SOUTH KOREA. The Shilla Duty Free posted a +29.0% year-on-year rise in second-quarter revenues for its Korean downtown duty free operations, reflecting a strong rebound from the MERS-ravaged corresponding period last year.

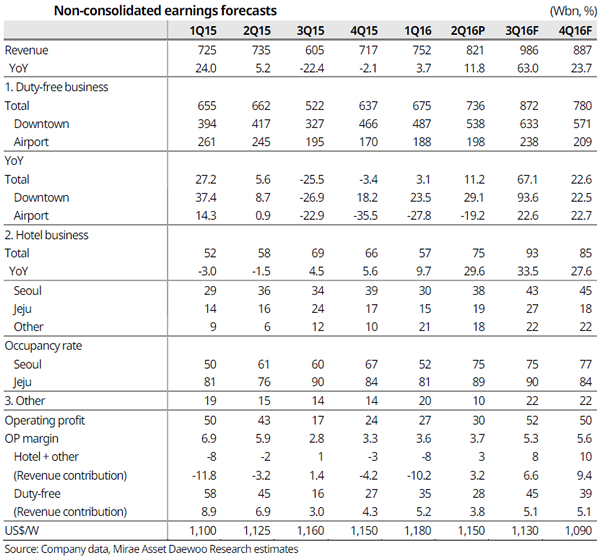

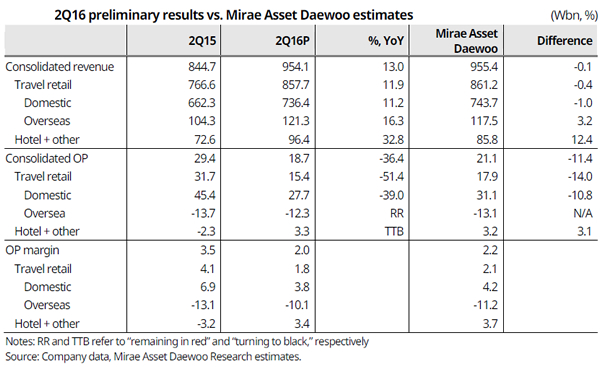

Downtown store revenue climbed to KW538.2 billion (US$473.6 million) for the quarter, with growth outstripping the +23.5% increase in the total Korean duty free market (see Mirae Asset Daewoo chart below) for the period – encouraging news for Shilla given the increase in competitors following last year’s government licence additions.

However, Korean airport sales fell -19.2% to KW198 billion (US$174.2 million), driven by a downturn in Incheon International Airport revenues caused by reduced floor space in the wake of last year’s tender results.

Overseas duty free revenues (principally Singapore Changi Airport and Macau International Airport) rose by +16.3% year-on-year to KW121.3 billion (US$106.7 million). More pertinently, however, Shilla posted a KW12.3 billion (US$10.8 million) operating loss on those operations, reflecting in particular the high cost of entry at Changi.

The offshore losses put a big dent in The Shilla Duty Free’s overall operating profits, which fell -51.4% to KW15.4 billion (US$13.6 million). Even profits on the more lucrative Korean downtown business fell sharply, down -39.0% to KW27.7 billion (US$24.4 million).

A key factor in that decline has been, as we reported recently, the rocketing costs of commissions to Chinese travel retail agents – up from between 7% and 10% to around 23% since the advent of new duty free retailers last year. As one leading luxury brand executive told The Moodie Davitt Report recently, “The real winner in Korean duty free is the Chinese travel agent.” These numbers bear out that view.

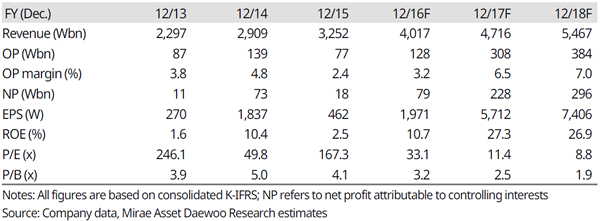

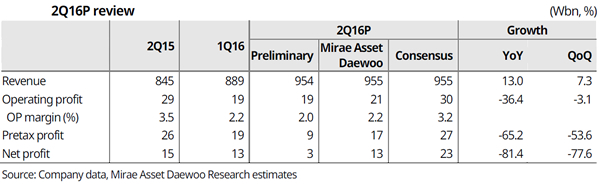

The Shilla Duty Free is the key revenue and profits contributor to parent Hotel Shilla, whose consolidated revenues rose +13% year-on-year to KW954.1 billion (US$839.6 million), while operating profits tumbled -36.04% to KW18.7 billion (US$16.5 million).

