THAILAND. The Royal Thai Navy, operators of the new U-Tapao Rayong-Pattaya International Airport, have split their commercial concessions into two awards following an open tender.

King Power International has been awarded the ten-year duty free contract while a partnership between powerful Thai retailer Central Department Store Company (Central Group) and DFS Group (through DFS Venture Singapore) has won the similar length duty paid retail and services (mainly F&B) concession. DFS confirmed the award to The Moodie Davitt Report today.

Importantly, The Moodie Davitt Report understands, the Central Group/DFS partnership will also be responsible for the airport duty free pick-up counters. Commercial operations begin next February. The airport, while currently only handling low traffic volumes, mainly to China, is targeted to become a busy international hub,

Competition is understood to have been intense for the contracts. According to the Bangkok Post,King Power beat four other bidders (including a local partnership with Korean retailer Lotte Duty Free and the Central Group/DFS consortium), for the duty free shop contract. The report claimed that the Central Group and DFS alliance beat off competition from five other parties, including King Power for the general retail and services concession.

Citing Vice Admiral Luechai Sri-eamgool, Director of U-Tapao Rayong-Pattaya International Airport, Reuters reported that both winning bidders must pay at least 15% of their revenue to the airport authority or a minimum guarantee, whichever is higher.

White-hot competition for Suvarnabhumi Airport concession expected

The split concession model is notable in the context of the planned bid for commercial operations at Bangkok Suvarnabhumi International Airport, the country’s main international hub.

King Power International currently runs that business under a single master concession that expires in 2020. A tender is set to be called soon by Airports of Thailand, which is examining various models including a multiple concession structure.

According to the Bangkok Post, terms of reference for the contract (or contracts) will be forwarded for consideration by the Airports of Thailand board before the end of the month.

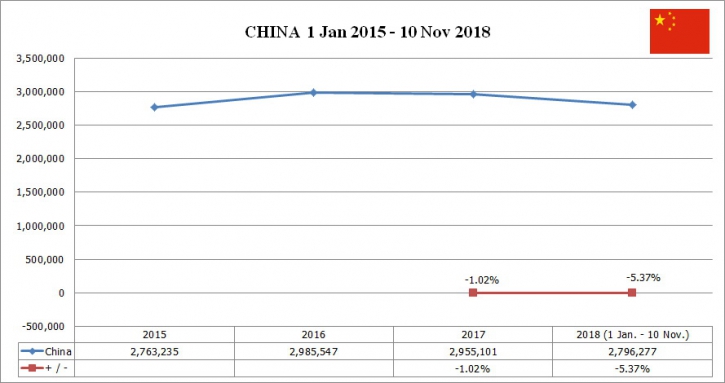

With Chinese tourism previously booming in Thailand until July’s tourist boat accident off Phuket, which has prompted a perhaps temporary slump since, the hugely successful King Power operation is certain to face white-hot competition at Suvarnabhumi. (Thai tourism authorities are scrambling to mitigate the damage caused by the tragedy, which resulted in the loss of 46 lives. The Tourism Council of Thailand predicts Chinese arrivals will plunge by around -25% to 1.9 million in the October-December period).

Korean travel retail giants Lotte Duty Free (at the Show DC complex) and The Shilla Duty Free (via downtown store Shilla Duty Free Phuket) both have bases in Thailand, in Bangkok and Phuket, respectively, and are considered certain bidders.

With a powerful Thai partnership now successfully established, DFS will certainly be back for more and Bangkok Airways, which earlier this year formed a new duty free retail business unit called More Then Free Co (which runs shops at Samui, Surat Thani and Luang Prabang airport)s, was reported recently by the Bangkok Post to have held talks with “duty free operators in France and Germany” to join the upcoming bid. It would not take much deduction to conclude that those parties are likely to be Lagardère Travel Retail and Gebr Heinemann.

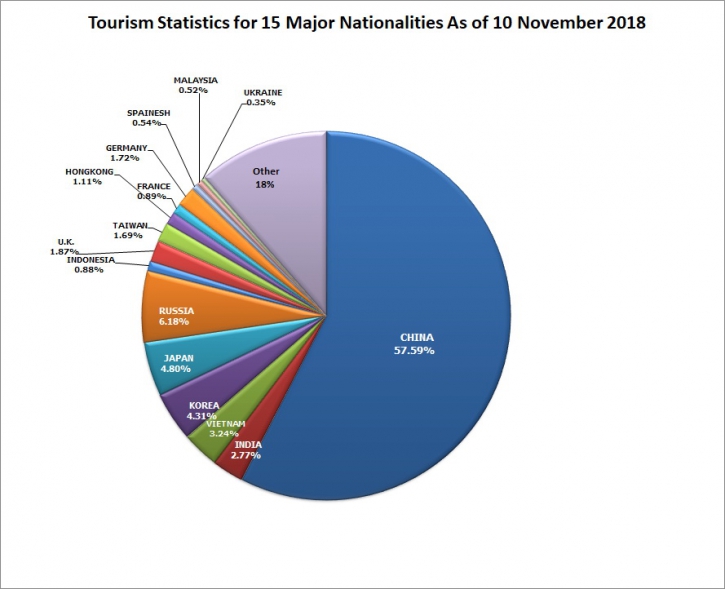

Tourism is booming in Thailand. The country attracted around 35 million visitors last year, driven by surging Chinese tourism (see charts), which has translated into a retail boom for King Power International. The Tourism Authority of Thailand projects a record 40 million tourists in 2019.

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results.

If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise.

We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.