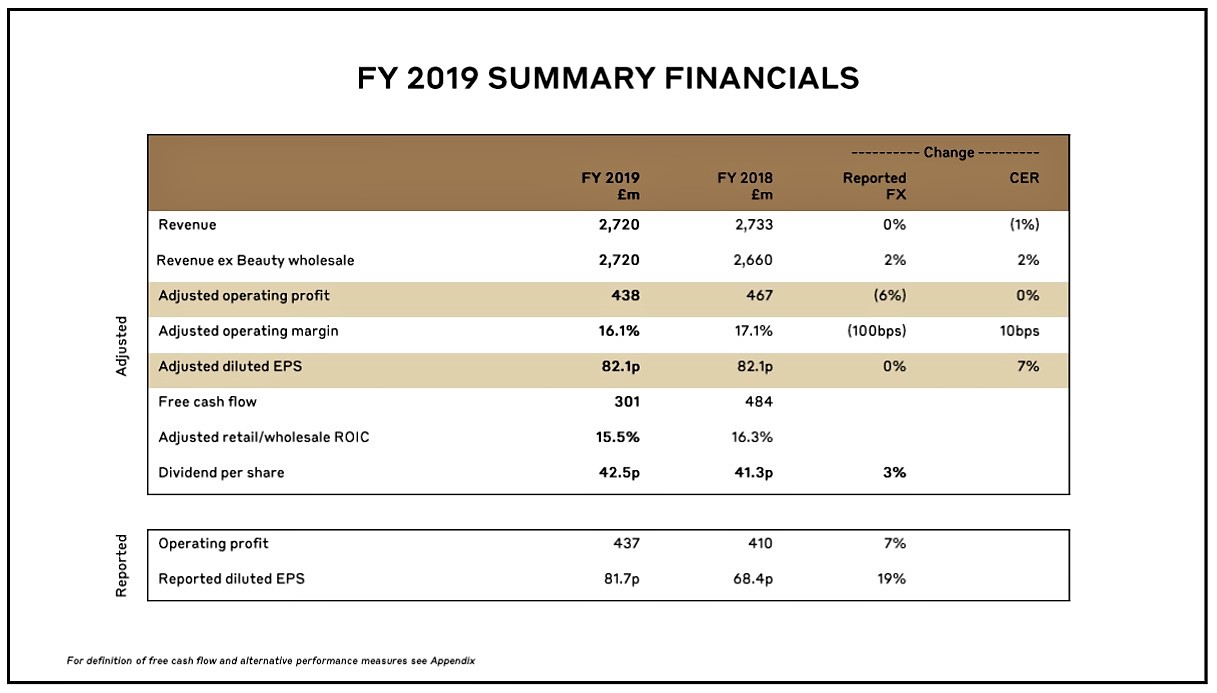

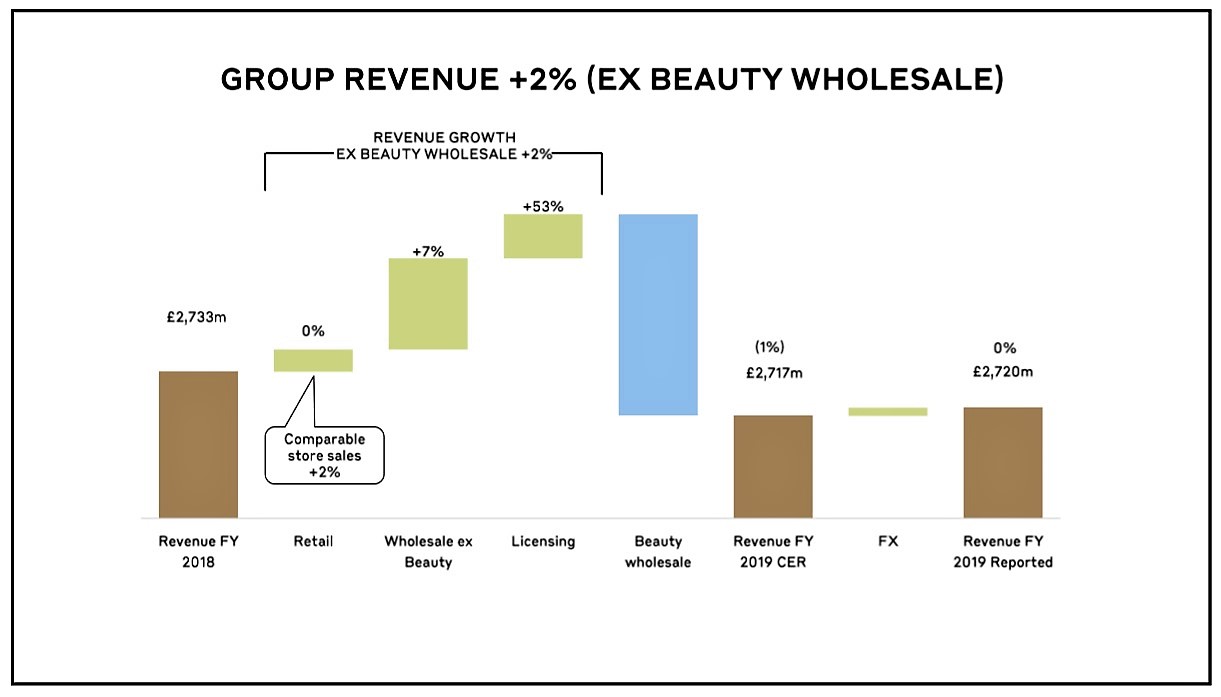

International fashion house Burberry generated flat sales in its latest financial year 2019 (ending March 2019), but its wholesale division, encompassing travel retail, delivered the biggest revenue growth among its segments (see bridge chart below).

The luxury group produced revenue of £2,720 million (US$3,523 million) in FY2019, marginally down on £2,733 million (US$3,540 million) in FY2018. Chief Operating & Financial Officer Julie Brown described the result as “broadly stable”.

Within wholesale, which grew 7% (excluding beauty*), the company stated: “Asia Pacific delivered exceptional growth supported by strong Chinese spending in travel retail”.

Among Asian markets, Korea increased by low single digits “benefiting from growth in local consumption as well as exceptional spending from travelling Chinese consumers in the first half of the year”. Meanwhile Japan declined by low single digits “impacted by softer tourist flows towards the end of the year”.

Burberry added: “Mainland China delivered low single digit percentage growth, with a stronger second half due to the shift of Chinese spending away from other Asian tourist locations”.

A journey of transformation

The fashion house is on a multi-year transformation and repositioning journey. From this perspective, FY2019 and the current FY2020 are described as “foundational years where we will re-energise the brand, rationalise and invest in our distribution and manage through the creative transition, after which we will accelerate and grow”.

Burberry said: “In FY2019, we achieved our first year financial, strategic and operational objectives. During the year, we launched a new creative vision with a refreshed logo and monogram and a new product aesthetic, starting with Riccardo Tisci’s debut runway collection: Kingdom. We supported the launch with high-impact communications across key cities generating exceptional visibility and brought the new Burberry to millions of luxury consumers globally.”

Digital at heart

Burberry pioneered digital in the luxury sphere and it remains committed to furthering its proposition. The company introduced the B-Series, a monthly drop of limited-edition products sold on social platforms. More recently it partnered with Instagram to allow customers to purchase products directly from the Burberry Instagram shop.

In retail, Burberry has focused on refreshing its flagship stores in line with its new creative vision, with over 80 retail doors expected to be revamped by the end of FY2020. The company is also closing 38 smaller, non-strategic stores in secondary locations.

Wholesale is also being rationalised by phasing out non-luxury doors. “All these initiatives helped reignite brand heat and significantly shift consumer perceptions of Burberry,” said the company.

* In October 2017, beauty transitioned from a wholesale business to a licensed partnership with Coty. Including the impact of this change on the H1 2019 results, full year total wholesale revenue decreased by 7% (reported).