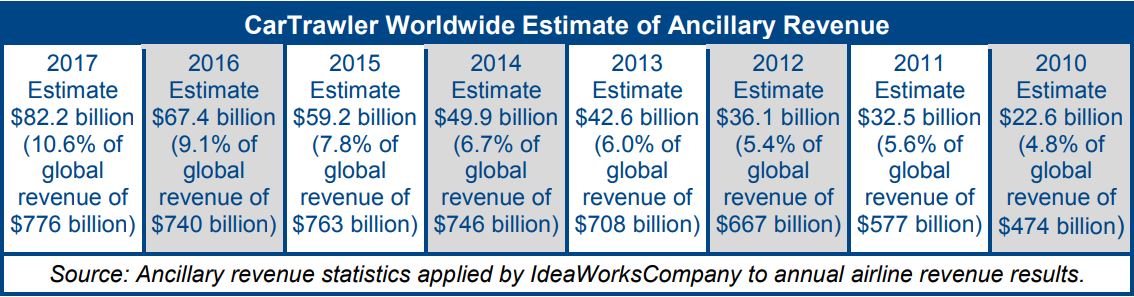

INTERNATIONAL. Airline ancillary revenues are projected to leap by +22% year-on-year in 2017 to US$82.2 billion. That’s according to airline ancillary revenues consultancy IdeaWorksCompany, in partnership with CarTrawler, a leading provider of online car rental distribution systems.

The CarTrawler Worldwide Estimate of Ancillary Revenue report shows a big increase of +264% from the 2010 estimate of US$22.6 billion (the first annual ancillary revenue estimate).

Earlier this year, CarTrawler and IdeaWorksCompany reported the ancillary revenue disclosed by 66 airlines for 2016. These statistics were applied to a larger list of 184 airlines to provide a global projection of ancillary revenue activity by the world’s airlines in 2017.

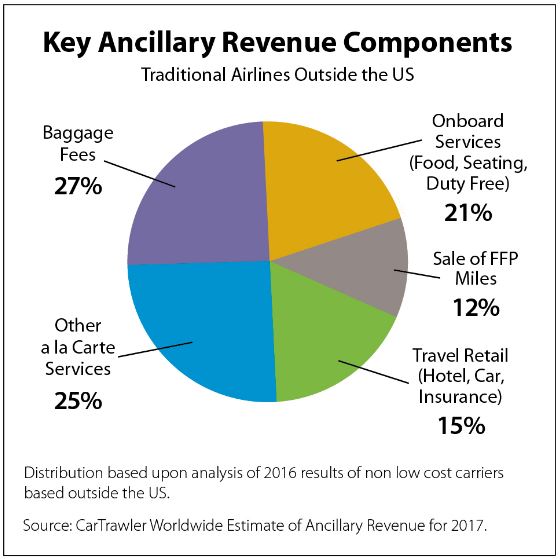

Ancillary revenue is generated by additional activities that yield revenue for airlines beyond the core movement of customers. This range of activities includes commissions gained from hotel bookings, the sale of frequent flier miles to partners, the provision of a la carte services – as well as retail and other services.

Analysis performed by IdeaWorksCompany during the past seven years reveals what it claims are natural groupings (or categories) based upon a carrier’s ability to generate ancillary revenue. The “percentage of revenue” results associated with four defined categories have been applied to a worldwide list of operating revenue disclosed by 184 airlines. The following describes the four categories:

Traditional Airlines: This category represents a catch-all for the largest number of carriers. Ancillary revenue activity may consist of fees associated with excess or heavy bags, extra legroom seating and limited partner activity for a frequent flier programme. The average percentage of revenue increased by nearly one percentage point to 6.7%, from 5.8% last year. Examples include Cathay Pacific, Copa Airlines, Etihad Airways, and Iberia Airlines.

Major US Airlines: US-based majors generate strong ancillary revenue through a combination of frequent flier revenue and baggage fees. The percentage of revenue for this group in the forecast is 14.2%, a jump from last year’s 12.3%. This was likely due to an expansion of bundled fare offers and ever-growing frequent flier revenue. Examples include Alaska, American, Hawaiian, and United.

Ancillary Revenue ‘Champs’: These carriers generate the highest activity as a percentage of operating revenue. The percentage of revenue achieved by this group leapt to 30.9% in 2017 from 25.5% for 2016. The size of the increase can be attributed to higher results from the big carriers in this category: Frontier, Ryanair, Spirit, and Wizz.

Low Cost Carriers: LCCs throughout the world typically rely upon a mix of a la carte fees to generate good levels of ancillary revenue. The percentage of revenue for this group in the forecasts is 11.8%, unchanged from 2016. Examples include Brussels Airlines, China United Airlines, Condor, Interjet, and Jazeera Airways.

“Airlines all over the world are moving to a la carte methods to provide more choices for consumers while boosting ancillary revenue. The pace of ancillary revenue activity quickens when major alliance members, such as Air France/KLM, American, Lufthansa, Qantas, and United embrace ancillary revenue methods,” the report stated.

“The changes have a ripple effect through the oneworld, SkyTeam, and Star alliances, which encourages member airlines to adopt the same methods to smooth commercial and operational connections.”

This partially explains why the largest share of the 2017 increase came from the Traditional Airlines category, at US$6.1 billion (representing 41% of the total increase). Airlines using an a la carte approach usually find more than 50% of passengers select higher priced bundled options, according to the study. When this activity is matched by an ever-growing pool of airlines, the result is billions more ancillary revenue.

Ancillary Revenue ‘Champs’ represented US$4.1 billion, or 28%, of the 2017 increase. “These airlines have built networks that now offer attractive options for business travellers,” the report states.

“Fare bundles that provide more flexibility, better seating, and fast track service at airports have been developed to lure commercial customers from traditional airlines. In addition, frequent flier programme benefits are now a common feature for airlines in this category, such as those offered by AirAsia, Frontier, Jetstar, Norwegian, Pegasus, and Spirit.”

Carriers in the Major US Airlines category contributed US$4.6 billion to the increase for 2017. The growing threat of low cost carriers has prompted these airlines to aggressively adopt a la carte methods, according to the study.

IdeaWorksCompany concluded: “The economic boon of ancillary revenue has proven to be a highly useful tool to fix airline finances. It delivers profit-boosting results during times of severe economic distress, and works effectively to lift profits even higher when airlines are achieving investment-grade margins.

“But airlines should tread carefully. A la carte pricing works best when consumers are truly free to choose the product that best meets their needs. Good retail practice ensures the ability to easily remove unwanted products from a shopping cart and place them back on the shelf. But some carriers continue to treat ancillary revenue as an opportunity to simply charge new fees without creating a better product.

“Fortunately, a la carte pricing magnifies the power of the marketplace to reward good value and punish bad products. This year’s global increase illustrates that principle admirably.”