INTERNATIONAL. Tax free shopping sales in Asia fell -7% year-on-year in September, compared to declines of -13% in August, according to Global Blue.

The number of transactions dropped -3%, while average spend was also down -4% over the same period. Global Blue said Singapore, Japan and South Korea all saw declining tax free sales for the first time in three years.

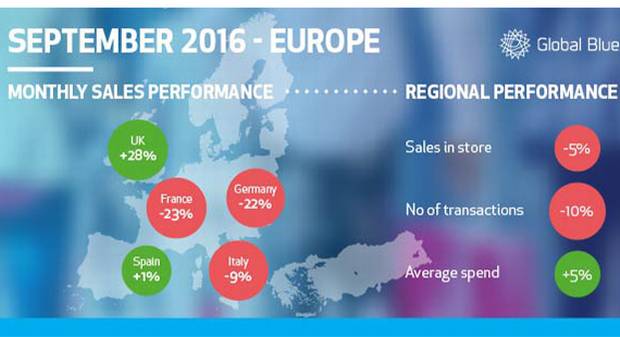

In Europe, tax free shopping declined -5% year-on-year during September, compared to -3% in August.

European transactions were down -10%, but average spend was up +5% year-on-year.

Asian countries

Global Blue said the increase in arrivals by middle-class Chinese travellers supported growth in tax free sales and the number of regional transactions, but was not enough to offset the decline in spend in Singapore, Japan and South Korea.

Both Japan and South Korea saw a -9% dip in sales, while in Singapore sales fell -7%.

The positive momentum seen earlier in the year has now gone, Global Blue said, reflected by the deep drop in average spend in Japan of -30% year, and the -13% fall in South Korea.

In these two countries, the rise in arrivals was offset by the decline in average spend as a result of the strengthening currency in both countries. In September, the Japanese yen was +21% and the Korean won was +10% against the Chinese yuan, Global Blue noted.

A shift in the Chinese traveller profile towards value seekers and experiential Free Independent Travellers is becoming the “new normal” across the region, the retail intelligence company said, which also had a negative impact on sales.

Global Blue said it was witnessing a change in shopper profile in Japan’s department stores, as Millennials and Free Independent Travellers look beyond the country’s department stores and head to more niche or independent fashion and luxury retailers outside the Global Blue merchant network.

With increasing numbers of less affluent Chinese arriving in Singapore from second- and third-tier cities, the country’s duty free retailers have been slow to offer a more diverse retail mix, Global Blue said.

Chinese travellers are using Singapore as a departure point for cheaper shopping over the border in Malaysia.

The number of travellers entering Singapore by land is rising (up +55% according to the latest Singapore Tourism Board figures reported in Jing Daily). Some of these tourists are on overland tours and therefore take in cheaper markets as well as Singapore’s high-end malls, unlike the higher-spending visitors who arrive by air.

Singapore is also facing a challenge this quarter due to health concerns over the Zika virus outbreak, which is reducing visitor numbers, Global Blue noted.

Chinese shopping across South Korea and Singapore saw tax free sales declines of -15% this month.

While the tough comparison with 2015’s MERS-hit summer period has ended in South Korea, the Chinese are not returning in any great numbers due to the political tensions between the two countries, Global Blue noted.

Hong Kongese tax free sales in South Korea and Singapore significantly declined in September (-77% and -98% respectively). While the local currency is strong, the legal context for the largely daigou traders is negatively impacting on sales, according to the company.

Indonesians and Thais are now making up for the tax free spend at both destinations. In Singapore, Indonesian tax free sales are up +7% year-on-year, fuelled by positive currency exchange rates. In South Korea, Thais contributed to a massive sales spike of +87% year-on-year. Singaporean sales were also up +17% in September, a result of high net worth individuals who are regular shoppers in the region.

European countries

The tax free shopping decline in Europe is a slight improvement compared to the first half of the year, the company said, although countries hit by terrorism last year saw a reduction in sales.

France and Germany continued to feel the effects of the downturn in visitors from Asia, with tax free sales down -23% and -22% respectively in September.

The most serious decline in spending in France came from the Chinese, at -40%, while in Germany, Chinese spending was down -26%.

Spain and southern European countries continued to outperform the continental Europe average of duty free sales, Global Blue said. Spain saw an increase in tax free sales of +1% compared to last September, while Greece increased total sales by +18%.

The UK benefited from the fall in the pound and currently remains the best value luxury destination for duty free shoppers. The pound is now around -14% down on the euro since the Brexit vote, and almost -20% against the US dollar, Global Blue said.

However, this situation is unlikely to last beyond next spring, the company noted, as most luxury goods are imported into the UK. From next season price increases on all imported goods will inevitably lead to higher prices in UK stores.

The UK also benefited from the end of Ramadan and the annual back to school period for Chinese students, characterised by visiting families’ gift spending.

The Chinese are the most valuable nation of shoppers for UK retailers, and they increased their spending by +25% during September.

Saudi Arabia, Qatar, the UAE and Kuwait contributed to a +8% uplift in European sales in September.

Cutbacks by the Saudi government, where well over half the population are state-employed, will put pressure on Saudi citizens’ outbound travel plans and spending in the medium term, Global Blue noted.

Morocco posted a +28% rise in total sales in Q3 year-on-year, as shoppers avoided destinations that have suffered terrorist attacks. Cyprus saw a +11% uptick during the same period; Global Blue attributed this to an increase in Russian shoppers.