Plenty of challenges but even more opportunities. Constant innovation in products and technology. Flexibility and adaptability and a realisation that some of the retail formulas of the past no longer apply. Sustainability as a core not a token value.

Those were some of the key themes from beauty sector leader L’Oréal Travel Retail in Cannes last week as it summed up the channel’s 2018 performance and the company’s priorities.

The French beauty giant is seeing mixed performances across regions this year: from Asia Pacific’s surging growth to double-digit spending falls in key Latin markets.

But at both its packed annual retailer dinner at the TFWA World Exhibition, and the division’s always much-anticipated press conference, the French beauty giant expressed optimism for travel retail’s future and underlined its commitment to the sector.

“Our brand portfolio is the best insurance against any storm. We have all price points to serve every type of consumers and we have new products constantly. And the best antidote to any depression is innovation and new brands and products.” – Nicolas Hieronimus

Speaking at the Monday night dinner, L’Oréal Luxe President and L’Oréal Deputy CEO Nicolas Hieronimus told the industry’s leading retailers, “You should believe in us because we believe in travel retail. We’ve always supported travel retail – there can be clouds in the sky amounting to a storm. But as we’ve seen today [a reference to the big winds in Cannes that threatened to derail the annual dinner], storms come and go but L’Oreal remains to foster your growth and hopefully ours.”

Hieronimus made a neat play on the familiar ‘VUCA’ acronymn [i.e. volatility, uncertainty, complexity and ambiguity of market conditions] quoted at that morning’s TFWA Conference, changing the definition to “volatility, uncertainty and Chinese-activated” in a reference to the pivotal global influence of the Chinese travelling shopper.

“It’s true that Chinese customers are really changing travel retail around the world wherever they shop,” he said. “It’s very important to acknowledge that today the Chinese are the centre of our world.”

“I said some time ago that health is the future of beauty, and it’s true. The demand for suncare, for sensitive skin products, in particular with La Roche-Posay, is a reality everywhere.” – Vincent Boinay

But it’s not just about the Chinese, Hieronimus insisted. “Beauty is both the biggest and fastest-growing category in our industry. So therefore if you have new airports, new spaces to allocate, then beauty is the obvious choice. Because we have global brands but local operational teams that are extremely close to you and the specifities of every single country and every airport in the world

“Our brand portfolio is the best insurance against any storm. We have all price points to serve every type of consumers and we have new products constantly. And the best antidote to any depression is innovation and new brands and products.” [We’ll bring you more from Nicolas Hieronimus in this week’s Moodie Davitt e-Zine].

At Wednesday’s press conference, L’Oréal Travel Retail Managing Director Vincent Boinay said travel retail was growing steadily overall, but that regional performances are “more than ever very contrasted”.

Chinese shoppers have been driving soaring Asia Pacific sales, but currency devaluations and political and economic jolts in South America have weakened the market there, he said. Somewhere in the middle is Europe “where traffic is growing much faster than business”.

“At the end of the day, we at L’Oréal Travel Retail are performing quite well. Why? We are a strong portfolio player; we have more than 40 years of expertise in the channel; and we are backed by a diverse and talented team,” noted Boinay.

Luxury remains the driver in travel retail, but the accessible L’Oréal Paris brand is also playing a key role, as are digital initiatives to increase engagement. In addition, new categories that L’Oréal Travel Retail has been championing in recent years – dermacosmetics and haircare – have enjoyed growing traction in the channel.

“Dermacosmetics is becoming a very significant business within the skincare segment in particular, and it’s related to the worldwide trend of medical beauty,” said Boinay. “I said some time ago that health is the future of beauty, and it’s true. The demand for suncare, for sensitive skin products, in particular with La Roche-Posay, is a reality everywhere.”

On haircare, Boinay believes the challenge is “to make haircare relevant for travellers”. The company’s Kérastase brand is addressing this point in the channel.

Adapting to a low-cost environment

Commenting on the Europe region, Europe, Middle East, Africa and India General Manager Gianguido Bianco said that air traffic, boosted by steady Chinese arrivals and a rebound of Russians, was growing. However in continental Europe, the weight of low-cost traffic is now almost half of total traffic.

“We are seeing decreasing spend per pax, so we have challenges to recruit and increase penetration,” he said. Exclusives, and accessibly-priced brands and products are some of the enticements being offered to passengers. “Our key priority is to engage customers with surprising and memorable experiences,” Bianco added, referencing activations from Atelier Cologne and House 99 by David Beckham among others.

Travel Retail Americas Managing Director Yannick Raynaud described a “fantastic 2017 but a very varied start to 2018”. She explained: “We are challenged because 75% of the nationality footprint is having a crisis – devaluations of the Brazilian real and Argentinian peso, plus political uncertainties.”

Americans – “an untapped opportunity”

Raynaud added: “The trade war between the US and China is impacting traffic. It has slowed significantly and the spend per passenger is decreasing in double digits. This is tough but it’s also temporary. We are here for the long run and we will continue to build strong consumer experiences in the region.”

L’Oréal Travel Retail is also focusing on American passengers – traditionally modest buyers in travel retail – but comprising over 33% of traffic. “Only 2% of them buy in duty free so imagine the untapped opportunity,” said Raynaud.

L’Oréal Travel Retail is using its portfolio to attract attention – from brands such as home-grown Kiehl’s, to NYX Professional Makeup and Urban Decay – and implementing concourse disruption through a variety of airport activations to increase penetration.

