|

“We believe that volatility will be going on in single markets but provided that currency levels remain relatively stable, we expect an overall improving performance in the second half. “ |

Julián Díaz CEO Dufry |

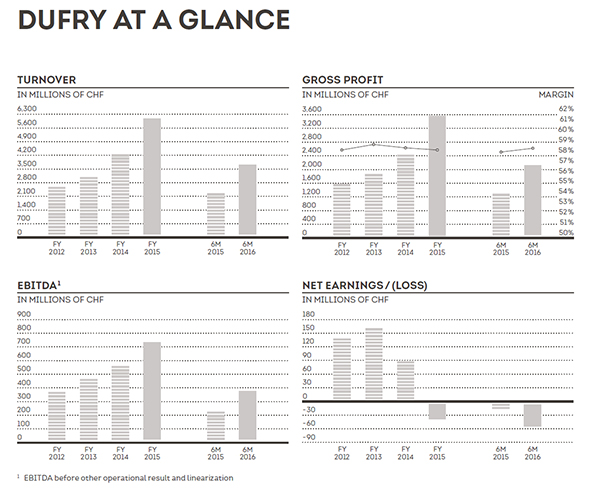

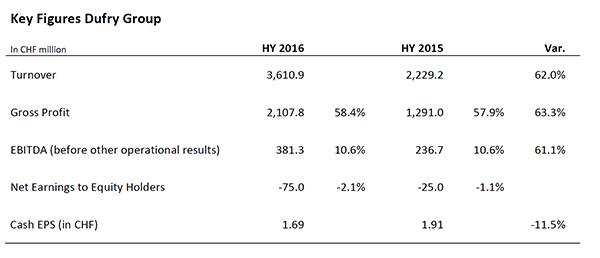

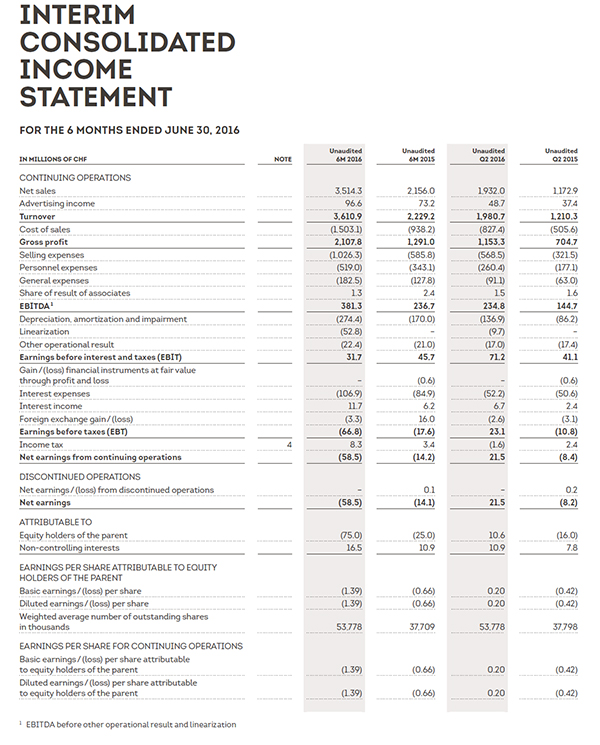

INTERNATIONAL. After what it described as a “volatile” first half of 2016, Dufry today posted a +62.0% rise in turnover to CHF3,610.9 million (US$3686.66 million at today’s exchange rates), driven mainly by acquisition, with a +61.1% hike in EBITDA to CHF381.3 million (US$389.3 million).

However, organic growth fell into negative numbers (see below for full details), reflecting major regional challenges, notably in Russia (and with the Russian travellers), Turkey and Latin America.

Nevertheless, the group’s geographic diversity has made it less dependent on individual markets and concessions (its biggest contract represents just 6% of sales and its top ten concessions 25%) and left the company optimistic of further second-half improvement. The markets seem to have understood that position with Dufry’s share price rebounding after an early fall to rise +0.10% so far today (13.00 CET) to CHF112.20.

Dufry also posted strong cash generation, with free cash flow growing by +66% and reaching CHF200.3 million (US$204.5 million).

While the consolidation of World Duty Free Group (WDF) added 66.6%, pro-forma organic growth (which includes WDF) was down -1.6% in a deeply challenging first half. Organic growth was mainly impacted by the further decline in Russian passengers worldwide and mostly in Turkey, where strong seasonality reinforced the impact.

In other markets, most of the trends seen in the first quarter also prevailed in the second, notably strong growth in Spain and many parts of the Caribbean, and the “ongoing relative improvement” in Brazil, Dufry said. In reported terms, organic growth was -6.3% during the period with like-for-like growth reaching -7.0% and contribution from new concessions amounting to 0.7%. The FX translation effect was a positive 2.4%.

The vote on the United Kingdom leaving the European Union on 23 June resulted in the devaluation of the British Pound by almost -10%. Thanks to the group strategy of natural hedging already implemented beforehand, there has been no impact on margins. Equally the balance sheet and cash flow effects have been largely neutralised and there will be only a translation effect going forward when consolidating numbers in Swiss Francs, Dufry said.

In the short term, first data suggests an acceleration in turnover growth in the UK due to the weaker Pound Sterling, while other European markets have remained unchanged so far.

Dufry Group CEO Julián Díaz commented: “I am optimistic, based on the results achieved in the first half of 2016 and despite the many extraordinary external events that occurred in the period under review.

“The performance proves the strength and the validity of our geographic diversification strategy, which has made the company less dependent on single locations. The remarkable increase of our free cash flow illustrates that we are performing strongly operationally despite the volatile environment overall.”

