JAPAN. Japan Airport Terminal Co (JATCo) posted a -1.5% year-on-year revenue decrease from merchandise sales operations for the first three months of FY2016 to JP¥32,245 million (US$321 million).

Operating income for the segment fell a sharp -38.3% to JP¥1,669 million (US$16.6 million) in the period between 1 April and 30 June. JATCo said this was linked to increased marketing costs from promoting its airport-style downtown duty free shop Japan Duty Free Ginza. The 3,300sq m store, opened on the eighth floor of the Mitsukoshi Ginza department store in January, is a joint venture between JATCo, Isetan Mitsukoshi Holdings and NAA Retailing.

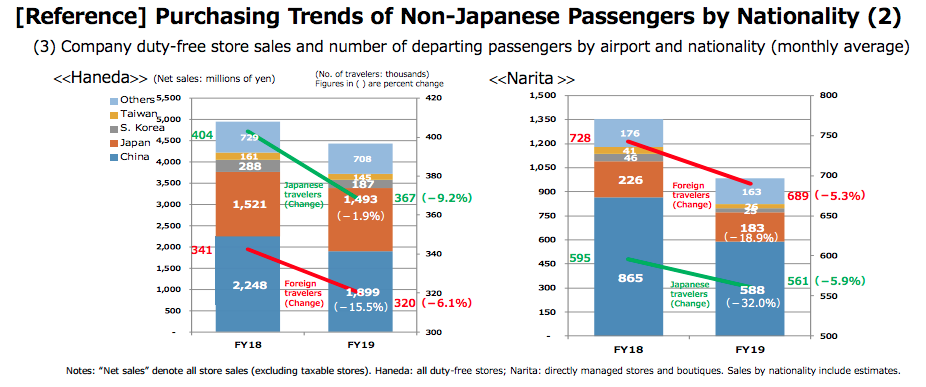

However, July visits were largely booked before the yen’s 6 per cent rise against the US dollar following the UK’s vote by referendum in June to leave the European Union. JATCo said sales at its international terminal stores decreased. This was attributed to the slowdown of the so-called ‘Bakugai’ (‘explosive buying’) phenomenon driven by Chinese travellers. There was a resultant negative impact at both Narita and Kansai International airports. This impact was greater than the addition of revenue from the opening of Japan Duty Free Ginza.

Retail sales to tourists in Japan are being hit by the recent strengthening of the Japanese Yen (particularly since Brexit), as well a decline in luxury purchases by Chinese consumers.

Although acknowledging that retail revenue fell short of its target in the first quarter, JATCo remained positive. “We believe that consumption by international visitors to Japan, in the duty free market in particular, will expand further in line with the growth of inbound tourists in the mid- to long-term,” it stated.

Sales at domestic terminal stores rose slightly, primarily due to an increase in passenger volume. Other revenues grew due to an increase in the wholesaling of products to stores at Haneda Airport’s international terminal in line with growing international passenger volume.

Food & beverage operating revenue increased +9.6% to JP¥5,073 million (US$50.5 million), while operating income for the segment was down -19.1% to JP¥32 million (US$319,000). This was attributed to an increase in outsourcing costs.

JATCo said sales from food & beverage operations increased slightly as a result of growth in domestic passenger volume. Sales from inflight meals rose more significantly, as foreign carriers increased flights and the company acquired a new client. Other revenues in the segment grew due to an increase in outsourcing business at Haneda’s international passenger terminal.

Consolidated operating revenues for the cumulative fiscal first quarter rose +1.0% compared with the same period in the previous year, to JP¥48,896 million (US$487 million). Operating income was down -40.7% to JP¥1,724 million (US$17.2 million), ordinary income fell -24.0% to JP¥2,694 million (US$26.8 million), and net income dropped -25.3% to JP¥1,816 million (US$18.1 million).