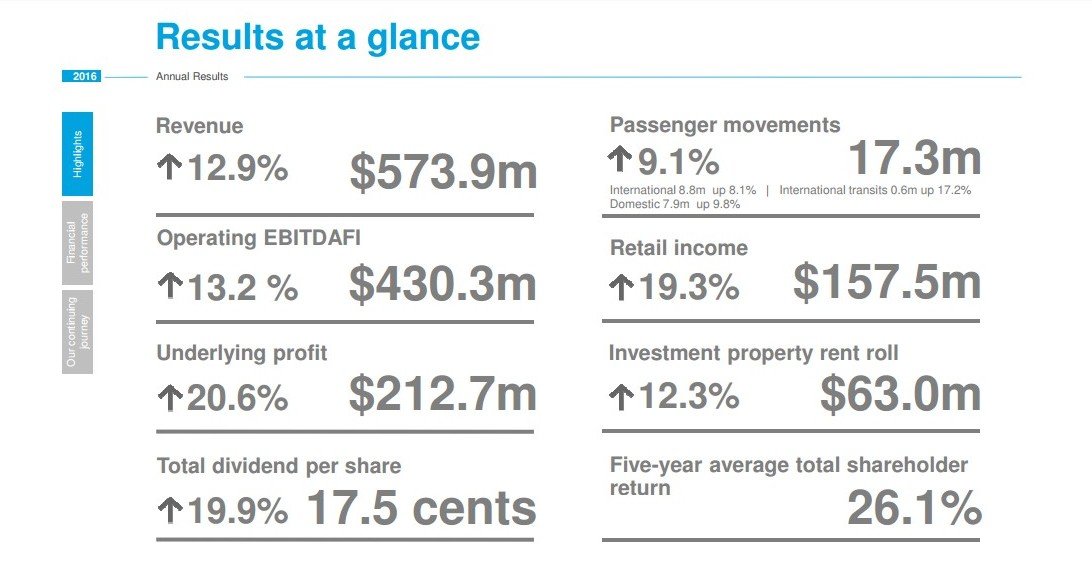

NEW ZEALAND. Auckland Airport’s retail revenue rose +19.3% to NZ$157.5 million (US$114.09 million) for the year ended 30 June, well ahead of a +9.1% increase in passenger movements.

Strong traffic growth, new commercial agreements in duty free (with Aer Rianta International and Lagardère Travel Retail in place since mid-2015) and “outstanding” specialty performance contributed to the “excellent” growth in retail income, the company said.

Retail income per international passenger increased by +10.1% to NZ$17.36 (US$12.55). However, this result was supported by the release of a NZ$0.30 per international passenger provision for potential losses following the changeover of duty free operators. No loss eventuated.

Overall passenger spend rate (PSR) fell -1.3% in the financial year to 30 June 2016 (but was up +1.3% excluding tobacco) as a result of the duty free transition. Specialty and destination categories stood out with “exceptional” PSR growth averaging +17% for the year.

General Manager Retail & Commercial Richard Barker told The Moodie Report: “We have had very good growth on destination and specialty stores – driven by the strong growth in Chinese passengers. While we have had a lift in duty free income, the revenue increase is a result of a balanced performance across the board with growth in higher-margin specialty categories contributing to the increase in income. We have had 20 retailers with more than +20% like-for-like sales which we are proud of.”

PSR gains, however, were not universal as duty free faced challenges when compared to the previous financial year, Auckland Airport noted. The “bed-in period” for Aer Rianta International and Lagardère Travel Retail meant that PSR fell over the first half of the year. However, it improved in the second half of the financial year and was up +4.0% year-on-year. Both retailers delivered improved sales performance across core categories, with cosmetics/skincare and confectionery spend rates up by over +40% and +20% respectively.

The airport operator commented: “The new duty free retailers have brought new focus, and their changing product range has helped to drive increased sales in traditional higher-margin product lines.”

It said the strong growth in retail revenue provides the company with confidence to construct a new international retail hub, part of the planned upgrade of its international departures area.

Retail sales (excluding foreign exchange) rose +11.6%; specialty & destination merchandise sales increased by over +25%; and food & beverage turnover was up by +9% following improvements to the offer.

The airport also posted a +11.6% increase in average revenue per parking space (see below for full details).

Auckland Airport said it would be securing new, high-quality specialty and food & beverage outlets for the upgraded international departures retail hub. It added: “New duty free agreements support future retail performance as rental mechanisms share the benefit of growing passenger numbers and increased space.”

Auckland Airport said it would be securing new, high-quality specialty and food & beverage outlets for the upgraded international departures retail hub. It added: “New duty free agreements support future retail performance as rental mechanisms share the benefit of growing passenger numbers and increased space.”

The company said that “significant work” is planned for 2017 with expansion of the international departures area continuing throughout that year. Construction of the Pier B extension will commence.