Díaz continued: “While organic growth continued to be in line with expectations in most of our operations, two factors negatively impacted some of our locations: the decline of sales to Russians worldwide, which had a particularly strong impact on our businesses in Turkey and Russia; and the devaluation of some emerging market currencies, most notably the Brazilian Real and the Argentinian Peso, which were still negative but continued to improve in the second quarter.

Díaz continued: “While organic growth continued to be in line with expectations in most of our operations, two factors negatively impacted some of our locations: the decline of sales to Russians worldwide, which had a particularly strong impact on our businesses in Turkey and Russia; and the devaluation of some emerging market currencies, most notably the Brazilian Real and the Argentinian Peso, which were still negative but continued to improve in the second quarter.

“In terms of business development, we have continued with our refurbishment programme of 60,000sq m of retail space, as well as with the opening of new stores. Since January 2016, we refurbished 25,000sq m and opened 15,800sq m of retail space.

“On the longer term view, we are very pleased with the renewal of a number of concessions, including some attractive contracts in Brazil, Mexico, the UK and Switzerland. The management of the concession portfolio is the basis for our success now and in the future and securing these contracts allows us to develop and grow the business in the long term.

“On the longer term view, we are very pleased with the renewal of a number of concessions, including some attractive contracts in Brazil, Mexico, the UK and Switzerland. The management of the concession portfolio is the basis for our success now and in the future and securing these contracts allows us to develop and grow the business in the long term.

|

“The performance proves the strength and the validity of our geographic diversification strategy, which has made the company less dependent on single locations.“ |

Julián Díaz CEO Dufry |

“Regarding the integration of World Duty Free, we are on track and we currently execute the various action plans, which we expect to fully complete by latest mid-2017. The initial synergy targets remain unchanged at EUR 100 million.

“We believe that volatility will be going on in single markets but provided that currency levels remain relatively stable, we expect an overall improving performance in the second half. Developed markets in general have a good performance. Moreover, thanks to our variable cost structure we are in a good position to protect our profitability and cash generation when compared to, for example, the luxury or airline industry.

“Our highly diversified geographic footprint, the ability to approach both domestic and international passengers as well as the possibility to quickly adapt our assortment to changing customer behavior or to new passenger flows are important assets to minimize risks and optimize performance.”

Contract renewal and extension critical

Dufry said that the renewal and extension of contracts has been a priority.

Key examples included the extension of the company’s two most important Brazilian contracts in São Paulo until 2032 and Rio de Janeiro until 2023 in May 2016. Another example was the renewal of the concessions at Cancún Airport for an additional ten years in July, which also includes Cozumel Airport. Collectively they represent one of the larger contracts in Central America.

Dufry also extended its airport retail contracts in Birmingham and Bristol for seven and eight years respectively in the UK and, as reported last week, extended its Zürich Airport concession for ten years.

RESULTS BY REGION

RESULTS BY REGION

Southern Europe and Africa

Turnover grew+104% to CHF744.2 million in the first half of 2016, versus CHF364.6 million one year before, driven largely by acquisition. The underlying growth in the division was flat. Spain continued to grow strongly in the second quarter and Portugal and France performed well. The performance in Northern Africa remained “subdued” in the second quarter.

The relative improvements realised in Q1 with respect to an increase in Russian passengers could not be sustained in the second quarter, Dufry noted, which resulted in a decline in Greece, and most importantly in Turkey. “The situation in Turkey remains challenging and due to seasonality has more weight in the second and especially third quarter,” the company said in reference to a critical market that has been hard hit by recent terrorism and political turmoil.

Central and Eastern Europe

Driven by the World Duty Free acquisition, turnover rose +174% to CHF 964.1 million in the first half of 2016 versus CHF 350.8 million in the previous year. Underlying growth in the division was “flattish”, the company said. In the United Kingdom, the most important operation in the division, the “moderate positive performance” of Q1 continued in Q2. The same applied to the other operations in the division, including Finland and Switzerland, Dufry said.

Russia and Armenia continue to face a challenging environment, while other Eastern European operations such as Serbia and Bulgaria reported growing sales.

Latin America

In this key Dufry stronghold turnover rose +10.9% to CHF 719.9 million. Operations in Central America and the Caribbean continued with a “positive” performance, Dufry said, benefiting from an overall increase in passenger numbers, particularly by Americans, due to the strong US Dollar.

Conversely, South America continues to be impacted by the devaluation of some of the local currencies, Dufry said. In Argentina sales n Q2 improved slightly compared to Q1, while Brazil continued to improve and further narrowed the gap year-on-year, the company said. Overall, the division fell -11.1% in the first semester.

North America

Turnover rose +37,5% to CHF790.1 million with underlying growth reaching +3.2%, as a result of a strong performance by Hudson and other duty paid concepts. In duty free, the stronger US Dollar positively impacted group operations in Canada, while the opposite effect was seen in the USA.

DETAILED FINANCIAL BREAKDOWN

Dufry said that its gross profit margin continues to improve, reaching 58.4% in the first half of 2016, improving 50 basis points from 57.9% in the previous year. The improvement was mainly driven by the synergies of The Nuance Group integration. The company underlined the quarterly variation of gross margin, according to the seasonality of certain regions.

EBITDA grew by +61.1% in the first six months of 2016 to CHF381.3 million (US$389.20). The EBITDA margin stood at 10.6% in the first half, in line with the same period last year. Profitability was positively impacted by the higher gross margin as well as lower personnel and general expenses. On the other hand, the consolidation of World Duty Free also generated an increase in concession fees [Spain, particularly, and the UK -Ed].

EBIT stood at CHF31.7 million (US$32.4 million) in the first half. EBIT has become more seasonal due to the higher seasonality of the World Duty Free business, Dufry pointed out.