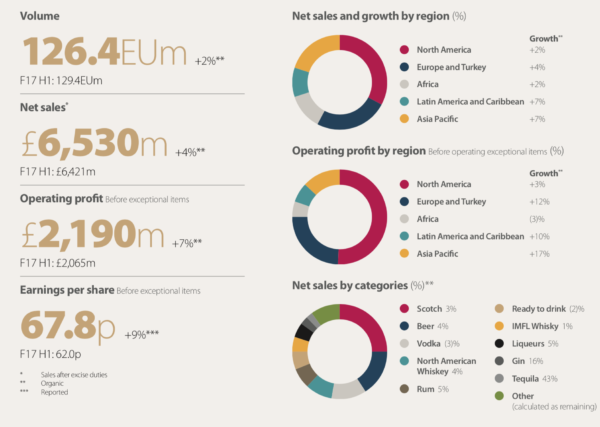

UK/INTERNATIONAL. Global drinks giant Diageo has reported net sales of £6.5 billion (US$9.27 billion) for the half year ended 31 December 2017 (financial year 2018), up +1.7% year-on-year. Operating profit of £2.2 billion ($3.14 billion) increased +6.1% on a like-for-like basis.

The company reported a net sales increase of +32% for Diageo Travel Retail Asia and Middle East (under its Asia Pacific strategic market results), a turnaround from the -19% decline in the last six months of 2016. That business saw organic volume increase +29% in the first half of fiscal 2018, with organic net sales surging +27%. This is in stark contrast to the -20% decline in organic volume and -18% decline in organic net sales experienced in the last six months of 2016.

“We are pleased to see that the strategic choices we have made within global travel are paying off, and that Johnnie Walker continues to maintain its strong position within the industry,” Diageo Global Travel Managing Director Dayalan Nayager told The Moodie Davitt Report.

