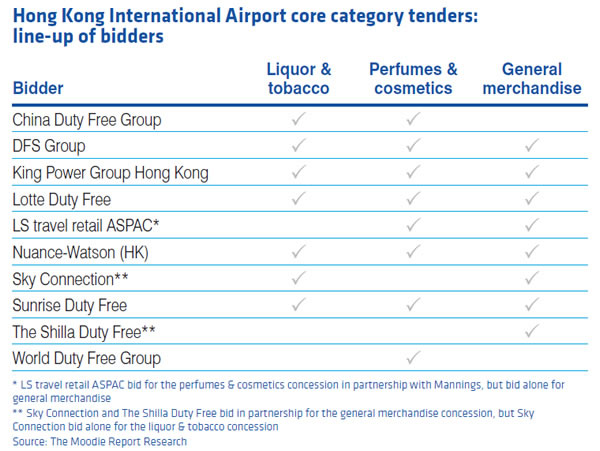

HONG KONG. Airport Authority Hong Kong is putting its three core category concessions – liquor & tobacco, perfumes & cosmetics and airside general merchandise – out to tender in late 2016, The Moodie Davitt Report can confirm. However, the Authority is still refining the category and contract mix and promises “significant changes” to the current concession structure in order to drive spending and improve the consumer experience at Hong Kong International Airport (HKIA).

DFS Group is the incumbent retailer for all three categories, which it was awarded in June 2012 after what ranked as the most hotly contested tender in airport retail history. The contracts were struck for five years with a three-year extension by mutual agreement.

Airport Authority Hong Kong believes that because of its desire to change the contract mix, and since the five-year term of the current concessions is approaching, it is right to re-tender rather than renegotiating or extending existing agreements. DFS declined to comment.

The new tender will involve key changes to the current concession model, The Moodie Davitt Report understands. In particular, Airport Authority Hong Kong plans to take the opportunity to reconfigure the spaces and redefine the concession mix in response to changing passenger needs, in an effort to enhance customer satisfaction and excitement.

| As a regular traveller I like not only what Hong Kong International Airport has to offer but the way it communicates that offer. |

In the context of difficult macro-circumstances (see below), the Authority has worked hard to stimulate spending in recent times by driving passenger growth (up +8.1% in 2015), intensifying its marketing efforts and refining the retail mix.

It recently introduced a Hong Kong-themed concept in Terminal 1’s East Hall to underline the concept of Sense of Place and created a one-stop shopping destination in the West Hall to enhance the passenger offer.

It is currently running a ‘Hottest Summer Rewards’ programme that offers a tiered range of cash coupons in return for spends of over HK$5,000, HK$20,000 and HK$50,000 respectively. The Authority has also introduced an increasingly successful home delivery service for single transaction spends over HK$1,000 to shoppers from Hong Kong and over HK$2,500 for those from Hong Kong Macau, Taiwan and Mainland China (delivery outside Hong Kong is limited to clothing, bags and accessories). From 1 August the airport will extend the free service to six new countries: Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam, for those spending HK$2,500 or more in a single transaction.

Competition for the contract is certain to be intense once more, despite the fact that DFS has had to battle major changes to trading conditions during the term of its contracts. In particular, the well-documented Chinese government crackdown on corruption and conspicuous consumption drove a sharp decline in demand for high-end luxury items, including watches, jewellery, leathergoods and spirits.

According to the Federation of the Swiss Watch Industry, watch sales dropped by around -23% in Hong Kong last year, a fall that was even steeper in the higher-priced categories. Additionally, a decline in Mainland Chinese visitors to Hong Kong in 2015 (driven by perceived anti-Mainlander sentiment and the pro-democracy protests) accentuated the challenges for downtown and airport retailers.

DFS, we understand, will be invited to tender – along with other leading international and regional players – based on a strong collaborative relationship with the Authority over the years. Airport Authority Hong Kong believes that the retailer has done an outstanding job in elevating the excitement and relevance of shopping at the airport.

NOTE TO AIRPORT AUTHORITIES: The Moodie Davitt Report is the industry’s most popular channel for launching commercial offers and publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or Tender, simply e-mail Martin Moodie atMartin@MoodieDavittReport.com

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.