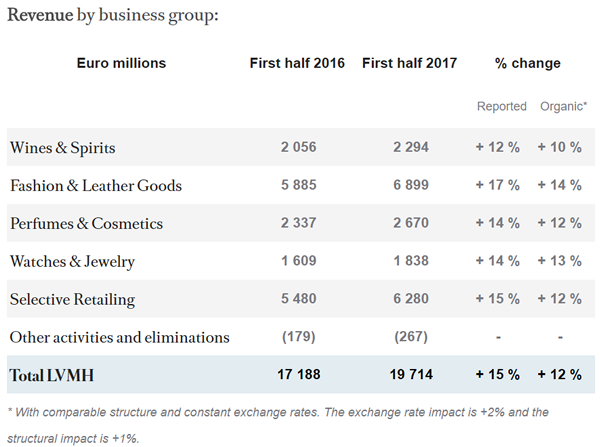

FRANCE/INTERNATIONAL. LVMH Moët Hennessy Louis Vuitton today reported its first half results for 2017, with the Selective Retailing division (which includes DFS) posting a +15% rise in revenue to €6,280 million. In organic terms, the growth figure was +12% year-on-year.

LVMH (majority owner of DFS) noted: “DFS experienced better momentum in Asia, while the T Galleria, which opened in 2016 in Cambodia and Italy, continued to develop.” The retail division’s profit from recurring operations hit €441 million, up by +8%.

As a group, LVMH H1 revenues reached €19.7 billion, an increase of +15% year-on-year.

LVMH said: “All geographic areas continue to progress well. During the first half of the year, the group benefited from a favourable comparison base, particularly in Asia but also in France, where activity was impacted last year by a decline in tourism. The current trends cannot reasonably be extrapolated for the full year.

In the second quarter, revenue increased by +15% compared to the same period in 2016, with the notable integration for the first time of Rimowa. Organic revenue growth was +12%.”

Profit from recurring operations was €3,640 million for the first half of 2017, an increase of +23%. Operating margin reached 18.5%, an increase of one percentage point. Group share of net profit amounted to € 2,119 million, an increase of +24%.

LVMH Chairman & CEO Bernard Arnault commented: “LVMH has enjoyed an excellent first half, to which all our businesses contributed. In the current climate of geopolitical and economic instability, creativity and quality, the founding values of our group have more than ever become benchmarks for all. The increasing digitalisation of our activities furthermore reinforces the quality of the experience we bring to our customers. In an environment that remains uncertain, we approach the second half of the year with caution. We will remain vigilant and rely on the entrepreneurial spirit and talent of our teams to further increase our leadership in the world of high quality products in 2017.”

The Wines & Spirits business group recorded organic revenue growth of +10% in the half. On a reported basis, revenue rose +12% and profit from recurring operations increased by +21%. All the Champagne houses have performed well, it said, with Europe and the USA “particularly dynamic”. Hennessy Cognac continued to show strong growth in the US market, while demand is recovering in China. The second half of the year is expected to experience a slowdown in volume growth given supply constraints.

The Fashion & Leather Goods business group recorded organic revenue growth of +14%. On a reported basis, revenue increased +17% and profit from recurring operations was up +34%. The momentum at Louis Vuitton continued while Fendi continued its strong growth. Loro Piana strengthened its presence in Asia with several openings. Céline, Loewe and Kenzo experienced good growth, noted LVMH. Marc Jacobs strengthened its product offering and continued its restructuring. Other brands continued to grow. Rimowa, which joined the LVMH Group, is consolidated for the first time in the first half-year accounts.

The Perfumes & Cosmetics business group posted organic revenue growth of +12%. On a reported basis, revenue grew +14% and profit from recurring operations was up +7%. Christian Dior showed “strong growth momentum”, sustained by its fragrances and the performance of its latest makeup creations. Guerlain enjoyed a successful launch of its new perfume, Mon Guerlain, said the company, while Parfums Givenchy experienced rapid growth in makeup, especially its line of lipsticks. Benefit continued to roll out its Brow Collection.

The Watches & Jewelry business group recorded organic revenue growth of +13%. On a reported basis, revenue growth was +14% and profit from recurring operations was up +14%. Bulgari continued to gain market share, said LVMH, in both jewellery and watchmaking, especially in China and Europe. TAG Heuer experienced solid revenue growth in a “tough” watch market.