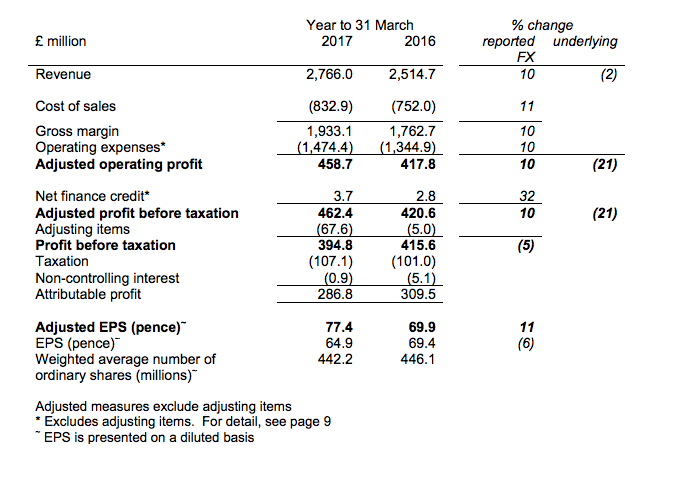

UK. British luxury brand Burberry posted pre-tax adjusted profits of £462 million, down -21% on an underlying basis, in FY 2017.

UK. British luxury brand Burberry posted pre-tax adjusted profits of £462 million, down -21% on an underlying basis, in FY 2017.

The brand posted revenue of almost £2.8 billion, down -2% underlying. The company said the declines were partly due to strategic actions taken to elevate the luxury retail and digital business, while retail growth was offset by declines in wholesale and licensing.

FY 2017 marked a “transitional period” for Burberry. The strategic partnership with Coty to accelerate the growth and development of Burberry’s beauty category has now received regulatory approval.

Burberry’s growth plans and simplification have been built into five key pillars. Three are focused on optimising revenue growth (Product Focus, Productive Space and E-commerce Leadership) enabled by Operational Excellence and Inspired People, improving efficiency and ensuring it has the right capabilities to deliver.

“The benefits of the revenue drivers are expected to build over the medium term and we are on track to achieve our targeted cost savings by FY 2019,” Burberry said.

Retail accounted for 77% of revenue. In FY 2017, Asia Pacific saw broadly unchanged comparable sales with an improved performance in the second half. The difficult Hong Kong market improved through the period although it remained negative for the full year, impacted by lower footfall partially offset by improved conversion, Burberry said.

In EMEIA, comparable sales increased by a high single-digit percentage, with an improvement to double-digit growth in the second half. Burberry noted that the UK had an ‘exceptional’ performance, while the Middle East remained ‘difficult’, experiencing negative footfall trends.

Comparable sales in the USA reduced by a low single-digit percentage. The relative strength of the US Dollar drove a strong increase in sales from US customers abroad, while demand at home reduced (both domestic and tourist).

Wholesale accounted for 22% of revenue, generated by sales of apparel and accessories, department stores, multi-brand accounts, franchise stores and travel retail. Beauty wholesale revenue fell by approximately -20% underlying, reflecting the rationalisation of distribution in key markets, to improve positioning and distributor de-stocking. My Burberry and Mr Burberry fragrances continued to gain share in key markets as emphasis was placed on building pillar fragrances, Burberry noted.

Wholesale accounted for 22% of revenue, generated by sales of apparel and accessories, department stores, multi-brand accounts, franchise stores and travel retail. Beauty wholesale revenue fell by approximately -20% underlying, reflecting the rationalisation of distribution in key markets, to improve positioning and distributor de-stocking. My Burberry and Mr Burberry fragrances continued to gain share in key markets as emphasis was placed on building pillar fragrances, Burberry noted.

Licensing, which made up 1% of revenue, was down -48% underlying, primarily due to the planned expiry of the Japanese Burberry licence.

Burberry Chief Creative and Chief Executive Officer Christopher Bailey commented: “2017 was a year of transition for Burberry in a fast-changing luxury market. The actions we have taken to lay the foundations for future growth are yielding early benefits and I remain confident that these will build over time.

“Marco Gobbetti assumes the role of CEO from July. With his extensive experience in the sector, we will build on these foundations to elevate and strengthen the brand further and take Burberry to the next level as a global luxury retail and digital business. I am excited to work closely with him in this next chapter.”