The Shilla Duty Free is the key revenue and profits contributor to parent Hotel Shilla, whose consolidated revenues rose +13% year-on-year to KW954.1 billion (US$839.6 million), while operating profits tumbled -36.04% to KW18.7 billion (US$16.5 million).

Group operating profit margin was 2.0%; with travel retail overall at 1.8%, Korean travel retail at 3.8% (6.1% downtown) and offshore duty free operations -10.1%.

MIXED REACTION FROM ANALYSTS

MIXED REACTION FROM ANALYSTS

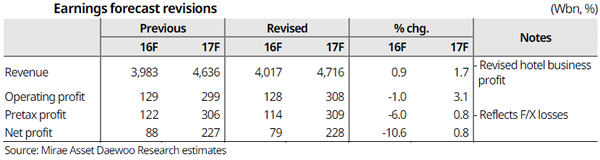

MIRAE ASSET DAEWOO : Regina Hahm, Equity Analyst (Cosmetics, Hotels & Leisure, Fashion) at Mirae Asset Daewoo Research Center, said: “2Q earnings were way weaker than the market estimates.

“However, I do think that it is positive that Shilla has further strengthened its existence in the market. It seems pretty apparent that group tourists have been absorbed by the Jangchung store [Shilla’s flagship Seoul shop -Ed], especially since the absence of Lotte World and WalkerHill.”

In a review of Hotel Shilla’s results, Ms Hahm noted: “The domestic duty free business, which was hurt by the impact of MERS, resumed robust growth. Revenue from the downtown duty-free operation [of Shilla] climbed +29.0% YoY to KW538.2 billion during the quarter, meeting our expectation (+27.7% YoY). In the corresponding period, the overall duty free market saw revenue growth of 23.5% YoY, even as new entrants began full-fledged operations.

“We think this shows the performance gap between major duty free players and less competitive, new players is widening further, which is natural given the importance of scale effects, the quality of sourced products, as well as experience in the duty free industry.

Looking forward to Q3, typically a peak season for both inbound and outbound tourism demand, Ms Hahm foresees strong growth potential in Shilla’s duty free business, particularly given the low base line from the MERS-hit comparative quarter in 2016.

She commented: “Airport revenue is likely to turn around in 3Q16, aided by the dissipation of high base effects.”

Commenting on the group share price, she concluded: “Hotel Shilla shares have long been weighed down by a series of negatives, such as controversies over domestic duty free industry policies, the loss of licences by a few major players, and MERS.

“In 2H, with the performance gap between new entrants and major existing players widening further, we expect Hotel Shilla to solidify its position as a leading player. Also, in our view, the stock could see a re-rating, given peak-season effects and strengthened market dominance.”

Accordingly, Mirae Asset Daewoo maintained its ‘Buy’ rating on Hotel Shilla with a target price of KW110,000 (currently US$96.80), the stock brokerage and investment bank company’s top pick in tourism. By mid-afternoon today (26 July) it was trading at KW61,700, off by -0.80%.

NOMURA: Analysts Cara Song and Jiun Im took a very different view, downgrading the stock from a buy to a reduce, and cutting their target price from KRW100,000 a share to just KRW47,000.

In comments quoted by Barron’s Asia, they noted: “Operating profit margins at the domestic downtown duty free stores (Hotel Shilla’s sole profitable business) declined sharply to 6.1% in 2Q16 (vs. 8.8% in 1Q16, 10.3% in FY15). The company attributed this to a bigger contribution from lower-margin group tourists (from 70% in FY15 to 85% in 2Q16).

“Considering that it is easier to attract group tourists than individual travellers by: 1) paying higher sales incentives to travel agencies; 2) more aggressive price promotions, Hotel Shilla’s customer mix has deteriorated, in our view.”

The analysts were particularly alarmed by the airport losses in Singapore, commenting: “Contrary to company guidance, Changi Airport DFS continued to struggle, with persistent losses in 2Q16. With the [Korean] government’s plan to issue additional DFS licences in 4Q16F, the DFS business environment could be dampened further.

“Reflecting this, we cut our net profit estimate by 49.5%/36.5% respectively for FY16F/17F. Our FY16F/ 17F net profit estimates are c.33% lower than Street expectations (Fig.11).”

Nomura also suggested there could be an added hit to earnings if Hotel Shilla’s planned part-acquisition of Miami-based DFASS Group in the third quarter falls through. The Moodie Davitt Report understands that constructive dialogue continues on that deal, though it is still some way from closing.