AUSTRALIA. Bids close this Thursday, 25 August on the Cairns Airport Terminal 1 duty free tender with interest likely from several of the region’s established players – and possibly some outsiders.

The concession covers Arrivals and Departures duty free. The incumbent is JR/Duty Free, which was awarded the contract in November 2011. As reported, the retailer chose “reluctantly” not to take up its three-year renewal option from the initial contract expiry in February 2017. That decision was based on profitability concerns over actual passenger numbers since 2012, which fell well short of those forecast in the 2011 RFP.

The key to the various financial offers tabled later this week (see below for likely bidders) lies in the passenger traffic projections.

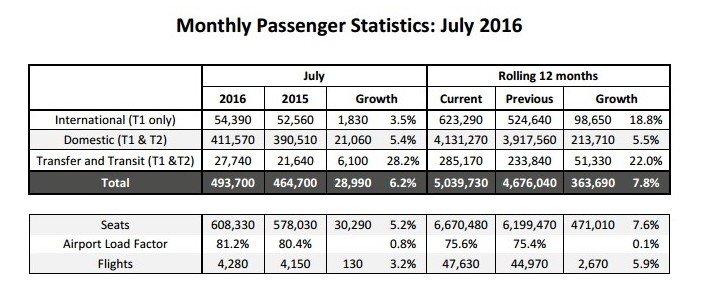

When the bid was announced Cairns Airport General Manager Commercial Fiona Ward was upbeat about traffic levels. She said the past year has seen “stunning” figures for international passenger growth as several new aviation services came on line. “In the year ending May 2016 T1 welcomed 697,000 passengers, who were eligible to make duty free purchases. This is an increase of +22%, or 127,000 passengers, over the year ending May 2015,” she said.

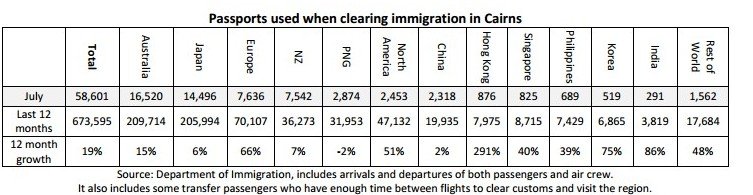

North Asian visitor numbers will be key to the success of the concession. Ms Ward said the Japanese market was “restrengthening” due to new flights and that the China Eastern seasonal service from Shanghai, China and the recently announced JinAir seasonal service from Seoul, South Korea add further attraction.

The 697,000 passengers for the year ended May represented strong growth. However, the absolute number was still below that forecast (868,000) for 2013 in the last RFP (which projected 1,194,000 passengers in 2016), underlining what a fickle exercise traffic projections can be.

POTENTIAL RUNNERS

Possible bidders this time include Lagardère Travel Retail, which has been building a strong specialist store presence at the airport, and Heinemann Asia Pacific, which operates at Sydney Airport and may desire more critical mass.

Despite its reservations over traffic numbers, incumbent JR/Duty Free is another likely runner, provided it can make the numbers work. Dufry, which now owns former Cairns Airport concessionaire Nuance, whose contract at Melbourne Airport was recently extended until 2022 will have studied the bid closely, as will Aer Rianta International, one of two duty free retailers at Auckland Airport across the Tasman Sea in New Zealand (Lagardère is the other). Additionally, two, possibly three Korean retailers – Lotte Duty Free, The Shilla Duty Free and Shinsegae Duty Free – could enter the fray. DFS has a downtown Galleria in Cairns, so is a possibility.

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.