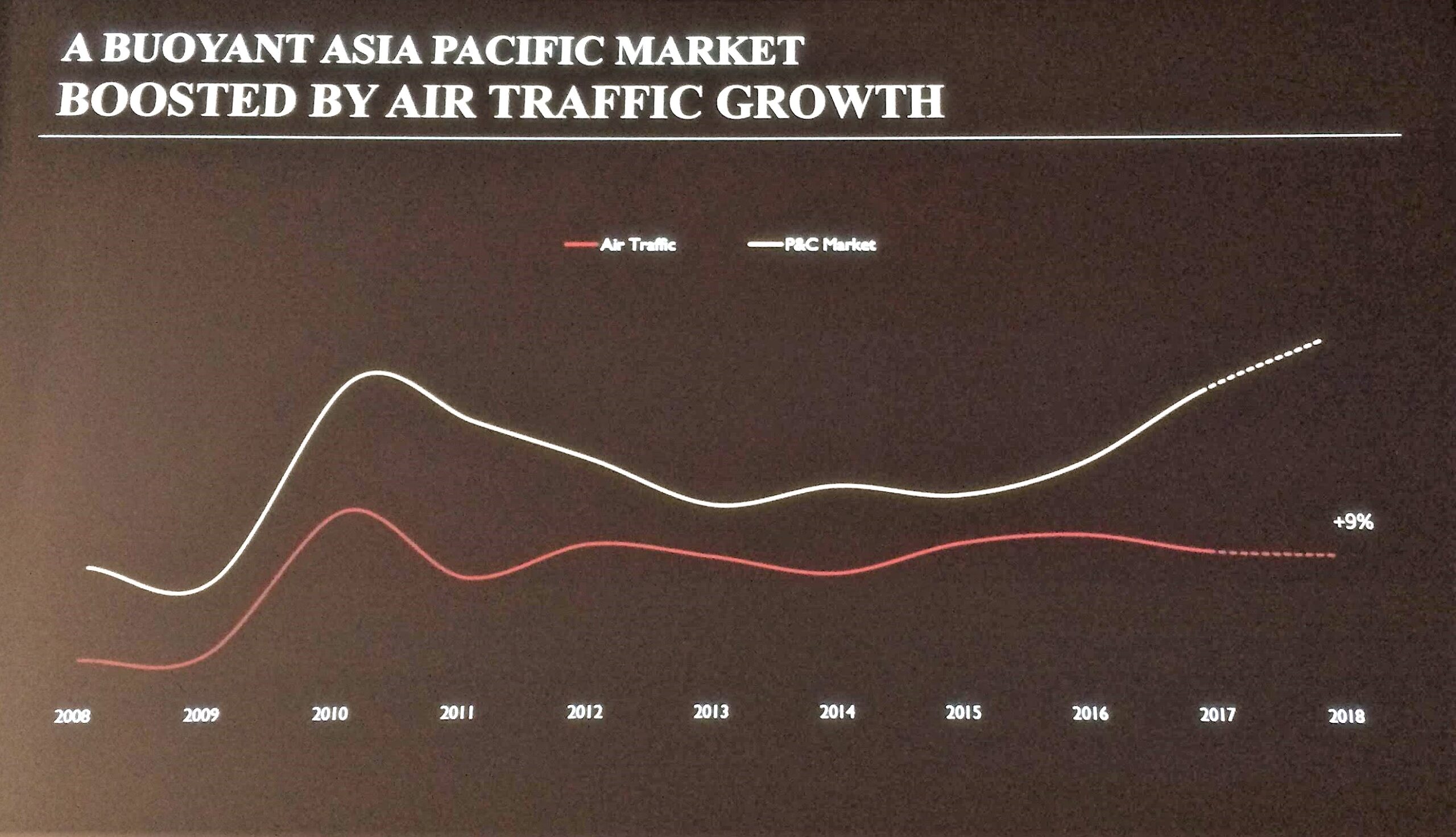

In Asia, conditions are infinitely better. “The situation in Asia Pacific is buoyant, to say the least,” said L’Oréal Travel Retail Asia Pacific Managing Director Emmanuel Goulin. “The spend per passenger is increasing, not only because make-up is growing, but skincare and fragrance are also booming. And of course one of the main drivers of our growth is the rise in the number of global Chinese shoppers.”

“Mobile phones have become a disruptor”

The prospects for more Chinese travellers remain very strong. Chinese passport holders are set to double in the next three years; more countries in Asia are wooing Chinese travellers by easing visa requirements; and more airports are being built in tier three and tier four cities in China giving their residents easier air access abroad.

But Goulin warned that it will become harder to attract demanding Chinese travellers. “They spend 85% of their time on their mobile phones – even when going through an airport,” he said. “Mobile phones have become a disruptor and that can be an opportunity or a threat depending on how you address it.” L’Oréal has therefore been active in revamping its e-retailer offer online, especially for the smartphone.

Portfolio-wise, L’Oréal Travel Retail is strongly positioned with star products in skincare and make-up in Asia, but lacking, to an extent, in fragrance. “But with the launch of Mon Paris from Yves Saint Laurent two years ago and with the launch to come of Armani Sì Passione, we are convinced that we’ll also get relevant products for Asia in fragrances. This is extremely important to the future of our business in the region.”

Sustainability and CSR

L’Oréal Travel Retail again strongly reiterated its commitment to sustainability and Corporate Social Responsibility, and Boinay promised he and his team would continue to champion these issues at every opportunity. The division’s three major actions in this area are:

– 100% of the travel by L’Oréal Travel Retail staff – some 13 million miles – is being offset this year via a reforestation project

– 90% of the retail design – for example L’Oréal Travel Retail’s TFWA Cannes displays – will be reused to stop wastage and to underline awareness of how materials are used and reused

– a disabled person in the L’Oréal Travel Retail marketing team – a tennis player who went to the 2016 Summer Paralympics in Rio de Janeiro – is being supported by the company to go to the 2020 Tokyo games.