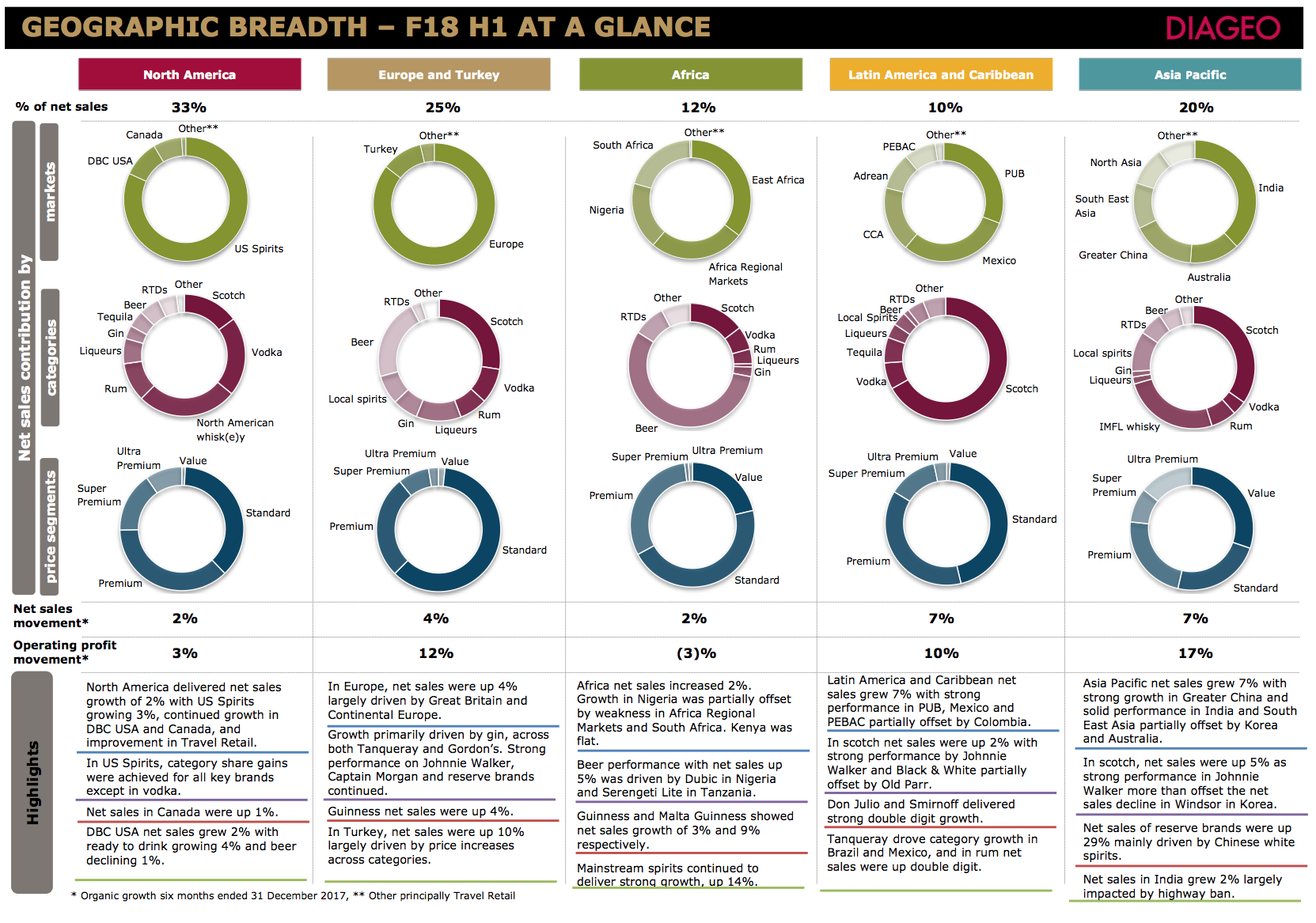

Diageo’s travel retail business in fast-growing markets such as Brazil and Turkey is handled by the company’s domestic arms, as outlined in The Moodie Davitt Report’s recent interview with Managing Director Dayalan Nayager. While duty free results are not broken out in those markets, Turkey saw an overall -8% first-half decline in reported net sales and a +3% net sales increase in the Latin American market.

The company’s overall organic growth of +4.2% was partially offset by unfavourable exchange rates, mainly the strengthening of the British Pound against the US Dollar. All regions performed well, however growth in Asia Pacific was hampered by short-term volatility in India.

Net sales growth in the period was slightly higher than predicted, driven particularly by a strong increase in Chinese white spirits despite the later timing of Chinese New Year, the company said.

“These results demonstrate continued positive momentum from the consistent and rigorous execution of our strategy,” said Diageo Chief Executive Ivan Menezes.

“We have delivered broad-based improvement in both organic volume and net sales growth. We have increased investment behind our brands and expanded organic operating margin through our sustained focus on driving efficiency and effectiveness across the business.”

“These results demonstrate continued positive momentum from the consistent and rigorous execution of our strategy” – Diageo Chief Executive Ivan Menezes

Diageo’s largest category, scotch whisky, was up +3%, with growth in North America, Mainland China, Southeast Asia and Travel Retail Asia and Middle East partially offset by weakness of The Singleton in Taiwan. Activity in the category included campaigns for Johnnie Walker Blue Label and other variants focusing on gifting, the festive season and travel retail.

The decline in vodka slowed compared to Diageo’s previous fiscal year, increasing +4% outside of the US where the category remains “challenging”.

North American whisk(e)y was up +4% , rum and liqueurs both +5% and gin showed an outstanding growth of +16%.

Menezes added: “By consistently delivering on our six strategic priorities, Diageo continues to get stronger: we have better consumer insight through superior analytics, improved execution on brand and commercial plans and have embedded everyday efficiency across the business through our productivity initiatives. This has enabled continued growth, improved agility, and consistent cash flow generation.

“Our financial performance expectations for this year remain unchanged. We are confident in our ability to deliver consistent mid-single-digit top-line growth and 175bps of organic operating margin improvement in the three years ending 30 June 2019.”