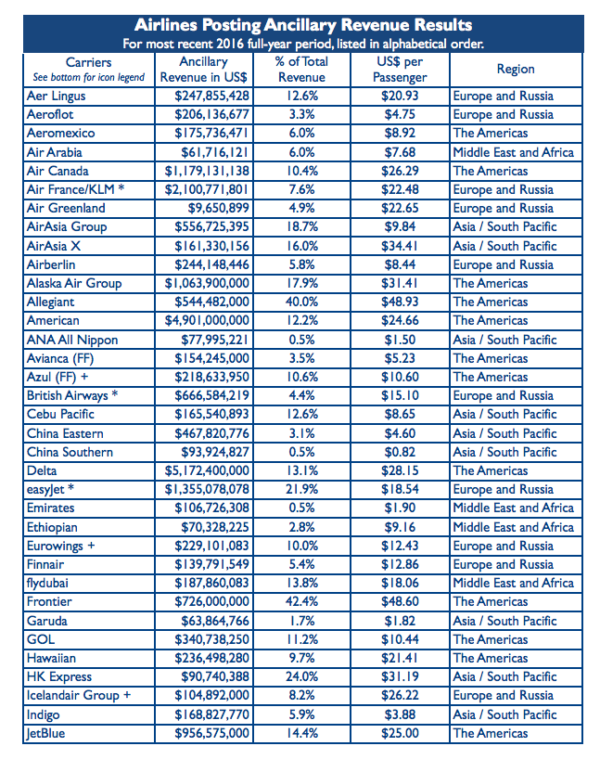

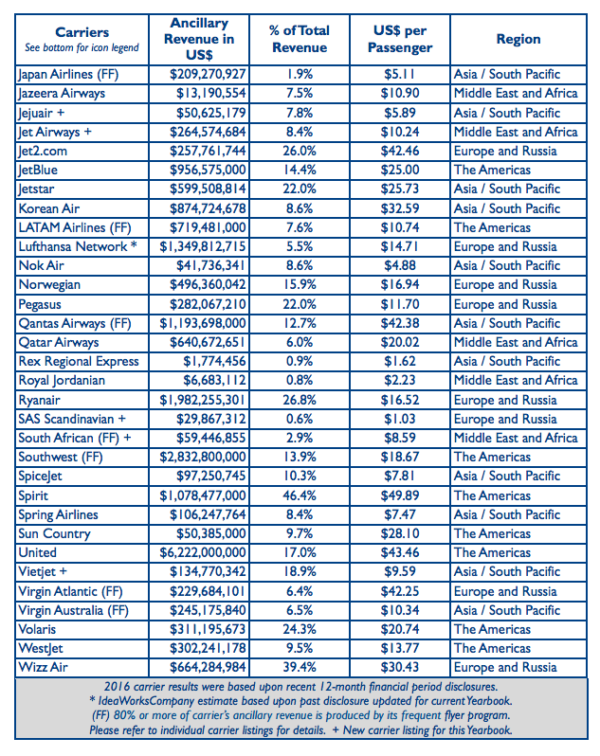

INTERNATIONAL. CarTrawler and IdeaWorksCompany have reported significant growth in the ancillary revenue source for airlines in 2016, which has grown to $44.6bn across 66 global carriers (with qualifying revenue).

The 2017 edition of the CarTrawler Ancillary Revenue Yearbook found the revenue source increased to a 9.7% share of total sales for the 66 airlines last year, compared to 2015’s 8.7%.

Of the 138 global airlines IdeaWorksCompany researched, the 66 of which disclosed qualifying revenue activity in 2016 included newcomers to the list: Azul, Eurowings, Jejuair, Jet Airways, South African, and Vietjet.

Qualifying revenue activity is defined as revenue beyond the sale of tickets generated by direct sales to passengers or indirectly as part of the travel experience, and includes frequent flyer miles activities, ‘a la carte’ components such as fees for checked bags, miscellaneous sources like advertising and commission-based products such as inflight retail and car rentals.

The ancillary pie is unique for every airline, stated IdeaWorksCompany, but is a successful revenue source delivering $6.2 billion for United Airlines, 39.4% of sales for Wizz Air, and $49.89 per passenger carried by Spirit Airlines, for example.

Not all airlines separate out inflight retail and duty-free data, but some examples in the report include:

- Aeroflot’s duty free sales for 2016 were RUB1.349 billion ($23.30 million). The cost of duty free goods sold was RUB732 million ($12.63 million), representing a profit of RUB617 million, or a mark-up of 84% on cost (mark-up was 93% for 2016).

- LATAM’s duty free income for 2016 was $11.14 million

- AirAsia Group plans to improve its range of duty free products with the intent to match the selection of airport shops. BigDutyFree.com is offered as a pre-order service for passengers

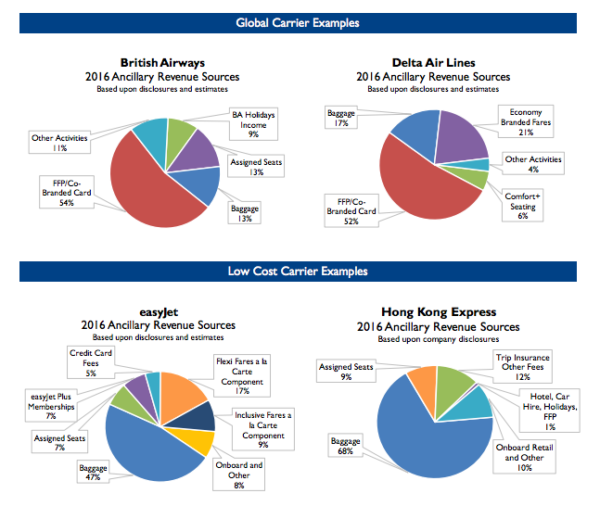

It is logical that airlines with low average fares have achieved the best “percent of total revenue” results, with the top 10 dominated by low-cost airlines. Low-cost carriers tend to rely on a la carte activity by aggressively seeking revenue from checked bags, assigned seats, and extra leg room seating.

“CarTrawler is delighted to see such significant growth in the ancillary revenue source for airlines. This is reflected in the size of the online car rental market, which Euromonitor states grew by 13% from 2015 to 2016. CarTrawler has facilitated a sizeable share of these bookings for its 100+ airline partners with total bookings increasing by 38% within this 12-month period. Not only are total bookings at an all-time high but conversion has more than doubled for some of our partners,” said CarTrawler CCO Aileen O’Mahony.

This year, the report includes a list of the a la carte items sold through Amadeus, Sabre, and Travelport for each of the 66 airlines. For example, optional extras for baggage, seat assignments, meals and sports equipment can be booked through Travelport-equipped agencies on AirAsia, and baggage, meals and unaccompanied minors can be booked for Pegasus through the Amadeus system.