CAR PARKING REVENUE SURGES

Parking revenue growth also outstripped passenger growth with revenue management tools and improved promotions driving revenue up +11.8%. Average revenue per space rose +11.6%. Valet services are now established at all terminals with exits up +127% year-on-year. Park&Ride revenue increased +25%. The airport said it will continue to add new capacity across the product range as demand supports. A further 1,500 spaces will be added by mid FY18, largely Park&Ride

TRAFFIC SHIFT

TRAFFIC SHIFT

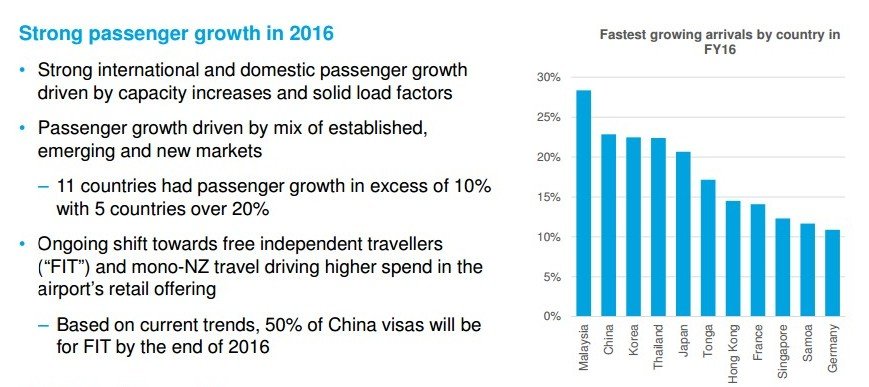

The strong growth in passengers occurred across a range of geographic markets: China, so important from a retail perspective, was up +23%, North America +9%, Germany +11% and the UK +6%

The airport operator noted an ongoing shift towards free independent travellers (FIT) and mono-NZ travel, which it said was driving higher retail spending. Based on current trends, 50% of China visas will be for FIT by the end of 2016

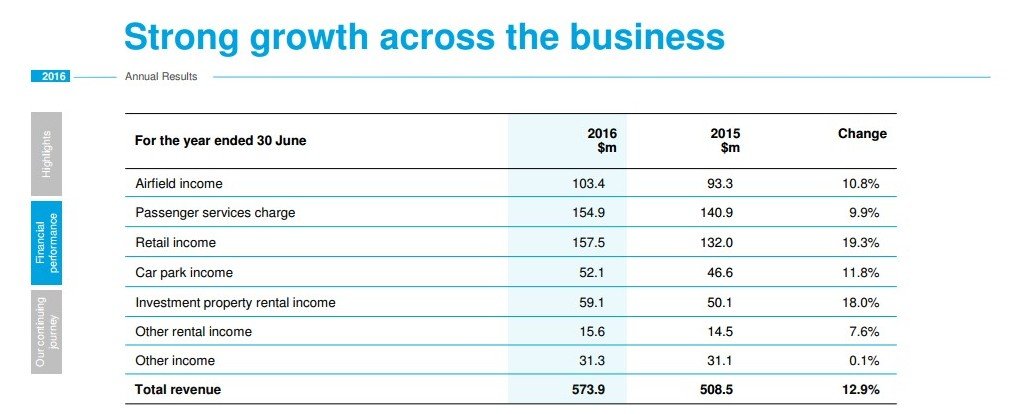

Aeronautical revenues (landing and passenger charges) increased +10.3% to NZ$258.3 million) and turnover from transport grew +11.8% to NZ$52.1 million.

Aeronautical revenues (landing and passenger charges) increased +10.3% to NZ$258.3 million) and turnover from transport grew +11.8% to NZ$52.1 million.

Auckland Airport Chair Sir Henry van der Heyden said: “The company has had an excellent 12 months and delivered strong results for its community and city, its country and investors.

“It has been another year of growth right across our business. We have seen a significant lift in the number of international airlines and capacity servicing Auckland. We have added new retailers and passenger products and we have also completed several large property developments this financial year.

“It has been another year of growth right across our business. We have seen a significant lift in the number of international airlines and capacity servicing Auckland. We have added new retailers and passenger products and we have also completed several large property developments this financial year.

“To support this growth, we have commenced a major upgrade of our international departure area, and have continued the planning and design work required to successfully construct our 30-year vision’s combined domestic and international terminal building and second runway. Finally, we have continued to focus on playing a leadership role for New Zealand’s tourism and aviation industries.”

To recognise the efforts of its team and the “exceptional” performance in the 2016 financial year, the airport company is paying a pre-tax performance bonus of NZ$1,500 to all permanent employees who do not participate in a short-term incentive scheme.”

Revenue was up +12.9% to NZ$573.9 million, while expenses rose +11.8% to NZ$143.6 million. Earnings before interest expense, taxation, depreciation, fair value adjustments and investments in associates (EBITDAFI) increased +13.2% to NZ$430.3 million. Total profit after tax grew +17.4% to NZ$262.4 million, while underlying profit was up +20.6% to $212.7 million. As a result of this, Auckland Airport’s underlying earnings per share grew +20.6% to 17.9 cents for the 2016 financial year.