FRANCE. Travel retail “remains a major growth engine”, according to French retail-to-press conglomerate Lagardère Group as it unveiled first-half results.

Lagardère Travel Retail division (which includes the Distribution operation) posted the strongest revenue and profits growth for the group’s four divisions. Revenue rose +9.1% on a consolidated basis and +5.4% on a like-for-like basis to €1,790 million.

The division’s recurring EBITDA rose €6 million or +20% to €36 million, but pure travel retail actually increased by €12 million. That came despite an estimated €4 million hit from the terrorism attacks in Paris and Brussels.

The division’s recurring EBITDA rose €6 million or +20% to €36 million, but pure travel retail actually increased by €12 million. That came despite an estimated €4 million hit from the terrorism attacks in Paris and Brussels.

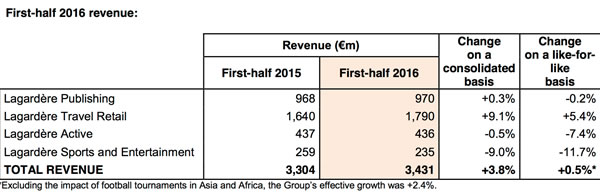

Conversely, group revenue rose just +0.5% on a like-for-like basis (+3.8% consolidated), while recurring EBITDA fell -17.2% to €101 million. Profits were affected by fewer sporting events in the first half.

However, the group confirmed its recurring EBIT growth target for 2016 as slightly above +10% based on a solid first-half and “encouraging” outlook for the second half.

Lagardère Travel Retail results in detail

Lagardère Travel Retail revenue suffered a €22 million negative foreign exchange impact (Polish Zloty and Australian, New Zealand and Canadian dollars). The scope effect was a positive €93 million.

Travel Retail delivered strong growth despite the impact of terrorist attacks in Europe thanks to strong network momentum, the group said.

North American news & books-to-food & beverage company Paradies, acquired in October 2015, performed in line with expectations, it added.

On a like-for-like basis, travel retail activities were up by +7.8% in the first half. This was driven by network expansion, the roll-out of new concepts, and an improved product mix, which offset the impact of terrorist attacks in Europe on tourist activities, the group said.

In France, business “held firm” over the period (up +0.3%). The slowdown in the duty free and fashion segments following the Paris and Brussels terrorist attacks and the impact of declining and lower-spending Chinese passengers was countered by the good performance of the Travel Essentials and Foodservice segments on the back of network expansion.

Europe (excluding France) reported “bullish” momentum (up +12.0%), spurred by network development particularly in Poland (up +29.0%), and the start-up of activities in Iceland and Luxembourg. The fast-paced growth of operations in Italy (up +8.4%) continued during the period, lifted by the growth in traffic and the opening of new sales outlets. Romania also posted strong growth (up +24.4%) lifted by the rise in tobacco prices, as did the Czech Republic (up +5.0%), despite the impact of lower spending by Russian passengers in duty free.

Trading expanded in North America (up +5.1%) on the back of network development and good performances from the legacy business, the group said.

The Asia Pacific region is also growing (up +15.0%), it noted, lifted by the continued development of fashion activities in China and the start-up of duty free at Auckland Airport, New Zealand in July 2015.

Conversely, the Distribution business (also part of Travel Retail) was down -3.1%, hit once again by discontinued export sales in Hungary.

Lagardère Travel Retail’s recurring EBIT (excluding distribution) increase of €12 million was buoyed by the consolidation of new activities including Paradies. However, results were dented by the impact of new activities starting up in New Zealand and new platform launch costs, particularly in Poland.

The group commented: “Despite the impact of terrorist attacks on tourism, estimated at a negative €4 million over the six-month period, Travel Retail delivered a strong performance in Europe, particularly in Italy and the Netherlands. Distribution declined by €6 million following the disposal of operations in Switzerland, the US and Spain.”